Forget The Blue Wave… The Bad Wave Of Inflation Has Hit

Inflation is here and it’s bad.

You see, inflation enters the economy in stages. It’s not as though the Fed begins to print money and poof! inflation appears. It takes time.

The first stage occurs in the manufacturing/ production segment of the economy when you see producers suddenly paying more for the raw goods and commodities they use to manufacture/ produce finished goods.

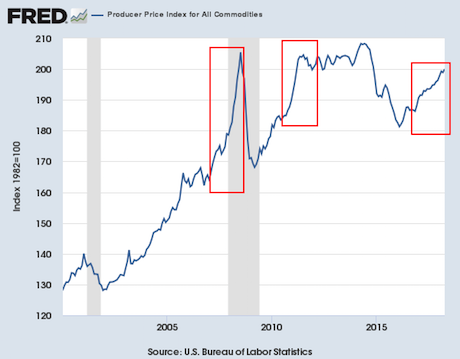

You can see this development in the chart below. The highlighted periods featured times in which Producer Prices for commodities or raw goods spiked approached record highs.

One or two months of higher Producer Prices for commodities or raw goods is no big deal, but once you’re talking 6-8 months of steadily rising Producer Prices it’s significant. At that point, manufacturers/ producers have to start raising the prices of finished goods or face shrinking profit margins

At that point, you move into the second stage of inflation: when the prices of ordinary objects begin to increase.

Bear in mind that phase 2 can happen in different ways. Management at companies doesn’t just say “raise the price now!” Instead, they can do different things such as charge the same amount for less of a finished product/ shrink the size of the container. This is called shrinkflation.

Another strategy is to start using cheaper/ lower quality raw goods (to reduce costs/ quality) while charging the SAME amount for the finished good. This too is inflation as the cost of the SAME item is MORE expensive, though it’s being masked because the QUALITY is LOWER and the price is the same.

We are now at THAT stage of inflation.

That Big Mac and Coke Now Comes With a Side Order of Inflation

U.S. companies are raising prices on everything from plane tickets to paint, passing on to customers higher costs for fuel, metal and food after years of low inflation.

- Source: Wall Street Journal

This is when things start to get REALLY ugly for the economy.

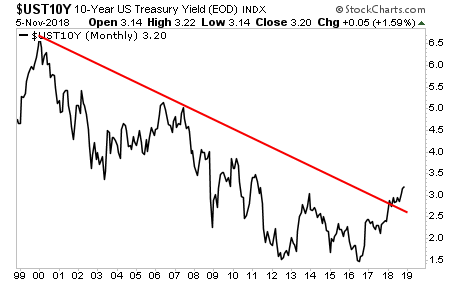

And the bond market knows it.

The bond market continues to blow up with yields on the all-important 10-Year US Treasury retesting their recent highs. Bear in mind, this is happening at a time when the US is planning a $1.3 trillion deficit next year and will be relying heavily on the debt markets to fund this.

This is a massive deal. This is effectively the bond markets telling the US that if it wants to issue debt, it’s going to cost it more.

And this is happening PRECISELY when the US is planning an astonishing $1.3 trillion deficit.

Mark my words,… 2019 will be when the US debt crisis hits.

For more market insights and investment ideas, swing by our FREE daily e-letter at www.gainspainscapital.com.