Global Stocks Start Off December With A Bang, US Equity Futures Rebound; Yuan Drops

There was something for everyone in last night's much anticipated Chinese PMI data, with the official number sliding to the lowest in over 3 years, suggesting the PBOC will need to do more stimulus and is thus bullish, while the unofficial Caixin print rising to the highest since June, suggesting whatever the PBOC is doing is working, and is also bullish. Not unexpectedly, global stocks decided to take the bullish way out, and have risen across the globe led by Asia, where stocks rose as much as 1.8%, Europe also green and US equity futures up 10 points as of this writing.

“There seems to be some modest improvement in investor sentiment on the global outlook and that has supported equities and commodities,” Nick Kounis, head of macro research at ABN Amro Bank told Bloomberg. "The China data were on balance positive." Sure enough global risk has been in a risk-on mood all morning:

- S&P 500 futures up 0.4% to 2089

- Stoxx 600 up 0.2% to 386

- MSCI Asia Pacific up 1.7% to 134

- US 10-yr yield up 2bps to 2.23%

- Dollar Index down 0.15% to 100.02

- WTI Crude futures up 0.6% to $41.90

- Brent Futures up 0.3% to $44.76

- Gold spot up 0.5% to $1,070

- Silver spot up 0.8% to $14.20

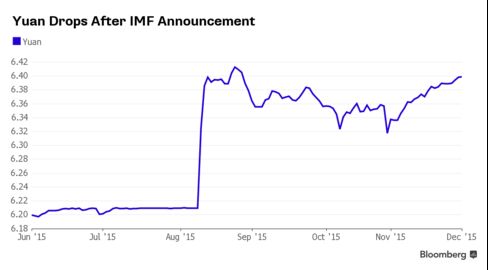

The Chinese PMI "confusion" was deftly handled by Bloomberg which in two separate pieces wrote, on one hand, that "an official manufacturing gauge sank to the lowest in more than three years" while on the other"a private gauge of Chinese factory output unexpectedly rose." Just as watched was how China's Yuan would react in its first day of inclusion in the IMF's SDR basket, and instead of jumping as some strategists had expected, the freely traded offshore yuan fell 0.3% while the onshore spot rate was little changed. Others such as HSBC, said this is precisely the priced in outcome.

Also of note, there were no surprises when it came to policy decisions from the central banks of Australia and India. Both kept their benchmark lending rates unchanged. Elsewhere around the globe, U.K. banks rallied after all seven major lenders passed the Bank of England’s stress tests.

The strong December start was perhaps factored in by the algos, which are well aware that global equities have risen in the last month of the year on all but five occasions since 1988. Helping push European stocks higher was PMI data out of the EU which saw the final German PMI also rise above the flash estimate, printing at 52.9, above the 52.6 expected, while German unemployment dropping to a record low.

A closer look at regional markets starts in Asia, where MSCI Emerging Markets Index rebounded from a two-week low, climbing 1.3 percent, as benchmark gauges rallied across Asia. Hong Kong’s Hang Seng China Enterprises Index advanced for the first time in seven days and the Shanghai Composite Index increased for a second day, adding 0.3 percent.

The ASX 200 (+1.9%) outperformed following a rebound in all sectors and commodity prices, while Nikkei 225 (+1.3%) was lifted by the stellar Japanese capex and continued gains in company profits albeit at a slower pace. Mainland China lagged (Shanghai Comp +0.3%) as participants digested the latest PMI releases in which official manufacturing PMI printed its lowest since August 2012 and Caixin manufacturing PMI was at a 9th month in contractionary territory despite beating expectations. 10yr JGBs traded higher following the well-received 10yr JGB auction which saw the highest b/c since September 2014.

Asian top news:

- China’s Manufacturing PMI Gauge Weakens to Lowest in Three Years: Readings show two-speed pace of growth as services outperform

- Macau Casino Revenue Falls 32% as China Curbs Hit VIP Gaming: Decline for 18th straight month, down 35% so far this year

- Rajan Holds India Interest Rate With Eye on Inflation Target: Will use space for more accommodation when available

- Australia Holds Key Rate as Economy Expands Despite Mining Bust: RBA leaves key rate at 2.0%, as seen by all economists surveyed

- Japan Pension Whale Stands by Stocks After $64 Billion Loss: GPIF lost 5.6% last quarter as stocks slid on China surprise

- Japan 3Q Capital Spending rose 11.2% Y/y; Est. +2.2%

- S. Korea’s Nov. Exports Fall 4.7% Y/y; Est. -9%; S. Korea’s Nov. Consumer Prices Rise 1% Y/y; Est. +0.9%

- Australia Nov. Manufacturing Index Rises 2.3 Pts M/m to 52.5

- Indonesia Nov. Consumer Prices Rise 4.89% Y/y; Est. 4.85%

In Europe, equities initially drifted lower heading into the North American crossover after a relatively choppy start, while the notable outperformer today has been the FTSE-100 (+0.4%), which has been led higher by financials after the BoE announced that all UK banks passed their stress test. On the other hand Linde (-11.9%) are the notable laggard in Europe after lower their 2017 forecast and expecting 2015 earnings to be at the lower end of expectations. However, the initial weakness in Europe to an extent also driven by concerns about the ECB doing less than expected on Thursday, has since been absorbed and the Stoxx had returned back into the green at last check.

European top news:

- Bank of England Sees Countercyclical Buffer Rising on Risk: BOE said it may begin forcing banks to set aside capital as soon as March to support lending in a downturn

- Linde Drops as Lower U.S. Pricing Clips Outlook for Profit: CEO Wolfgang Buechele reduced earnings targets at the gases supplier for the third time in just over a year

- German Unemployment Rate Falls to Record Low on Domestic Demand: Sign that robust domestic demand is bolstering confidence in the growth prospects for Europe’s largest economy

- Swiss Economy Unexpectedly Stagnated in 3rd Quarter on Franc: Weak performance in energy, construction and financial sector

- Zurich Says CEO Senn Steps Down, de Swaan Takes Interim Role: CEO resigned after insurer reported a loss at general insurance unit, abandoned takeover bid for Britain’s RSA Insurance Group

- UBS Traders May Be First to Face Sanctions in Currency Probes: As many as seven UBS traders may face sanctions from Switzerland’s financial watchdog in the coming weeks

- France Nov. Manufacturing PMI unchanged at 50.6; prelim. 50.8

- U.K. Nov. Manufacturing PMI falls to 52.7, below est.

- Euro-Area Oct. Jobless Rate falls to 10.7%; median est. 10.8%

Bunds remain in negative territory after falling below the 158.00 level in early trade amid touted profit taking following recent gains, although with little new fundamental catalyst driving the move the German benchmark rebounded off worst levels and while remaining in negative territory, did rise back above the 158.00 level. While T-Notes moved in tandem with their European counterparts, initially seeing softness however heading into the US open off their worst levels.

In FX, a gauge of developing-nation currencies rose for the first time in five days after closing on Monday within 0.03 percent of a record-low. India’s rupee strengthened as the nation’s central bank kept borrowing costs on hold Tuesday. Turkey’s lira strengthened 0.8 percent, advancing for a second day as a report showed manufacturing expanded in November. In a meeting with President Recep Tayyip Erdogan on Tuesday, U.S. President Barack Obama discussed how to deescalate the situation with Russia after tension over the downing of a warplane near the Syrian border.

The AUD/USD rose after Australian building approvals smashed estimates (Y/Y 12.3% vs. Exp. 5.7%, M/M 3.9% vs. Exp. -2.5%), while AUD found additional support following the RBA's decision to stand pat on rates and maintained a neutral bias. While also of note, the RBI kept all three of their main rates on hold as expected. In a similar fashion to yesterday, FX markets experienced volatility in early European trade, with GBP benefiting from UK/GE yield differentials and a softer USD index, as GBP/USD initially broke above the 1.5100 handle, however coming off best levels in the wake of a below expectation reading of manufacturing PM! (52.7 vs. Exp. 53.6). USD softness also benefited EUR/USD, which briefly broke above 1.0600 after reports that European names have taken off short bets today, before running into touted real money offers at 1.0620.

In commodities, we Oil futures in New York erased a gain of as much as 1.3 percent to trade little changed at $41.65 a barrel before this week’s meeting of the Organization of Petroleum Exporting Countries. Gold climbed a second day. Bullion for immediate delivery climbed 0.5 percent to $1,069.69 an ounce. Copper rose 0.5 percent to at $4,606.50 a metric ton in London.

Copper clawed back some of November's 10 percent losses, the worst month since January. It wasn't alone. An LME gauge of six industrial metals has now sunk for seven consecutive months, the longest losing stretch since 2009. The worst might not be over for copper, which is languishing near a six-year low. Hedge funds are betting there's more pain in store as economic growth slows to the weakest pace in more than two decades in China, the world's top consumer. Citigroup isn't so bearish. It forecasts many commodity markets, including copper, may strengthen in the second half of 2016 as the collapse in prices shrinks production.

Looking at today’s calendar, this morning in Europe was be all about the manufacturing PMI numbers for November, where we got the final Euro area (match), Germany (beat) and France (miss) readings along with the indicators for Italy, Spain and also the UK. We’ll also get some labour market data with the latest unemployment reads due for the Euro area and Germany. This morning will also see the release of the BoE stress tests with Governor Carney set to speak shortly after. In the US, the final manufacturing PMI will also be released for the US while the focus will be on the November ISM data (manufacturing and prices paid). October construction spending data is also set to be released, while later this evening the November vehicles data will be released. Fedspeak wise we’ve got the Chicago Fed President Evans set to discuss the economic outlook and monetary policy at 12.45pm.

Global top news:

- U.K. Banks Lead Europe’s Stock Rally After Stress-Test Results: Britain’s lenders led rally in Europe equities after Bank of England said all 7 major lenders passed stress tests

- ECB’s Split With Fed Risks Running Until Draghi Near Retirement: Market indicator shows next ECB rate hike not before Nov. 2018

- Yuan Drops as SDR Approval Seen Prompting PBOC to Reduce Support: Yuan weakened in offshore trading amid speculation China’s central bank will rein in intervention now that the IMF vote on reserve-currency status is out of the way

- Euro Area’s Modest Recovery Sets Scene for Draghi Stimulus: Factory growth in euro area accelerated amid a continued decline in unemployment, extending a tepid recovery that may require more stimulus from the European Central Bank. Euro to Bear Brunt of Yuan’s Inclusion in IMF Reserve Basket

- Oil Bulls Brace for Repeat of OPEC’s Bearish Blow at Meeting: Hedge funds are betting this week’s OPEC meeting will deliver another bearish blow to crude

- Zurich Insurance CEO Steps Down, De Swaan Named Interim CEO

- Putin Snubs Erdogan, Sees Obama in Test of Anti-Terror Front: In meeting, Obama and Putin don’t advance anti-terror alliance

- Einhorn’s Hedge Fund Plunged 5.2% in November, Set for 2015 Loss: David Einhorn’s main hedge fund at Greenlight Capital is poised for only its second losing year in almost two decades

- Power-Line Operator ITC Starts Review That May Lead to Sale: Study is part of effort to maximize value to shareholders

- Anadarko Ordered to Pay $159.5 Million for 2010 Gulf Spill: Fine due to role as part-owner of doomed Gulf of Mexico well that in 2010 caused biggest offshore oil spill in U.S. history

- Cyber Monday Sales Slow as Web Shopping Spans Holiday Season: Web-based sales climbed 17% Monday from year earlier as of 6pm in New York, after jumping 26% on Saturday and Sunday, IBM said

Bulletin Headline Summary from Bloomberg and RanSquawk

- The Asia-Pacific session saw RBA and RBI keep rates on hold, while Chinese mfg PMI printedlowest reading since Aug'12 and China Caixin mfg PMI print the highest reading since June

- FTSE-100 outperforms in Europe after financials bolster the index, with the BoE announcing that all major seven UK banks passed their stress test

- Looking ahead, today sees US manufacturing PMI, construction spending, ISM manufacturing and API crude oil inventories as well as comments from Fed's Evans and Brainard and ECB's Visco

- Treasuries decline led by 5Y and 7Y notes as markets wait for Yellen speech tomorrow, ECB and Draghi Wednesday, Nov. payrolls Friday and FOMC Dec. 16.

- Factory growth in the euro area accelerated amid a continued decline in unemployment, extending a tepid recovery that may require more stimulus from the ECB

- China’s manufacturing conditions slipped to the weakest level in more than three years as sluggishness in the nation’s old growth drivers add to risks facing the government’s growth target

- The euro’s worst year in a decade is looking even grimmer after the Chinese yuan’s inclusion in the IMF’s SDR basket, with its weight set to drop to 30.93% from 37.4%

- A U.K. manufacturing gauge fell more than economists forecast in November, while still signaling solid growth after reaching a 16-month high the previous month

- Obama urged Turkey and Russia to refocus their efforts on the common goal of combating terrorism, after Putin traded barbs with his Turkish counterpart, Recep Tayyip Erdogan

- Merkel’s Cabinet yesterday backed the deployment of German troops against Islamic State, including 1,200 troops along with Tornado reconnaissance planes, refueling aircraft and a frigate in support of France, according to the document obtained by Bloomberg News

- Swedes are responding to their government’s historic intake of refugees by turning to an anti-immigration group that both the ruling coalition and opposition deem too xenophobic to work with

- $110.825b IG priced yesterday, $21.405b HY. BofAML Corporate Master Index OAS narrows 1bp to +162, YTD range 180/129. High Yield Master II OAS widens 2bp to +640, YTD range 683/438

- Sovereign 10Y bond yields higher. Asian stocks rise, European stocks mixed, U.S. equity-index futures gain. Crude oil lower, copper and gold higher.

US Event Calendar

- 9:45am: Markit US Mfg PMI, Nov F, est. 52.6 (prior 52.6)

- 10:00am: Construction Spending m/m, Oct., est. 0.6% (prior 0.6%)

- 10:00am: ISM Manufacturing Index, Nov., est. 50.5 (prior 50.1)

- ISM Prices Paid, Nov., est. 40 (prior 39); TBA: Wards Domestic Vehicle Sales, Nov., est. 14.25m (prior 14.14m)

- Wards Total Vehicle Sales, Nov., est. 18.1m (prior 18.12m)

Central Banks

- 12:45pm: Fed’s Evans speaks in East Lansing, Mich.

- 6:30pm: Bank of Australia’s Stevens speaks in Perth

- 8:00pm: Fed’s Brainard speaks in Stanford, Calif.

DB's Jim Reid completes the overnight recap

Welcome to what looks set to be one of the busier December months that we can remember, certainly for central banks with the ECB and Fed very much in play. The month could be a battle between monetary policy Scrooge and Santa as we close out the year. December is rarely a bad month for risk but conditions are hardly normal at the moment. November was a month highlighted by what were huge declines across the commodity complex - Oil included - which makes this Friday’s OPEC meeting all the more important to keep a close eye on.

Although news-flow is still reasonably thin, European risk assets closed out November on a high yesterday reflecting the high hopes for this Thursday’s ECB meeting. The Stoxx 600 ended the session up +0.46% and at a three-month high while credit indices generally closed with some modest gains. The Euro continues to tumble, trading below $1.06 for all of yesterday’s session and is now at its weakest level since April. 2y Bund yields edged ever so slightly lower to -0.422% with the spread versus similar maturity Treasuries at 135bps which is the widest it’s been since 2006.

Those gains in European equities were in stark contrast to what was a generally weaker day in the US. The S&P 500 finished -0.46% having dipped lower into the close, although in reality it traded with a weaker tone for most of the session reflecting perhaps the soft second-tier data yesterday which did little to sway Fed expectations though. That said US credit indices outperformed with CDX IG finishing half a basis point tighter.

Before we go on, we’re straight to China this morning where the November PMI numbers are in. There are some mixed messages in the data, with the official reading falling 0.2pts to 49.6 (vs. 49.8 expected) which is the lowest since August 2012. This compares to a modest rise in the non-official Caixin reading, which was up 0.3pts to 48.6 (vs. 48.3 expected), albeit also in negative territory. Meanwhile and highlighting the divergence between sectors, China’s non-manufacturing PMI climbed 0.5pts to 53.6 – the highest level since July. Chinese bourses were initially weaker post the data but have rebounded for modest gains post the midday break. As we go to print, the Shanghai Comp and CSI 300 are +0.15% and +0.35% respectively.

Elsewhere, it’s been a pretty positive start for markets in December. The Nikkei is up +0.95% despite Japan’s manufacturing PMI declining a tad (52.6 from 52.8). The Hang Seng is +2.09% while the Kospi (+1.61%) and ASX (+1.93%) have also gained. The AUD is half a percent better off following some better than expected net exports data in Q3, while the RBA also left the cash rate on hold. Oil markets have made modest gains along with industrial metals this morning.

The notable newsflow from yesterday’s session was the widely expected confirmation from the IMF of the inclusion of the Chinese Yuan in its SDR basket. The currency will be added from the 1st October 2016 and will comprise 10.92% of the overall basket which was a little bit lower than the 14-16% previously drawn up from the IMF staff estimates. Speaking on the decision, IMF Chief Lagarde said that ‘the renminbi’s inclusion in the SDR is a clear indication of the reforms that have been implemented and will continue to be implemented and is a clear, stronger representation of the global economy’. In a note published this morning, DB’s China Chief Economist Zhiwei Zhang noted that the inclusion is structurally positive for China, as he believes that this may act as a catalyst to boost the momentum of reforms in China and indicates that the authorities are keen to integrate China’s economy further with the global economy. The onshore CNY was set 0.02% weaker this morning at the fix and has been little changed for much of the session.

In terms of the data flow yesterday, in the US the notable takeaway was a much softer than expected Chicago PMI for November, which fell 7.5pts to 48.7 (vs. 54.0 expected) and back to where it was in September after some falls for new orders and prices paid. The ISM Milwaukee (45.3 vs. 48 expected) also fell deeper into contractionary territory, down 1.4pts last month although there was better news for the Dallas Fed manufacturing survey which was up 7.8pts to -4.9 (vs. -10.0 expected), the highest since July albeit remaining in negative territory. These reports came before today’s ISM manufacturing print which our US economists expect slipped into negative territory in November to 49.0 (which is more bearish than the current market consensus of 50.5) having fallen to 50.1 in October. They note that this is based on the recent weakness in the NY and Philadelphia Fed surveys also, which is consistent with a decline in factory activity but not the overall economy (for the overall economy to be contracting, the level of the manufacturing ISM would have to be near 43). The other notable data point yesterday in the US was a slightly more disappointing than expected pending home sales report for October, with sales up just +0.2% mom (vs. +1.0% expected).

The economic data yesterday in Europe was focused on Germany where there was a disappointing start for Q4 retail sales with the November reading printing at -0.4% mom, which was below the +0.4% expected. It’s worth noting that this data can be very volatile, while sales do not have a strong correlation with overall consumption. Also out in Germany was the preliminary November CPI reading, although this offered no surprises at +0.1% mom for the month as expected, helping to nudge the YoY rate up one-tenth to +0.4%. Italy’s CPI print was a bit more disappointing at -0.5% mom, while in the UK mortgage approvals for the month of October nudged to 69.6k from 60.0k the previous month.

Also of interest yesterday was the news that the Fed is to adopt Dodd-Frank bailout limits, aimed at limiting the Fed’s ability to rescue individual companies during a crisis, the likes of which we saw for AIG and Bear Stearns during the financial crisis. The revised rule now means that the Fed will only be able to save companies with a ‘broad-based program’ rather than to select individual institutions.

Copyright ©2009-2015 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every time you engage ...

more