Flip Flopping Thursday – Trump Policy Reversals Confuse Markets

What next?

Yesterday, President Trump crashed the Dollar by completely reversing his stance on China, saying to the WSJ: "They're not currency manipulators" which is exactly the opposite of what he ran on in his campaign, Trump insisted that one of his first acts as president would be to direct his treasury secretary to label China a currency manipulator. It was part of a "contract" with American voters that he pledged to fulfill.

In fact, Only days ago, in an interview with the Financial Times, Trump reiterated that campaign pledge. "You know when you talk about, when you talk about currency manipulation, when you talk about devaluations, they are world champions," he said of China. "And our country hasn't had a clue, they haven't had a clue."

That's not the only major reversal we have this week, Trump gave held a press conference with NATO Secretary General, Jens Stoltenberg and Trump explained his reversal there saying: "“I said it was obsolete. It’s no longer obsolete.” I guess if you want Trump to completely reverse his position on you, your company, your country or your institution – all you have to do is meet with him…

Janet Yellen came out a winner yesterday as Trump said: "I like her, I respect her.” As for the Fed’s interest rate policies, he told the Journal, “I do like a low-interest rate policy, I must be honest with you.” This is after criticizing Yellen during the campaign for creating a “false market” by keeping interest rates low “because she’s obviously political and doing what Obama wants her to do.” Yellen, he said at the time, “should be ashamed of herself.”

In the same interview on Wednesday, he completely reversed his position on the U.S. Export-Import Bank: “It turns out that, first of all, lots of small companies are really helped, the vendor companies,” Trump said on Wednesday. “But also, maybe more important, other countries give [assistance]. When other countries give it we lose a tremendous amount of business.”

In a separate interview Wednesday, Mick Mulvaney announced an end to the administration’s federal hiring freeze designed, the White House said when it was unveiled last month, “to stop the further expansion of an already bloated government.” As noted by the Daily Beast:

The freeze was a key campaign promise, featured prominently in a series of policy proposals that Trump dubbed his “Contract with the American Voter” and in which he also promised to reform the tax code, repeal Obamacare, and spend $1 trillion on infrastructure projects in his first 100 days in office -- Wednesday was day number 83.

If Trump is looking to devalue the Dollar, mission accomplished because nothing spooks investors out of a currency faster than political instability and, if you can't tell which way the Government fees about major policy issues from one day to the next – that's about as unstable as things get!

Worst of all for the markets, if we don't have day to day policy consistency, how can we continue to count on Trump's other promises to fix healthcare, lower taxes and build giant walls? Without these things – all we have left is our hatred for immigrants and poor people.

Meanwhile, the President claims victory on Job Growth, which fell 50% in March, Energy, which is 12.5% more expensive than when Trump was elected, Regulations, which were protecting citizens but are no longer doing so and The Border, which was never an actual problem and still is/isn't because nothing has really been done other than a few showy round-ups and asking for bids for a wall that hasn't been budgeted.

Does Trump hate Kim Jong Un because he's better at pretending things are going great than he is? Maybe it's because he is worshiped as a God while Trump is ridiculed as a buffoon? Trump hates Kim so much that he's offered to pay China (in the form of a BETTER trade deal) if they "solve the North Korea problem." Wouldn't giving China a BETTER trade deal – on any pretext – be a complete and utter sell-out of the Trump base?

Policy uncertainty is a given. Betrayal of the electorate is a matter of opinion but those things are running headlong into economic uncertainty as we wrap up the first quarter of 2017 and begin seeing earnings reports and the first real economic data of the Trump Error (day 84).

This morning we got the PPI report and that was down 0.1%, shocking leading economorons, who predicted it would hold steady after last month's 0.3% increase. Low PPI is not good for Corporate Earnings since it reflects the prices the domestic producers receive for their output. Pair that with rising labor and materials cost (energy priced up 12.5%) and you have a bit of a margin squeeze.

Earnings are expected to be up 10% from Q1 2016 and, though Citigroup (C), JP Morgan (JPM) and Wells Fargo (WFC) all beat on earnings this morning, none are gaining from the results and WFC is down 2% with clear signs of a slowdown in lending. C and JPM's gains came mainly from Investment Banking and Trading, not from the ordinary business of running a bank, so don't look for any good news there to benefit the sector, which has pulled back considerably from it's highs (we are short FAS calls in our Short-Term Portfolio).

Yesterday, in our Live Trading Webinar (where we made over $250 per contract in 2 hours trading oil (/CL) lower), we discussed a potential long trade on the Ultra-Short Financial ETF (SKF) and now that the earnings are out on some of the banks, I am more in favor of it than I was yesterday. SKF is currently at $29:35 and a good way to play it (and it makes a good hedge) is:

- Buy 20 SKF May $27 calls for $2.35 ($4,700)

- Sell 20 SKF May $30 calls for 0.75 ($1,500)

- Sell 5 C 2019 $45 puts for $3 ($1,500)

That puts you in the $6,000 spread for net $1,700 and all SKF has to do is be over $30 in 36 days (May expiration) and you collect $6,000, which is a $4,300 (252%) return on cash but you would have the remaining obligation to buy 500 shares of C, which is now $58.50 and just reported great earnings, for $45 through Jan 2019. That will cost you about $2,260 in ordinary margin but still a nice return ($4,300) no matter how you slice it.

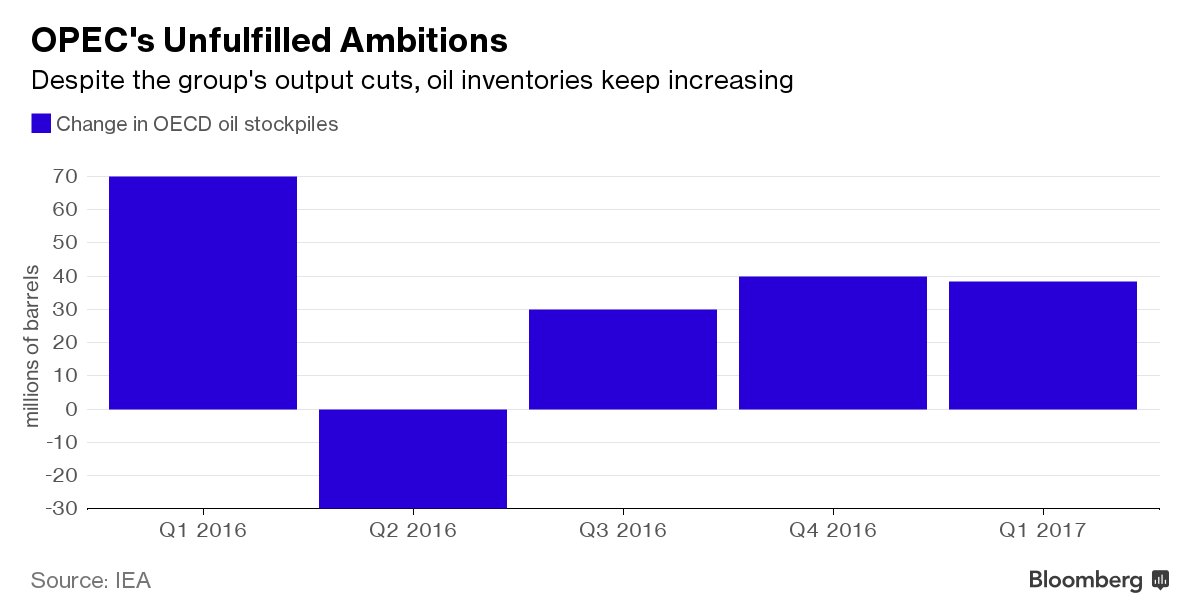

Speaking of slicing, the IEA has once again lowered it's demand forecast for oil in 2017 but still pegs overall growth at 1.3Mbd though now they are warning that "this outlook could still prove optimistic." As a perpetual skeptic, it's the word "optimistic" that stands out here as the International Energy Agency is supposed to represent the people of Earth who, as consumers of fuel, would like to see prices lower and demand lower, not higher. Sadly, like our own EIA, the IEA has become a puppet for the energy industry.

We're still looking for more downside to oil into next week's contract rollover but, after that, we plan to join the bull party into July, when we'll be shoring again. That's not flip-flopping, that's planning to play a seasonal market where the Fundamentals (massive oil supply glut/low demand) have been thrown out the window and a lack of regulations allows the markets to be manipulated with such regularity that we can make a nice living playing it.

Tomorrow is a holiday so have a fantastic weekend.

Disclosure: Our teaching theme at Phil's Stock World is "Be the House, NOT the Gambler." Please see " more