Foreign Bonds Rallied Last Week As Dollar Dipped And Stocks Fell

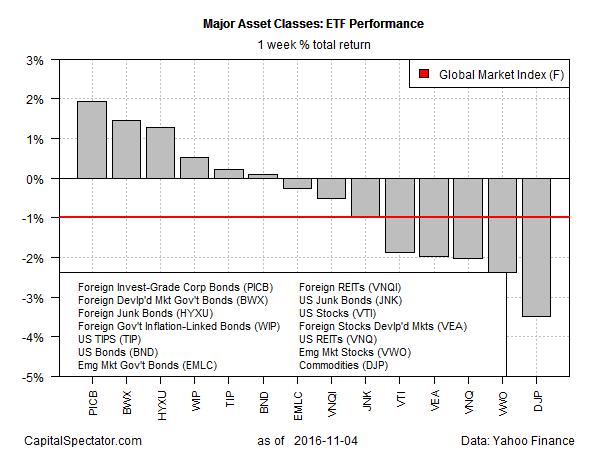

The first week of November wasn’t kind to stocks, commodities, or real estate investment trusts (REITs), but a falling US dollar supported foreign bonds—the only corner of the major asset classes to post significant gains, based on a set of proxy ETFs.

Taking the top performance spot for the five trading days through last Friday (Nov. 4): PowerShares International Corporate Bond (PICB), which posted a 1.9% total return—the first weekly gain for the ETF since mid-September.

A key factor in foreign fixed income’s rally is a softer US currency. The US Dollar Index fell for a second week. Note, however, that the rally in offshore bonds wasn’t all-inclusive. In particular, emerging-market fixed income didn’t participate and instead posted a slight loss last week, based on VanEck Vectors JP Morgan EM Local Currency Bond (EMLC). On the other hand, investment-grade US bonds (BND) and inflation-index Treasuries (TIPS) inched higher.

Last week’s biggest loser (again): broadly defined commodities. The iPath Bloomberg Commodity ETN (DJP) fell for the third straight week, shedding a hefty 3.5% during the five trading days through Nov. 4.

Despite the advance in offshore bond markets, a generally negative bias defined last week’s trading action, which weighed on an ETF-based version of the Global Markets Index (GMI.F). This investable, unmanaged benchmark that holds all the major asset classes in market-value weights fell 1.0% over the five trading days through last Friday.

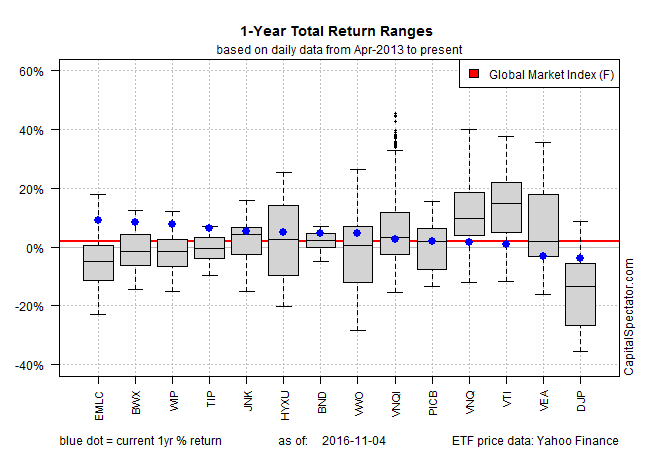

Turning to one-year results, EMLC continues to hold the top spot. This ETF that tracks emerging market government bonds is up 8.9% in total-return terms for the 12 months through Nov. 4.

Meantime, commodities are still in last place among the major asset classes for trailing one-year results: DJP is down a modest 2.5% for the past year.

GMI.F’s one-year total return decelerated again last week, dipping to a gain of just 2.0% vs. the year-earlier level.

Disclosure: None.