Flextronics Is A Strong Buy In 2015

A) Introduction

Flextronics International (NASDAQ:FLEX) is a supply chain company that designs, manufactures, ships, and services electronic products for original equipment manufacturers (OEMs). We believe the company offers a rare opportunity in which the stock combines an attractive valuation with strong price momentum and strong company insider buying. Each of these factors is good determinant of future success, and we will outline why as we progress through the analysis. The report will start with a breakdown of Flextronics valuation profile, then will proceed to an analysis of the price and profit growth, followed by an analysis of recent "smart money" transactions, and concluding with some qualitative analysis and conclusions. Flextronics will outperform in 2015 based on its strong combination of value, price momentum, and industry tailwinds.

B) Value Breakdown

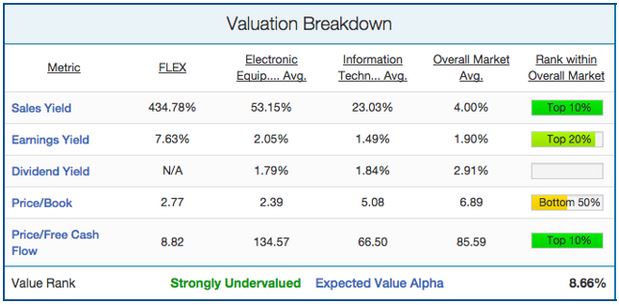

We take a quantitative approach to investing, preferring to focus our analysis on a certain set of metrics that have a strong predictive ability. We'll start by analyzing Flextronics's value profile. This is important to look at as "Value stocks (with low ratios of price to book value) have higher average returns than growth stocks (high price-to-book ratios)". Flextronics valuation profile is shown below:

A few things are apparent from looking at the table above. First, FLEX is wildly undervalued relative to its industry group on a revenue basis with a sales yield of 435% versus a group average of 53%. This means investors can currently get over $4 of sales for every $1 they invest. This is especially impressive from a company that is projected to see increased revenues in the future. FLEX is undervalued on an earnings basis as well, with an earnings yield (7.63%) more than triple the industry group (2.05%) and sector (1.5%) averages.

As Dan Strack outlined in his article, Flextronics is the king of free cash flow. This is reflected in its price/free cash flow ratio (8.82), which is way below the industry group (135), sector (67), and overall market averages (86). Additionally, the stock has used this cash flow to its advantage through huge share buybacks (retirement of 30% of share float in last few years). This more than makes up for the lack of a dividend, as investors benefit from effectively owning a larger percentage of the company. Overall, we feel the company is strongly undervalued and will outperform the market by 8.66% due to this undervaluation.

C) Growth Breakdown

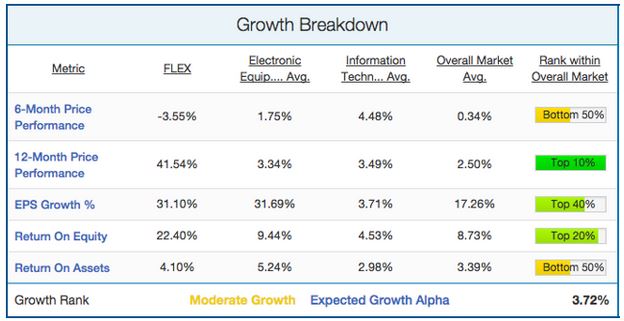

There are a variety of different growth metrics that have been shown to predict stock returns. Most important among them is price momentum. Winning stocks keep winning, and losing stocks tend to keep losing. Flextronics growth profile is shown below:

While FLEX has underperformed over the last six months (-3.55% vs. +4.5% for tech sector), the stock performed very well overall during 2014 (+42%). In terms of profit growth, the stock grew annual EPS by 31%, which falls in line with the industry group growth average of 32%. FLEX is financially efficient as well, returning 22% on equity, which puts it in the top 20% of the market. Overall, we feel the stock possesses moderate growth and will outperform the market by 3.72% due to this. This can obviously change quickly, as our model relies on price momentum as an input, which can change at the market's whim.

D) "Smart Money" Breakdown

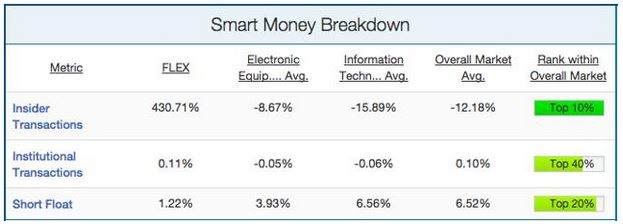

In addition to value and momentum, we will also analyze how the "smart money" on the street is playing Flextronics. "Smart money" stakeholders are short sellers, company insiders, and institutions. Each of these stakeholders tends to be much more sophisticated than the average investor. We have found loads of academic research showing that short sellers, company insiders, and institutions all predict stock returns. This breakdown is shown below:

As we can see above, company insiders at Flextronics have been buying stock in bulk (increasing their ownership of the stock by 430%). This number is due to the massive $51 million purchase by Glenview Capital Management (10% owner) on October 3rd. As shown in the link above, company insider buying is usually a very good sign for the stock in the year ahead. The stock is also seeing very little short interest (1.22% of the float), meaning that shorts don't see much downside in the stock (also a very good sign). Also shown in the link above, low short interest stocks tend to outperform the market by a wide margin. Institutional buying is right on par with the overall market average.

E) Qualitative Analysis & Conclusions

There are some qualitative risks involved with Flextronics that are not identified in the type of quantitative analysis we've done so far. First of all, Lenovo completed the acquisition of Flextronics's biggest customer (10% of sales) - Motorola - on October 30th. Reading through Flextronics' 2015 Q2 earnings transcript (interestingly enough on October 29th), you get the sense that management is cautiously optimistic on the outcome of the deal. While Flextronics and Motorola have a strong relationship together (Flextronics acquired Motorola's Mobility division in 2013), there is always a risk when dealing with new management. A breakdown in the relationship is obviously a very improbable event, though it is a possible risk. On the positive side, Flextronics's Consumer Technology Group (CTG) business unit stands poised to gain from the strong expected demand of wearables in 2015. These devices tend to have a complex manufacturing process, benefiting a manufacturing specialist like Flextronics.

Overall, we feel Flextronics offers a strong combination of price momentum and value. The recent +$50 million purchase by Glenview Capital is also very encouraging, as is the abnormally low level of short interest. Flextronics releases Q3 earnings on January 28th, with analysts expecting $0.26 EPS and $6.625B in revenue. The company has beaten both EPS and revenue estimates 6 times in a row, making it highly likely they will beat again. We believe Flextronics is a "Strong Buy." Investors looking to learn more about our analytical style can do so here.

Disclosure: None.

If its any prediction of a good investment, the stock was upgraded twice last year from Hold to Buy by Argus, and by Needham. Last year the stock jumped over 47%, but can it continue its upwards momentum?