Global Stocks Slide, Futures Drop After Turkey Shoots Down Russian Warplane

It had been a relatively quiet session overnight, with German GDP reported in line as expected, and attention focused on the second revision of US Q3 GDP in a few hours, when as reported previously, the geopolitical situation in the middle east changed dramatically when NATO-member country Turkey downed a Russian fighter jet allegedly over Turkish territory even though the plane crashed in Syria, and whose pilots may have been captured by local rebel forces.

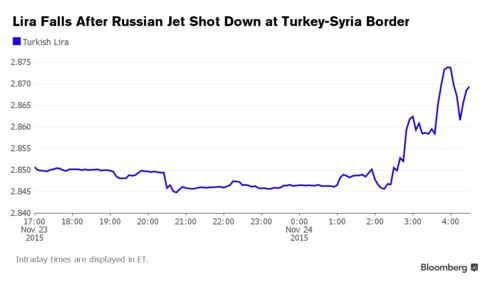

The news promptly slammed Turkish assets and FX, sending the Lira tumbling...

pushing lower European stocks and US equity futures while sending 2 Year German Bunds to record negative yields.

(Click on image to enlarge)

Since then, there has been a modest rebound in risk, however assets on both side of the Atlantic remain subdued on concerns just what the Russian response will be. According to Frants Klintsevich, deputy head of upper house’s security and defense committee, Russia views Turkish actions as “extremely agressive", even though Kremlin spokesman Peskov said that "it would be wrong to make some kind of assumptions right now, to make any statements until we have the complete picture. Therefore, we just have to be patient. This is a very serious incident, but again, it is impossible to say anything without complete information."

Elsewhere, the commodity pain continues and as Bloomberg notes, "there's no respite for mining stocks." BHP Billiton sank to its lowest in seven years in London trading. The world's largest mining company faces a one-notch downgrade to its credit rating in the next 12 months. Standard & Poor's says the move depends on BHP's response to potential falls in iron ore and oil prices. The fortunes of the Bloomberg World Mining Index, a gauge of 81 stocks, are tied to the outlook for commodity prices, particularly base metals. An LME index of six industrial metals has sunk to the lowest since 2009 on falling demand from China, the biggest commodities user. Citigroup is sticking its neck out and saying platinum may prove to be a good bet after slumping to a seven-year low on Monday.

In other overnight news, Bill Ackman’s increased his Valeant stake through a syntehtic long of 12.5 million share equivalents by buying calls and selling puts, China loosening control over brokerage business, VW approval of diesel engine fix, Noble Group put on S&P credit watch negative, and Carl Icahn announced new 7.13% Xerox stake.

Where global markets stand:

- S&P 500 futures down 0.3% to 2079

- Stoxx 600 down 1.1% to 376

- FTSE 100 down 0.7% to 6260

- DAX down 0.7% to 11013

- German 10Yr yield down 3bps to 0.5%

- MSCI Asia Pacific up 0.1% to 134

- US 10-yr yield down 2bps to 2.22%

- Dollar Index down 0.13% to 99.68

- WTI Crude futures up 1.1% to $42.22

- Brent Futures up 1.2% to $45.36

- Gold spot up 0.4% to $1,073

- Silver spot up 0.1% to $14.16

A more detailed look at global markets shows that Asian stocks traded mostly lower mirroring the lacklustre close on Wall St. as the continued losses in the metals complex weighed on risk sentiment after copper retreated below USD 4,500/ton . This saw the ASX 200 (-1.0%) pressured by large mining names. Nikkei 225 (+0.2%) traded mildly higher with Sharp shares soaring over 20%. Chinese bourses completed saw the materials sector underperforming in the Shanghai Comp. (-0.2%), while the Hang Seng (-0.4%) was weighed on by financials after China's Asset Management Association stated that 12 of its registered private funds were not contactable and it could declare the funds abnormal. There were also reports in the WSJ that China is to drop the limit on brokers' proprietary trading and allows for net short positions. 10yr JGBs traded flat amid light volumes despite the BoJ entering the market to purchase JPY 1.1trl in government bonds.

In Europe equities were weighed on by the uncertain sentiment (Euro Stoxx: -1.0%), particularly given that Turkey is a member of NATO and as such any escalation could have a wider impact on other NATO members . However equities came off their worst level in the following hour, amid no sign of immediate escalation on the back of the incident. In line with the softness in equities, fixed income markets saw a bid, while also benefitting from month end extensions, which are set to come into effect sooner than usual given the Thanksgiving Day holiday in the US on Thursday.

European Top News and Eco data:

- Germany Relied on Domestic Demand for Growth in 3Q: Growth led by private, government consumption last quarter as trade dragged on output amid a global slowdown.

- Altice Drops as Goldman Sells 61m Shares in Drahi Trade: Drahi’s Next in “funded collar” trade with Goldman, covering 81.2m of Altice’s Class A shares, according to statement late Monday

- Brussels Lockdown Stays as Terror Alert Extended by a Week: Schools, subway will be closed for 1 more day before gradually re-opening on Wed., PM Charles Michel told press conference late Mon. Paris Suffers Slump in Christmas Bookings After Attacks

- German Nov. IFO Confidence at 109.0; Median Forecast 108.2; Germany 3Q construction investment -0.3% vs survey 0.1%

- Finland Oct. PPI -3.2% y/y

- France Nov. business confidence 102 vs survey 101

In commodities, WTI held onto the Saudi inspired gains seen yesterday to see WTI and Brent remain above the USD 42.00/bbl and USD 45.00/bbl respectively. In the metals complex, gold rebounded off its lows amid concerns regarding the Turkish strike of a Russian plane, while also being supported by USD softeness.

In FX, the most notable event of the European morning has come in the form of the military incident between Turkey and Russia. Turkey have reportedly shot down a Russian jet, which they suggest was in Turkish airspace, however Russian press have stated the plane remained over Syria. The pilots parachuted out of the jet and as such there have been no reported casualties . In terms of how this filtered through to financial markets. Immediate weakness was seen in TRY, with USD/TRY moving sharply in the wake of the news, while bourses in Moscow and Istanbul have also both seen significant weakness throughout the morning.

Other implications have been a bid in JPY, with the safe haven benefitting from the uncertainty to see USD/JPY soften and move away from the 123.00 level, while gold also benefitted from a flight to safety.

Away from the events in Turkey, the key data release of the morning has come in the form of German IFO release (Business Climate 109.0 vs. Exp. 108.2) and while the higher than expected release saw no immediate impact, EUR continued its trend through the morning of strengthening, notable against the GBP, with stops being tripped in EUR/GBP at 0.7025-30.

Looking ahead, today also sees the secondary reading of US Q3 GDP, The September S&P/Case-Shiller home price index is also set to be released later, along with November consumer confidence (expectations for a bounce) and finally the Richmond Fed manufacturing index. We also get API crude oil inventories and comments from a host of BoE and ECB speakers.

Top Overnight News:

- Turkey Says It Shot Down Russian Warplane Near Syria Border: Turkish military downed Russian warplane in NW Syria after it violated Turkish airspace, local media reported, citing military officials it didn’t identify.

- Fed Rate Odds Rise to 74% in Bond Market as Pimco Sees Liftoff: Probability that Fed will act at its Dec. 15-16 session increased from

- China Said to Ease Control Over Brokerages’ Proprietary Trading: Govt cancels rule requiring brokerages to hold daily net long positions in proprietary trading accounts.

- VW Wins Approval for Fixes for Some Dirty Diesel Engines: Co. has approval to repair most of its rigged European diesel engines; made deal with U.S. regulators to resubmit questionable software for review in 85k other vehicles.

- Ackman’s Valeant Stake Expands to 9.9% in Show of Commitment: Holding grew to 9.9% in series of transactions starting in Oct.

- Tesla Motors Invites Customers to Personalize Model X SUV: SUV’s price starts at $80,000 before federal tax credits or state rebates.

- OPEC Seen Holding the Line as $40 Crude Looms Over Vienna: Group will keep strategy of undercutting rival producers when ministers meet next week, according to 30 analysts, traders surveyed by Bloomberg.

- Clinton Says Pfizer Deal Leaves Taxpayers ‘Holding the Bag’: “This proposed merger, and so-called inversions by other companies, will leave U.S. taxpayers holding the bag,” Democratic presidential candidate said in statement on Mon.

- Icahn Amasses 7.13% Stake in Xerox, May Seek Board Seats: Will speak with leadership over “improving operational performance and pursuing strategic alternatives, as well as the possibility of board representation,” according to boilerplate in regulatory filing.

Bulletin Headline Summary from RanSquawk and Bloomberg

- Turkey have reportedly shot down a Russian jet, which they suggest was in Turkish airspace, however Russian press have stated the plane remained over Syria

- Sentiment was weighed on by the news regarding Turkey, however European equities have come off their lows ahead of the North American crossover amid higher than expected German IFO data

- Looking ahead, today also sees the secondary reading of US Q3 GDP, consumer confidence index, API crude oil inventories and comments from a host of BoE and ECB speakers

- Treasuries gain as European stocks slid after Turkey said it shot down a Russian jet near the Syrian border; auctions continue today with 2Y FRN and 5Y notes, WI 1.665% vs 1.415% in October.

- The Russian warplane was shot down near the border and the two pilots were captured by Turkmen forces in Syria, AHaber TV reported. One of them is dead, CNNTurk reported, citing unnamed local sources

- Russia’s Defense Ministry denied that the aircraft had ever left Syrian airspace, while acknowledging that one of its jets had crashed in the country

- Yellen, responding to a letter calling for higher interest rates on behalf of savers, said Americans would have been worse off had the central bank not kept rates near zero since 2008, and repeated that she expects to tighten policy “gradually” after liftoff

- China has canceled a rule requiring brokerages to hold daily net long positions in their proprietary trading accounts as the nation’s stock market stabilizes following its summer slump, according to people with knowledge of the matter

- Bank of England Governor Mark Carney said Britain is going to have low interest rates “for some time” and officials must watch out for financial-stability risks arising from cheap borrowing costs

- Germany’s Ifo institute business climate index climbed to 109 in November, the highest level since June 2014, from 108.2 in October; Ifo said the Paris terror attacks didn’t have a negative impact on the survey data

- Passenger bookings for flights arriving in Paris during the Christmas period are down 13% from last year with visits from the U.S, Spain, Japan and Germany worst affected, according to a study based on figures from 200,000 travel agencies

- Investigators raced to examine an explosive vest similar to those used in the Paris attacks for clues as police across Europe hunted for a key suspect in the assaults and Brussels remained on security lockdown

- Russia and Iran underscored their growing alliance in the Middle East by bolstering business ties and projecting a united front on the civil war in Syria, where both have deployed military power to support President Bashar al-Assad

- $2.68b IG priced yesterday, $900m HY. BofAML Corporate Master Index OAS holds at +162, YTD range 180/129. High Yield Master II OAS widens 3bp to +635, YTD range 683/438

- Sovereign 10Y bond yields lower. Asian stocks mixed, European stocks lower, U.S. equity-index futures decline. Crude oil, gold and copper gain

US Event Calendar

- 8:30am: Advance Goods Trade Balance, Oct., est. -$60.9b (prior -$58.633b, revised $59.147)

- 8:30am: GDP Annualized q/q, 3Q S, est. 2.1% (prior 1.5%)

- Personal Consumption, 3Q S, est. 3.2% (prior 3.2%)

- GDP Price Index, 3Q, est. 1.2% (prior 1.2%)

- Core PCE q/q, 3Q S, est. 1.3% (prior 1.3%)

- 9:00am: S&P/Case Shiller 20 City m/m SA, Sept., est. 0.3% (prior 0.11%)

- S&P/CS 20 City y/y, Sept., est. 5.1% (prior 5.09%)

- S&P/CS 20 City Index NSA, Sept. est. 183.03 (prior 182.47)

- S&P/CS US HPI m/m, Sept. (prior 0.44%)

- S&P/CS US HPI y/y, Sept. (prior 4.68%)

- S&P/CS US HPI NSA, Sept. (prior 175.43)

- 10:00am: Consumer Confidence Index, Nov., est. 99.5 (prior 97.6)

- 10:00am: Richmond Fed Mfg Index, Nov., est. 1 (prior -1)

- 1:00pm: U.S. to sell $35b 5Y notes

DB's Jim Reid concludes the overnight wrap

There was plenty of white noise for markets to consider yesterday. More deep losses in metal markets, big volatile swings for Oil, credit market fragility tested again by Vodafone pulling its latest bond offering (despite sweetening the deal with step-up language), the biggest pharma acquisition ever with Pfizer acquiring Allergan, surprisingly hawkish ECB chatter and better than expected European PMI’s but some softish US data.

So it was perhaps surprising at the close of play to see such muted moves for risk assets all things considered. European equities were down modestly with the Stoxx 600 finishing -0.37% while in the US and after equity markets had been on track for one of the smallest high-to-low ranges of the year so far, a late fall into the close saw the S&P 500 (-0.12%), Dow (-0.17%) and Nasdaq (-0.05%) all close a smidgen lower. Credit markets were largely flat while in the Treasury market US 10y yields closed 2.5bps lower at 2.238% and 2y yields finished unchanged just below 0.920%, although at one stage traded north of 0.940% after yesterday’s 2y auction drew a yield of 0.948% - the highest since April 2010.

It’s been a similar start for bourses in Asia this morning where commodity names in particular have led the bulk of bourses lower. Losses are being led out of China in particular where the Shanghai Comp and CSI 300 are -0.21% and -0.33% respectively. The Hang Seng is down a similar amount while the ASX is -0.95%. Markets in Japan have reopened a touch higher after Japan’s Nikkei flash manufacturing PMI rose 0.4pts to 52.8. Commodity markets are a bit more mixed this morning (Oil posting a modest half a percent gain) while commodity currencies have rebounded generally. Meanwhile late last night the US issued a global travel alert citing ‘increased terrorist threats’ and Belgium has extended its lockdown in Brussels for another day.

Much of the focus today will be on two important data releases in the US. Firstly, the advance goods trade balance reading for October is expected to show a modest widening in the deficit, reflecting a drag from net exports which would be consistent with recent trends in the export and import components of the manufacturing ISM survey. Released at the same time will be the second reading for Q3 GDP. Our US economists are expecting growth to be revised up from the initial 1.5% print to 2.3% reflecting greater inventory accumulation, which is slightly ahead of current market expectations for 2.1%. They also note that this would point to less growth in the current quarter, because of the need to run inventories down a bit further and so we could see some implications for Q4 projections.

Taking a closer look at some of those themes which played out in markets yesterday. As noted it was a broadly weak day for metals in particular with fresh 'across the board' lows being reached as supply concerns reverberate. Copper closed down just shy of 2% and below $4500 for the first time since May 2009. Zinc closed down -1.28% although was down as much as 4% intraday, while Nickel fell nearly 5% and to the lowest since 2003. There was a steep fall for Gold (-0.82%) also, hovering around its five year low, while other precious metals also saw declines.

Meanwhile, it was a much more volatile session for Oil markets yesterday. WTI (-0.36%) actually closed the session little changed at just below $42, although that masked a 5.8% intraday range during the session, sparked by a big surge higher off the low print after Saudi Arabia said that it plans to cooperate with all oil producers and exporters, from inside and outside of OPEC to ‘preserve the stability of the market and prices’. The next OPEC meeting, due to take place in Vienna, is scheduled for the 4th December – a date worth keeping an eye on and a busy end to the week given the ECB meeting a day before.

Over at the ECB it was comments from board member Lautenschlaeger which, along with data, helped sovereign bond yields in the region nudge higher, 10y Bund yields in particular closing up +5.0bps at 0.528% and wiping out all of last week’s grind lower in the process. In contrast to the much more dovish commentary from Draghi on Friday, Lautenschlaeger said that she doesn’t ‘see any reason for further monetary policy measures, especially not for an extension of the purchase programme’. Justifying this, the board official said that ‘data in the last few weeks indicates that the euro-area economy has so far shown itself to be resistant to uncertainty in the global economy’ and that ‘we should give the numerous and, all-in-all formidable, monetary-policy efforts time to show their full effects’.

The main focus of yesterday’s data was on the November flash European PMI’s. In particular, there was a new cyclical high reached for the Euro area composite at 54.4 (vs. 54.0 expected) which was up half a point from October. This was supported by equal +0.5pt gains for both the manufacturing (52.8 vs. 52.3 expected) and services (54.6 vs. 54.1 expected) components, while our European economics colleagues noted that sub indices for composite new orders and employment rose to the strongest levels since May 2011. Meanwhile regionally, there was a positive surprise in Germany where the composite was up +0.7pts to 54.9 (vs. 54.0 expected) after being boosted by services, however in France the composite nudged down 1.3pts to 51.3 (vs. 52.5 expected) which is a reflection of a decline in the services activity, most likely impacted by the terror attacks. Our colleagues note with the composite PMI average of the big two countries virtually flat on the month, the flash PMI’s imply that on average Italy, Spain and Ireland rose by just over a point in November. Bigger picture and assuming no change in December, the composite PMI suggests euro-area output growth of 0.5% qoq in the last quarter of 2015, largely ahead of current market expectations. Importantly, the PMI surprise would likely have a negligible impact on the ECB decision in December.

Wrapping up yesterday’s data. Across the pond the main data of note was a softer than expected existing home sales reading for October, where sales were down -3.4% mom (vs. -2.7% expected) during the month, dragging the annualized rate down to 5.36m but consistent with other recent housing market data. The flash manufacturing PMI declined a greater than expected 1.5pts to 52.6 (vs. 54.0 expected) which was the lowest since October 2013. Finally, the October Chicago Fed national activity index came in a slightly softer than expected -0.04 (vs. +0.05 expected).

Looking at the day ahead, this morning in Europe the early focus will be on Germany where we will get the final reading for Q3 GDP where there is expected to be no change to the initial +0.3% qoq print, while later on we’ll get the November IFO survey. In France we well get the latest November confidence indicators. Over in the US this afternoon the aforementioned headline releases are the second reading for Q3 GDP and the October advance goods trade balance. The September S&P/Case-Shiller home price index is also set to be released later, along with November consumer confidence (expectations for a bounce) and finally the Richmond Fed manufacturing index. This morning we’re also expecting comments from BoE Governor Carney who is set to testify to UK lawmakers on the Treasury Committee on the BoE’s latest inflation report.

Copyright ©2009-2015 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every time you engage ...

more