Forget The Underdog, CorEnergy Is A Cinderella Story

Yesterday, CorEnergy Trust (NYSE:CORR) announced that it was acquiring 100 percent of the Grand Isle Gathering System from Energy XXI USA Inc. (NASDAQ:EXXI) for $245 million. CORR also said it intends to offer 11,250,000 shares of common stock to generate new proceeds of around $86.4 million (estimated at $6.68 per share).

You may recall that in a previous article, I explained that CORR is my "underdog REIT in 2015," and my recommendation in the more speculative REIT was based on the company's "premier partnerships" with energy infrastructure businesses. I wrote:

Instead of competing for deals in the open market, CorEnergy can source off-market deals and essentially be the "go to" landlord of choice.

I view CORR as more of a bank (or BDC) than a REIT, since the company provides sale/leaseback-funding utilizing net leases, and the only way it would lose revenue is if the tenant defaulted under its lease contract.

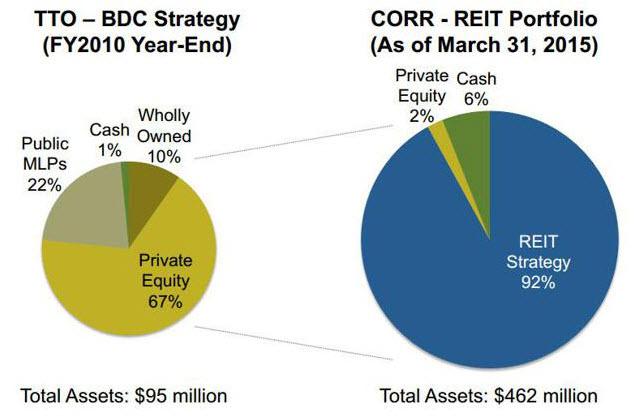

Although CORR is new as a REIT ($462 million in assets), the business was formed over 10 years ago, and many of the original investors remain equityholders in the company. The chart below illustrates the securities portfolio in 2010, when CORR was named Tortoise Capital Resources, and which was the company's last year structured as a BDC. The company was taxable so that it could hold pass-through entities (it had total assets of $95 million, no line of credit at the time and a $0.44 dividend).

Today, CORR is completely repositioned with $462 million in assets - and capabilities to fund projects for public and private companies in transaction sizes typically from $15 million to $250 million.

CORR's portfolio of energy infrastructure assets includes utilities, storage terminal operators, and oil & gas producers. One of the bigger risks for CORR is its size and reliance on larger customers. For example, its largest asset isPinedale Liquids Gathering System, which represents around 48 percent of revenue.

Ultra Petroleum (NYSE:UPL) (the guarantor) has publicly disclosed operating cost reductions, which are mitigating the impact of lower gas prices. The company has lowered both drilling & completion costs and operating costs, and it is profitable.

Like a pipeline capacity payment, CORR's minimum rent is not based on usage or commodity prices. The Pinedale property was generating around 80 percent of CORR's revenue, and over the last few quarters, the exposure has decreased considerably.

CORR's second-largest tenant, MoGas Pipeline (acquired in November 2014), has annual contracts with LDCs or utilities, which contracts for capacity on the pipeline, so CORR receives base payments regardless of usage.

The latest deal announced with CORR and its new tenant, Energy XXI USA Inc., is said to generate around $40.5 million in annual rent payments, with "potential additional variable rent linked to oil revenues realized." Based on the acquisition cost of $245 million and the annual rent (of $40.5 million), CORR appears to have scooped up a whopping 16.5 percent cap rate (initial yield).

In addition to the exceptional asset-level returns, the Grand Isle Gathering System will enhance CORR's diversification within its REIT-qualifying energy infrastructure sector. The new asset includes 153 miles of undersea pipeline that transports oil and water from six Energy XXI fields in the Gulf of Mexico and one filed operated by ExxonMobil (NYSE:XOM).

The 16-acre terminal includes four storage tanks, a saltwater disposal facility with three injection wells and associated pipelines, land, buildings and facilities.

The Grand Isle deal is in perfect alignment with CORR's core business model, in which the REIT provides capital to the oil & gas sector in a highly constrained marketplace. Given the price volatility and lack of visible production growth, many operators have been forced to reduce CapEx budgets, leaving CORR in a sweet spot.

In response to the environment, upstream companies are moving decisively to optimize their operations by taking out non-essential costs and reallocating capital - steps these companies just didn't have to take previously.

Across the energy spectrum, attention to return on invested capital (or ROIC) has never been more important to energy companies. As a result, CORR helps E&P operators to bolster their ROIC by reallocating capital. The seller keeps control and continues to operate the asset, while owning the associated commodities and making all commercial decisions regarding utilization of the asset.

Continue reading this article here.

Brad Thomas is the Editor of the Forbes Real Estate Investor.

more