Gold At A Crossroad

Another one of those death crosses showed up on the spot Comex gold chart Tuesday. The 50-day simple moving average (SMA) crossed under the 200-day SMA. For position traders, that’s a sign of substantial weakness and a motivator for short selling. The short-term SMA was last under water from October 2014 through February 2016 during a sell off that took bullion down to a $1,057 low. Gold rebounded to top out at the $1,375 level in July and broke down seriously in the wake of the US presidential election.

We had warning signs of the breakdown long before any ballots were cast (see our columns from September 8 and September 19).

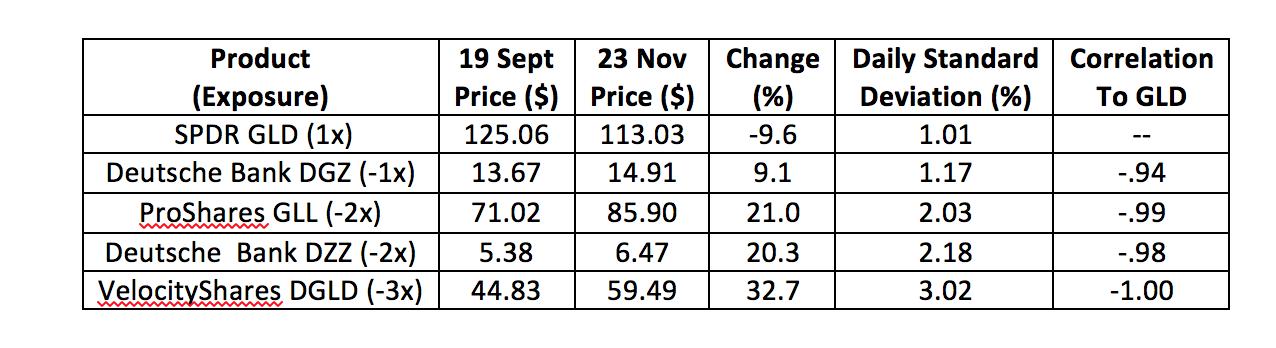

We posited a case for bearish gold ETFs and ETNs in our September 19 column. Those came with a caveat to mind the effects of compounding because investors are often surprised when their geared products – those offering inverse and/or leveraged exposure – produce seemingly disparate returns. But let’s not get ahead of ourselves. Let’s look at the returns first.

(Click on image to enlarge)

Product returns are in the ballpark of expectations – some variation is due to differences in product construction, some is due to compounding and some is due to discounting.

Returns earned through compounding are path dependent, meaning they’re contingent upon the strength of the market’s trend. The inverse products aim to provide a multiple (-1x, -2x or -3x) of gold’s daily return. Returns are magnified if gold declines several days in a row, producing gains greater than the sum of each day’s gold return. A rise in gold prices over several days produces losses less negative than sum of each day’s return. The same is true if gold’s volatile, i.e, rising and falling significantly, GLL’s return would likely be lower than the sum of each day’s gold return.

And what about discounting? That’s happening because Deutsche Bank, the issuer of the DGZ andDZZ notes is dire financial straits. Traders, concerned about the bank’s solvency, are haircutting the ETN’s market price to cover that risk.

So, is there more room on the downside for gold?

Technically, $1,181 is a key support level for the Comex December contract. If that level holds – as it has through Wednesday’s floor trading session – there’s a base for a rebound. A collapse of that support, though, could set up dramatic selling.

Disclosure: Brad Zigler pens Wealthmanagement.com's Alternative Insights newsletter. Formerly, he headed up marketing and research for the Pacific Exchange's (now NYSE Arca) ...

more