Fed Raises Rates & The Dot Plot Moves Higher

GOP Set To Vote On Tax Plan Next Week

The House and Senate have been in conference this past week. They have agreed upon a plan in principal. Some minor variables need to be solved. The goal is to have the votes early next week. The party leaders say they have enough votes to pass the bill. The Senate is expected to hold the final vote on Tuesday. The top individual tax rate in this new plan is 37% and the corporate tax rate is 21%. That’s 1% higher than the plan was originally. Lawmakers said that 1% increase was necessary to make the numbers work. The mortgage income deduction will be capped at $750,000. The Obamacare mandate will be repealed. For high tax areas like New York, $10,000 in state and local property taxes or income taxes will be allowed to be deducted. The deduction for pass-through companies is 20%. The top tax rate for pass-throughs is 29.6%. There won’t be a corporate alternative minimum tax. To get the moderate Senator Collins on board with the plan, the President agreed to pay subsidies to insurance companies and fund states to set up high-risk pools to prevent premiums from rising too quickly. The final bill will add about $1 trillion to the debt over 10 years.

FOMC Raises Rates 25 Basis Points

As expected, the Fed raised rates by 25 basis points. The guidance is for 3 rate hikes in 2018. I’ve been expecting 2-3 hikes, so that’s not a surprise. The Fed will increase its balance sheet shrinkage to $20 billion per month in January which isn’t a surprise as it said it would gradually increase the speed of the runoff in 2018. As you can see from the chart below, with the latest unwinding, the balance sheet is now at the smallest size since September 2014. I expect 2018 and 2019 to be the biggest years for the unwind. This depends on how the economy does. The longer the economy staves off a recession, the longer the unwind will go. The plan is to have the balance sheet stabilize between $2 trillion and $2.5 trillion.

As you can see from the table below, the median estimate for the unemployment rate is 3.9%. I find it amazing that the Fed expects green pastures in the labor market for the next 3 years. That would make this the longest expansion in modern history. The unemployment rate expectation fell 2 tenths of a percent probably because of the recent strong reports. Neither the PCE nor the core PCE expectation increased. The expectation for real GDP growth increased across the board. This year is expected to deliver 2.5% growth. I still think that’s slightly too low. The expectation for 2018 GDP growth has been lifted from 2.1% growth to 2.5% growth. As expected, predictions are being made based on recent strong results. The GDP growth might be significantly helped by tax cuts. I have a tough time coming up with an estimate for how much the impact will be. It seems like the Fed is ignoring the effect tax cuts will have in all its predictions.

The final noteworthy change, which I consider to be the headline of this FOMC meeting is the increase in the expected Fed funds rate in 2020 from 2.9% to 3.1%. With the Fed raising rates, it keeps moving the goal post for how much the total hikes will be. This implies the Fed won’t end its hikes in 2019. With such low inflation, I think the Fed will be slamming on the breaks in 2019 and 2020 if the forecasts are reached.

One interesting note about the rate hikes is that there were two dissenters. The two dissenters, Kashkari and Evans, won’t be voting members of the FOMC next year because of the rotation. Maybe, they wanted to let their opinions known before they lose that power. Since they are considered doves with that vote, the new FOMC might be slightly more hawkish.

Let’s look at the effect the rate hike had on asset prices. The dollar index had a rough day as it fell from $94.10 to $93.45. The dollar also might have been impacted by the fact that the GOP announced it agreed on the tax plan today. Gold was up 0.873%. It is still in a major downtrend. The Nasdaq was up 0.2% and the Russell 2000 was up 0.55%, but the S&P 500 was down 0.05%. The yield curve flattened as the 10-year yield fell more than the 2-year yield. The current spread between the two is 57 basis points. Because of how much it has fallen, many prognosticators are acting like it’s a given that the yield curve will invert next year. That is far from a guarantee. I think the tax cut could boost the economy and prevent a flattening. Predicting the exact date of the inversion might be immaterial because the time it takes from inverting to a recession varies widely. The yield curve will be the top story of 2018, besides bitcoin.

With the tone of the FOMC statement dovish, the chances of rate hikes in 2018 fell. The chance of 3 or more rate hikes by the November meeting fell from 27.4% to 15.2%. As you can see, even though the guidance was for 3 rate hikes, the market expects 2 rate hikes.

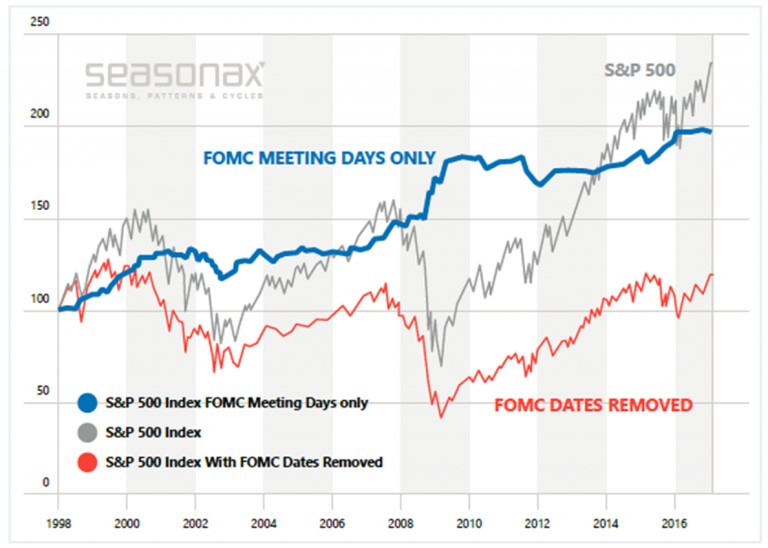

This will be the last time Yellen raises rates and it was her last FOMC press conference. The FOMC meetings have been good to the market. As you can see from the chart below, most of the rally has come on FOMC days. Yellen was able to avoid any big market volatility in her time at the helm of the Fed. The question is if the Powell Fed will be as kind to the market. Investors and economists will eagerly be awaiting his first FOMC meeting in March. The change in the Fed’s press communications will likely more apparent than any policy changes in the first few months of the Powell Fed.

Disclaimer: Neither TheoTrade or any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial adviser, ...

more