Financials – Interest Rates & Central Banks

It seems that, after all, the FED was a prognosticator on how best to save the US economy by using unconventional tools. At one point in time, we even thought the FED was playing Dr. Frankenstein by using quantitative easing (QE) to supercharge the stock market. While they could have created an unstoppable monster, it seems that it has worked well so far.

Now, it’s time for Mario Draghi, President of the European Central Bank (ECB) to play on the same playground. On March 10th, the ECB not only reduced its interest rate to zero, but also boosted its QE operation from 60 billion euros to 80 billion euros.

“The Governing Council expects key interest rates to remain at present or lower levels for a long period of time and well past the horizon of our net asset purchases,” Draghi said. Based on the current view, “we don’t anticipate it will be necessary to reduce rates further.”

In Canada, we are patiently waiting for the first Liberal Government’s budget to see how the new government intends to revive the ailing Canadian economy. So far, we have the natural resources and energy sectors that are struggling in a massive way. The latest oil price increase should put a small Band-Aid on this heavy wound. On the other hand, we have the service and manufacturing sectors taking the lead to pull the Canadian economy’s head right above water. Here’s what we can read from the Bank of Canada’s latest statement on interest rates:

“Prices of oil and other commodities have rebounded in recent weeks. In this context, and in light of shifting expectations for monetary policy in Canada and the United States, the Canadian dollar has appreciated from its recent lows. With these movements, both the price of oil and the exchange rate have averaged close to levels assumed in the January MPR.

Canada’s GDP growth in the fourth quarter was not as weak as expected, but the near-term outlook for the economy remains broadly the same as in January. National employment has held up despite job losses in resource-intensive regions, and household spending continues to underpin domestic demand. Non-energy exports are gathering momentum, particularly in sectors that are sensitive to exchange rate movements. However, overall business investment remains very weak due to retrenchment in the resource sector.”

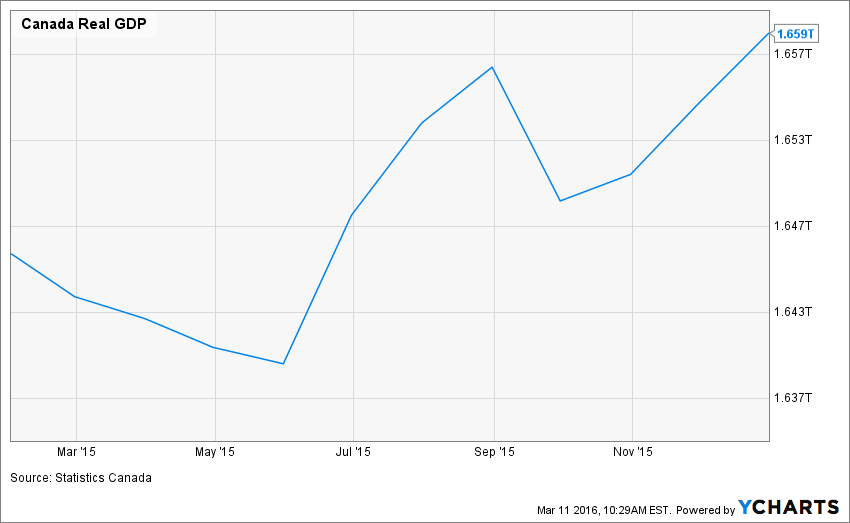

source: Ycharts

As you can see on the above chart is that we are not in recession, but we are not in a growing economy either.The Canadian economy is growing slowly, but we are closer to call it stagnation more than anything else.

In the US, we have a FED ready to pull the trigger on an interest rate hike once again in the upcoming months. With the unemployment rate below the 5% bar, the FED is navigating with a global economic stagnation situation and a US economy pushing further. At one point or another, we will see other interest rate hikes in 2016 if the US economy continues to create jobs.

“I still think they are going to raise rates in March,” said Gus Faucher, a senior economist at PNC Bank. “I don’t want to oversell it, but I think that while what goes on overseas has an impact on the U.S. economy, what’s much more important is what goes on domestically.”

We now have Japan at 0, Europe at 0, Canada at its lowest interest rate ever (0.50%) and the US that just increased their rates in December. On one side, this is quite a signal that the economy can’t grow by itself at the moment and needs an urgent boost of liquidity. On the other side, it may prepare the table for a very strong bullish market. Those who are currently benefitting from this low interest rate environment will definitely create value in the upcoming years. Who else better than companies of the financial industry to do that?

Canadian Banks: Are they worth it for Americans?

As a Canadian investor, banks are now trending at very low levels meaning they pay a very high yield for such a stable sector. As of March 11th 2016, here’s how much 7 banks were paying in yield:

| Company Name | Ticker | Yield |

| Roybal Bank | RY.TO | 4.41% |

| TD Bank | TD.TO | 4.01% |

| CIBC | CM.TO | 4.87% |

| BMO | BMO.TO | 4.31% |

| ScotiaBank | BNS.TO | 4.65% |

| National Bank | NA.TO | 5.23% |

| Canadian Western Bank | CWB.TO | 3.81% |

As you can see, you can easily buy any bank and earn over a 4% yield. Even better, all the above banks are expected to raise their dividend year after year. Some of them even raise them twice a year. This sounds like a bargain for most investors and if you are looking to build a solid core portfolio, I think that Canadian banks should be part of it.

Now, for Americans, those who bought Canadian Banks in 2015 thinking the storm was over, many were hit by the currency exchange rate. At the moment, the USD has lost steam compared to the CAD and I believe this issue is behind us. In other words, Canadian banks are worth a look for both Canadian and American investors. The Big 5 (the biggest 5 banks) all trade on the NYSE under the “same ticker” (just take out the “.TO”).

I did a filter in the financial sector and I’ve pulled out all companies showing the following criteria:

- Dividend yield between 2% and 10%

- 5 year dividend growth positive

- 5 year revenue growth positive

- 5 years EPS growth positive

I decided to cover 6 CDN and 9 US dividend stocks in my most recent DSR premium newsletter. I’m sharing 2 of them here.

Canadian Western Bank (CWB.TO)(CBWBF)

source: Ycharts

Based in Alberta, Canadian Western Bank went through its golden years since the 2000s with the exploitation of the oil sands in Northern Alberta. Now things are a little bit more difficult, pushing the stock price down by roughly 8% over the past 12 months. The good news in all this is that its dividend yield has never been so attractive, nearing the 4% bar (currently 3.81%).

While the market fears the worst in terms of credit deterioration for CWB, results so far have been surprisingly positive. CWB also managed to post loan book growth of 3% in its latest quarter. Even though the Alberta economy is seriously slowing down, CWB shows strong resilience.

Now that we see rising oil prices again, it might be the perfect time to enter a position in CWB if you are willing to take on more volatility in your portfolio. Still, this is a risky play.

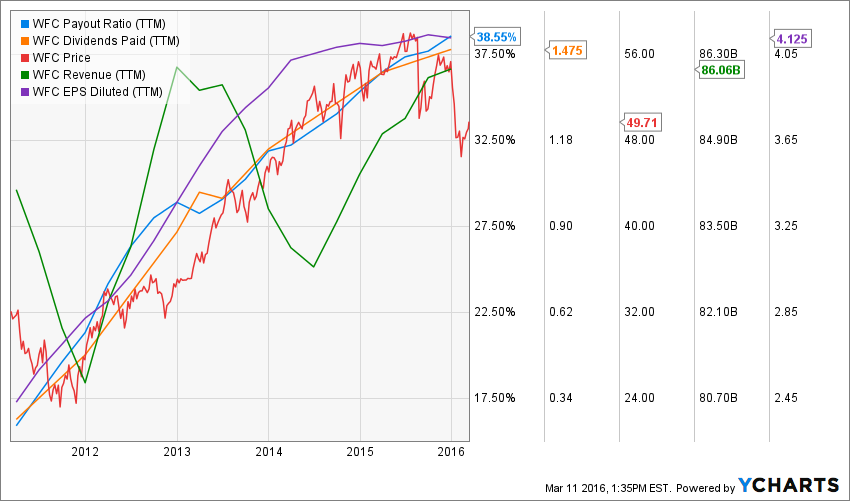

Wells Fargo (WFC)

Wells Fargo is a company offering financial services. It operates through 3 different segments: community banking, wholesale banking & wealth and brokerage & retirement. Wells Fargo is part of the famous Warren Buffett portfolio. WFC is one of the first banks to climb out of the 2008 financial meltdown.

The WFC business model is clean and simple. Most of its business comes from classic banking activities; savings and loans. The company has over 1 trillion in deposits and shows a very strong position to benefit from a rising interest rate.

The company has a strong history of risk management and its loan portfolio is well balanced between commercial (49%) and consumer (51%) loans.

We have a strong bank that is well situated on a nearly impossible-to-replicate competitive advantage. This ensures dividend growth for several years.

Disclosure: None.

Disclaimer: Any information shared on The Dividend Guy does not constitute financial advice. The Dividend Guy is ...

more