Gilead's HCV Sales May Have Peaked

Gilead GILD has been a tremendous growth story ever since its HCV drug, Sovaldi/Harvoni, hit the market. Gilead's HCV regimen is saving lives, which makes it a company of interest to competitors and regulators. Despite Sovaldi/Harvoni's tremendous contributions to Gilead's profits, GILD is up only 8% over the past year versus 12% for the biotech index IBB

The past is no longer prologue for GILD. The stock is a sell for the following reasons:

HCV Sales May Have Peaked

Gilead's HCV regimen is becoming a victim of its own success. The faster sales grow, the less likely they will be able to maintain that growth rate going forward.

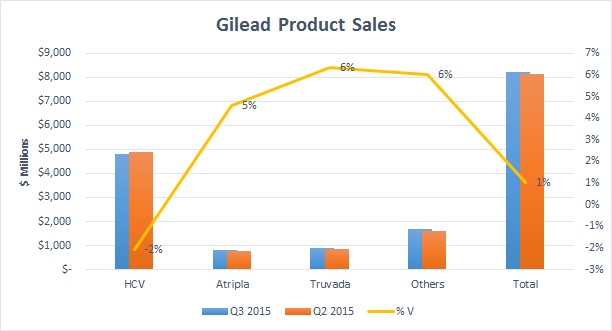

Source: Shock Exchange

Q3 product sales were flat Q/Q while HCV sales were down 2%. Sovaldi/Harvoni still represent over 58% of total product sales; as HCV goes, so goes Gilead. That's problematic as it appears that HCV sales peaked in Q1. In the U.S., there appeared to be pent up demand for Harvoni as new starts tallied 70,000. Starts fell to 62,000 and 60,000 in Q2 and Q3, respectively. There is still untapped potential but management expects U.S. starts to flatten out next year.

Gilead generated $870 million in revenue in Europe from 50,000 starts. This compares unfavorably to the $1.1 billion in revenue on 30,000 starts in Q2; this implies that the price of Gilead's HCV regimen has fallen off precipitously. Management expects revenue in Europe to be constrained by country specific budgets going forward. The fall off in European revenue was offset by $454 million in revenue from Japan. That said, due to the flattening of starts outside of Japan and declining prices in Europe, it appears that HCV revenue may have peaked.

Rate Hikes Could Be On The Way

GILD bulls must also realize that the overall market has been buoyed by zero interest rates and liquidity provided by the Fed. The Fed has been sending strong signals that it could raise rates in December for the first time in nearly a decade. The Fed has been preparing investors for months now, but that doesn't mean the market will not sell off. A rate hike and a disappointing Q4 earnings seasons could send broader markets into a tailspin - taking GILD with it.

Healthcare Regulation Is Still On The Table

In May, Senator Bernie Sanders ranted about the prices of HCV drugs and veterans' lack of access to them. After Presidential candidate Hillary Clinton also questioned drug price increases, the floodgates opened. A Senate Special Committee on Aging is expected to hold hearings on potential price gouging later next month. Stories of price increases from pharmaceutical companies like Valeant VRX, Turing and Mallinckrodt MNK have gotten lawmakers' dander up, and rightly so. Gilead is not currently a company of interest per se; however, in my opinion, Gilead's drug prices can only go lower from here.

good argument that sales have peaked, but I think you will be wrong. Revenues for GILD will increase QtoQ for next 4 quarters IMO.

The Shock Exchange doesn't see that way. Starts peaked in the U.S. in Q1. Starts are also beginning to decline in Europe. A combination of declining volume and declining prices could punish Gilead. The one caveat is that HCV sales are ramping up in Japan which could mask how poorly the U.S. and Europe are doing.