GBP/USD Falls On Poor UK Retail Sales

Christmas shopping was not so merry in the UK. The volume of retail sales dropped by 1.9% in December, far worse than 0.1% expected. In addition, the sharp drop came on top of a downwards revision for the month of November: a drop of 0.1% instead of a rise of 0.2% initially reported.

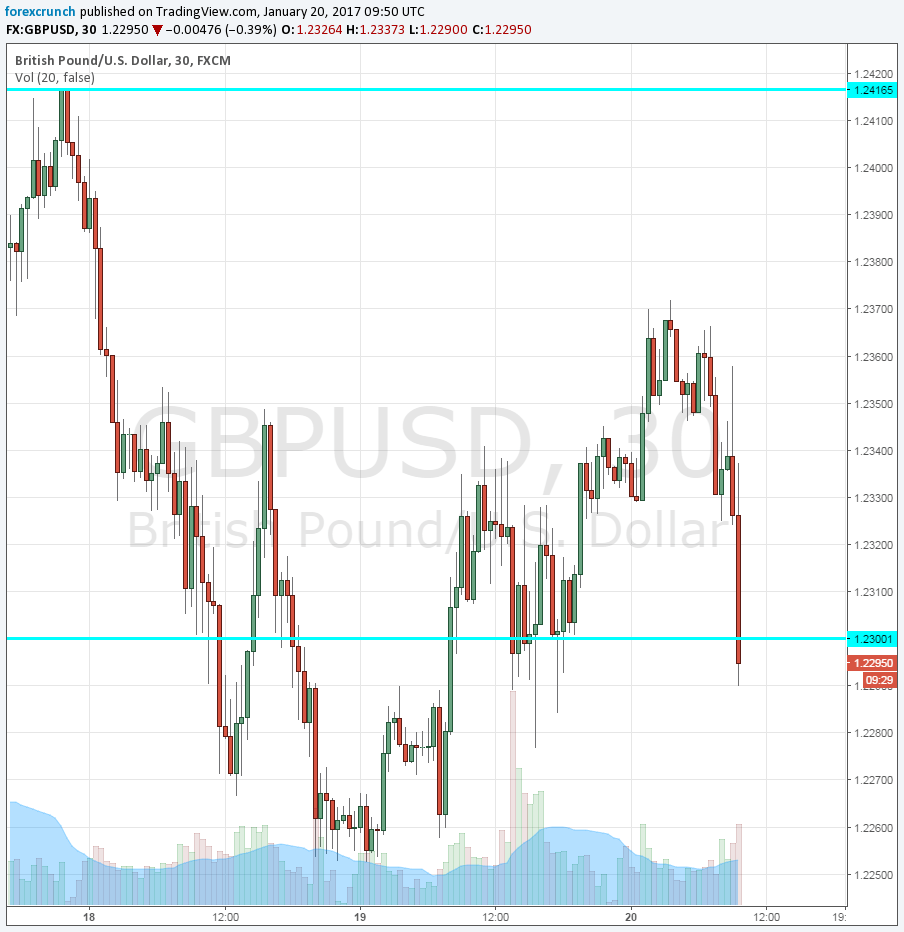

GBP/USD is now trading under 1.23, reaching a low of 1.2290, around 40 pips lower in the immediate aftermath and 80 pips below the highs of the day.

Is this Brexit related? It can be partially attributed to the EU Referendum. The fall of the pound is pushing prices higher and this has a negative effect on consumption. However, retail sales numbers are often quite volatile.

The Chancellor of the Exchequer Phillip Hammond said that UK consumers are already feeling the effect of the lower pound. The deflator used in the retail sales calculation jumped to 0.9% y/y, the highest since December 2013, the highest in three years.

Earlier this week, we learned that UK inflation jumped to 1.6% in both the headline and core figures. On the other hand, the jobs report was a pleasant surprise.

The main mover of sterling this week was May’s Brexit speech. GBP/USD dipped its feet under 1.20 in anticipation of Theresa May’s acceptance that the UK exits the single market. When the words actually came out of her mouth, cable jumped nearly 3%. The UK PM said parliament will get the final vote on the Brexit deal, that will contain a phased implementation.

Here is the move on the 30-minute pound/dollar chart:

(Click on image to enlarge)