General Electric Market Cap Down $240 Billion Last 10 Years

General Electric (GE) has gotten absolutely crushed over the last two days, falling 15% from $20.50 down to $17.50. GE’s peak of the current bull market for the S&P 500 came on July 20th of last year, but since then it’s down 47%. Even more shocking is that at $17.50, GE’s share price is trading at the same level it was at 20 years ago in early 1997. Of course, there have been dividends paid, but it’s not a good look for a company when share price is unchanged on a 20-year basis.

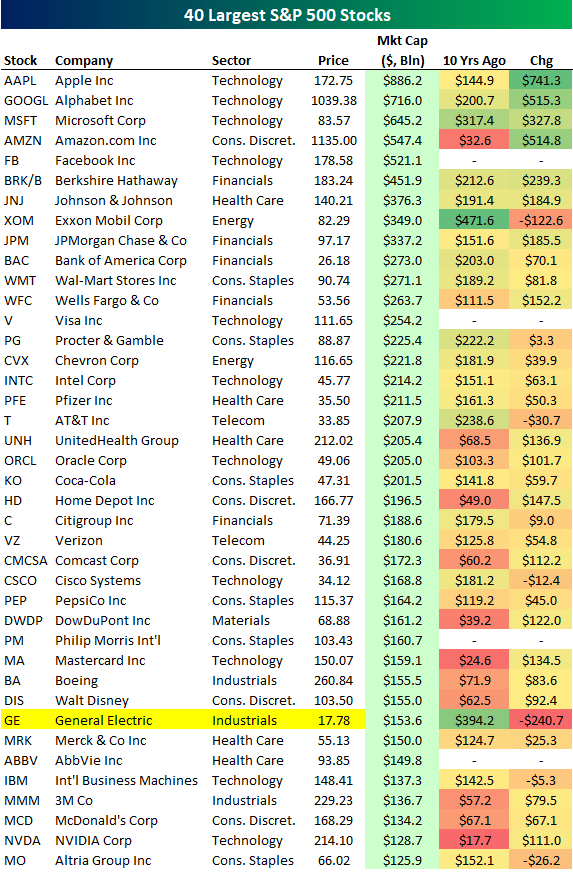

General Electric (GE) now has a market cap of $153.6 billion. That’s still larger than 93% of the stocks in the S&P 500, but it ranks 33rd from the top at this point. Ten years ago, GE was the second largest company in the S&P 500 behind only Exxon Mobil (XOM). Since then, GE has lost $240.7 billion in market cap.

Below is a look at the 40 largest stocks in the S&P 500 at the moment. While GE has lost $240 billion over the last ten years, three of the four largest stocks right now have each added more than $500 billion (AAPL, GOOGL, AMZN). Facebook (FB) has added $500+ billion in market cap as well given that it wasn’t even public ten years ago and it now has a market cap of $521 billion.

Had someone told you in 2007 that the S&P 500 would be up 80% ten years from now, you would have certainly expected GE to add to its market cap instead of subtract $240 billion. When it comes to long-term projections, it just goes to show you — expect the unexpected.

Disclaimer: To begin receiving both our technical and fundamental analysis of the natural gas market on a daily basis, and view our various models breaking down weather by natural gas demand ...

more