GBP/USD Forecast: Bearish Momentum To Increase Below 1.2910

Sterling slide continues at the beginning of the week, with the GBP/USD pair pressuring last week low around 1.2915 after London's opening. News coming from the UK showed that mortgages approvals rose in August, indicating that consumer credit rose before Carney announced a rate cut down to 0.25%, although at a slower pace than it had for the previous few months. Nevertheless, data suggests that consumer sentiment improved, fueled by a cheaper Pound.

The UK macroeconomic calendar for this week, has little to offer until next Friday, when the kingdom will release its final Q2 GDP figures, but the US one will be fulfilled with significant releases and FED's speakers, indicating that the pair will likely depend mostly on USD strength/weakness.

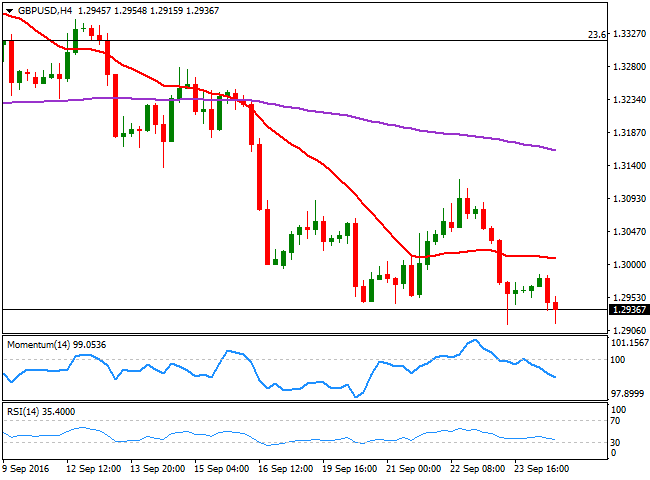

Technically, a bearish tone prevails in the 4 hours chart, as the price extends its decline below its 20 SMA, while indicators continue heading south within negative territory. A downward extension below 1.2910, should see the pair extending its slide down to the 1.2860/70 region, with further slides not expected for today, but eyeing 1.2793, the post-Brexit low.

The immediate resistance comes at 1.2950, with gains beyond this last targeting the 1.3000 region. Around this last, however, selling interest will probably re-surge and push the pair back lower.

View live chart of the GBP/USD