Fiscal Policy Works - A Monetized Fiscal Policy Works Even Better

“In some countries, monetization of public debt is now inevitable, with the central bank buying government bonds and either writing them off or rolling them over perpetually. In Japan, for example, there is no credible scenario in which public debt will ever be paid down to so-called sustainable levels. In China, the distinctions between public and private debt are blurred, but monetization will probably occur in some indirect fashion.” (Adair Turner, Getting Fiscal Stimulus and Central Bank Independence in Synch, Project Syndicate, May 11, 2017)

It is generally accepted that the economic prospects facing the advanced economies is improving. The factors behind the improving outlook include continued easy monetary policies combined with increased evidence of fiscal easing.

As the IMF indicated in its April 6, 2017 report, the advanced economies had eased their fiscal stance in 2016 by 0.2% of GDP, compared to the five previous years of tightening.

China also allowed its fiscal deficit to increase from 0.9% of GDP in 2014 to 3.6% last year.

Though the U.S. fiscal plan is hard to gauge, most forecasts assume an increase in the federal government budget deficit to about 4.5% of GDP range next year. The U.S. recorded a budget deficit of 3.2% Of GDP in fiscal 2016, its largest deficit in 3 years.

As Adair Turner has observed, monetary and fiscal policy working together are much more effective in stimulating economic growth than simply relying on either policy in isolation.

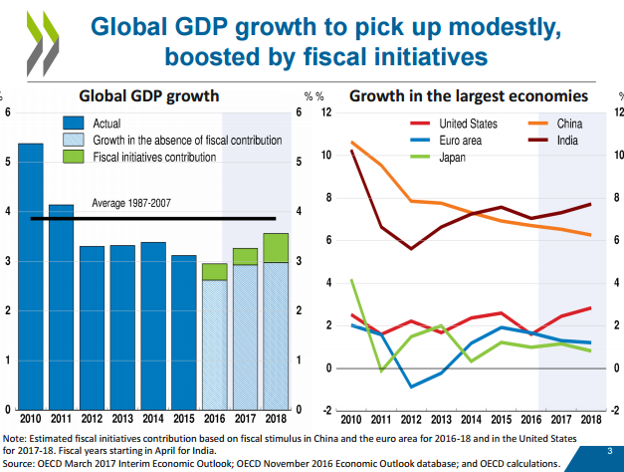

Last March the OECD forecast global GDP to pick up modestly to around 3.6% in 2018, from just under 3% in 2016. The OECD also emphasized that modest growth improvement can be traced to stronger fiscal initiatives in the major economies.

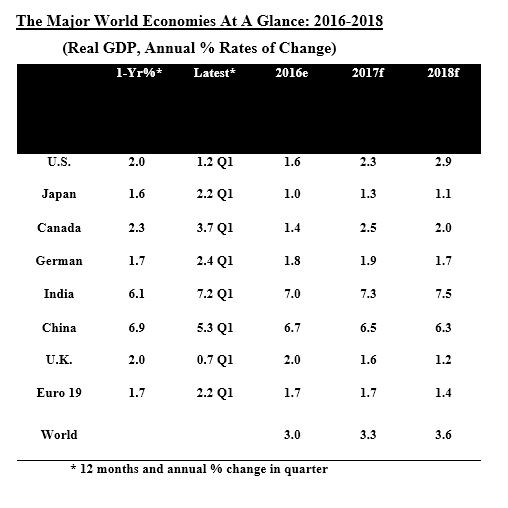

The IMF global forecast, issued in April, was quite similar. The IMF cited buoyant financial markets and a long-delayed cyclical recovery in manufacturing and world trade. The IMF projected the global economy to increase from 3.1% growth in 2016 to 3.5% in 2017 and 3.6% in 2018. The IMF stressed that the international recovery was modest because of a series of structural problems including low productivity growth and growing income inequality.

Recent surveys of international purchasing managers also portray a modestly improving global outlook for the goods and the service industries.

As the forecasts in the following charts and tables suggest, virtually all advanced economies, including the U.S. and Canada, are likely to post modestly improved growth rates over the next couple of years.

Disclosure: None.

IMF stands for In My Fantasy. The numbers seem to be a bit rosy, especially if the governments do not want more fiscal stimulus. The Republicans are scared that they won't be able to give the wealthy a tax break if they start spending too much. I don't think the IMF has solid footing for all this growth. China and India may grow but if consumer demand goes down, what will drive it?