General Electric Is Tired Of Being Important

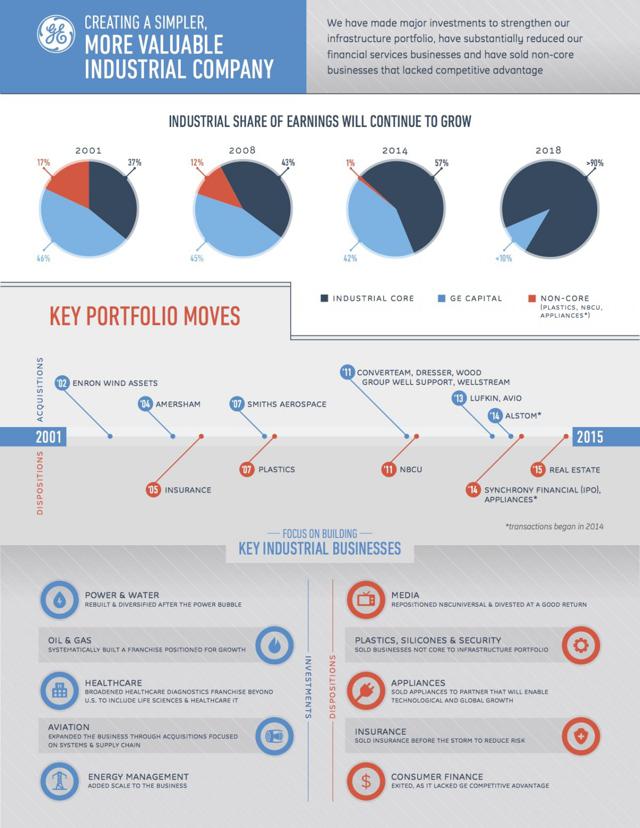

GE (GE) announced a number of changes including selling GE Capital's assets. Over $26 billion of real estate is going to Blackstone (NYSE:BX) with the performing loans associated with that real estate going to Wells Fargo (NYSE:WFC). Newly refocused on its industrial roots, GE will also lose its systemically important financial institution/SIFI designation. Losing the designation will free GE from a web of expense, rules, and complexity that takes the work of thousands of employees. Here is what the newly re-industrialized GE will look like:

GE Capital's return on capital is about 8% compared with about 14% for GE's industrial business. GE's sale of its mortgage assets appears to have attracted interest from potential buyers. Also, they have major real estate sales underway in Japan and Germany. With GE's new focus and new liquidity, they will be well positioned to go on offense with their industrial business. One potential deal would be for GE to buy up to $5 of the divestiture package coming to market in conjunction with the Halliburton (NYSE:HAL) acquisition of Baker Hughes (NYSE:BHI).

So if GE tries to be more like Honeywell or MMM or Emerson true industrials...this is a bad thing? I don't fully understand shorts, thanks.