Financial Stocks Remain In Drivers' Seat

After the November elections, the equity market has been soaring. The so called “Trump” rally actually had been building prior to the election, but recent trading volumes have an average of 20% higher volume than previous 5 years’ worth of trading data. Additionally, fixed income trading is skyrocketing, with volume hitting levels not seen since the financial crisis. Undoubtedly this is especially good for one asset class; financials.

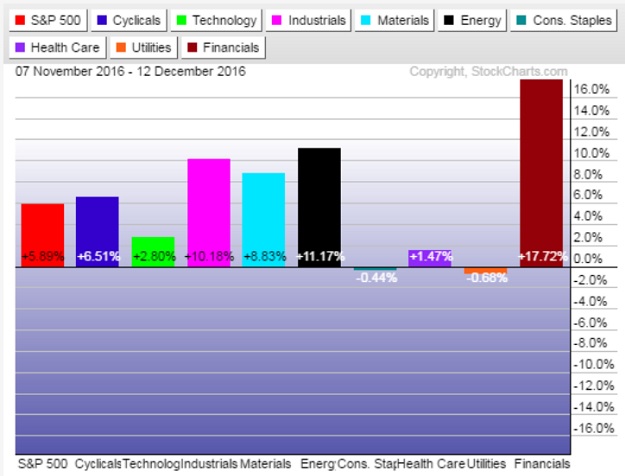

You can see in the chart below how the ramp up in financials isn't a small move. In the short-term, financials shares are benefitting from volatility and volumes, but the support for a longer-term trend is deregulation of one of the largest sectors in the US.

The Fed might kick financials into higher gear when the FOMC begins its two-day December meeting today, with central bankers widely expected to increase interest rates. Policymakers last hiked in December 2015, the first such move in more than nine years. Higher rates are generally considered beneficial to financial institutions who can charge higher rates for loans.

Disclaimer: Futures, Options, Mutual Fund, ETF and Equity trading have large potential rewards, but also large potential risk. You must be aware of the risks and be ...

more