Fear Vs. FANGs

"It would be wonderful if we could avoid the common setbacks with timely exits."

- Peter Lynch

Thesis:

So much has changed in the past two days. Today, Goldman has raised doubt on the economic "Goldilocks" scenario. Losses have now created anger in investors over minor downgrades. Money flows have switched from tech (QQQ) to Retail (XRT). The biggest shift seems to be the bullish psychology. Analysis of the current situation.

Nvidia:

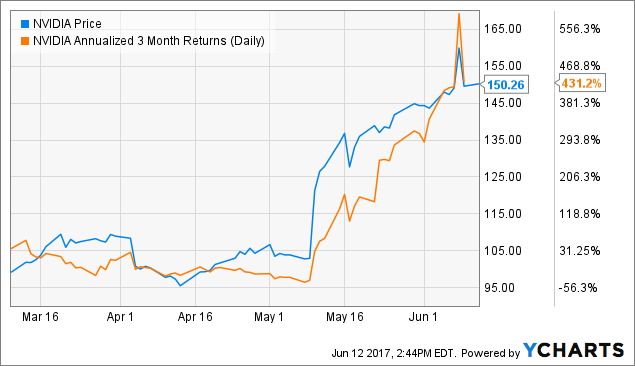

The most interesting stock of the recent tech selloff was Nvidia (NVDA).

The stock market's hottest stock, Nvidia, gets its most bullish Wall Street forecast yet

CNBC had a bullish piece including the potential of a $300 price target. This for a stock that has been a huge winner already.

That helped send the shares much higher, but reversed after Citron released a bearish view. And we had this incredible reversal.

Investors on margin are now experiencing some real fear.

Margin Debt:

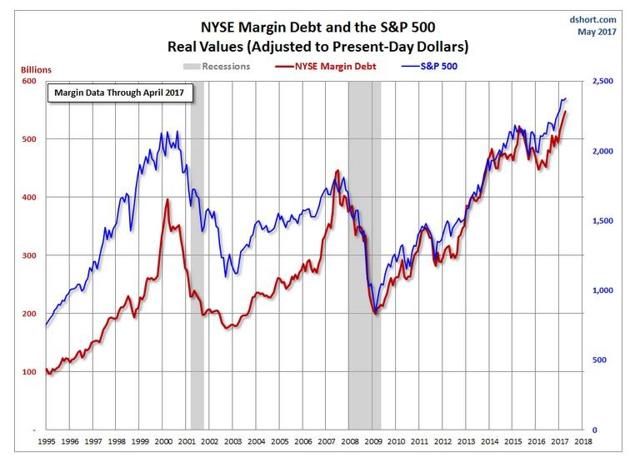

Reversals are important because margin debt has hit new record highs lately. Investors in names like NVDA, Tesla (TSLA ), (GOOGL), Amazon (AMZN), and Netflix (NFLX), who are on margin, are experiencing real losses for the first time in a long while. This can create selling pressure that feeds on itself.

(via Advisor Perspective)

Psychology:

The psychology of margin debt is very important. Many times these are investors who have been successful and making money. They conclude that the best way to make more money is to borrow and purchase more shares. However, the shares they are purchasing in stocks like NVDA, have already appreciated by a huge amount. So, a correction becomes much more painful. Also, because they are on margin, they have less capital to buy pullbacks.

One of the pillars of the economic backdrop could be ending.

End of Goldilocks:

From a widely read piece by Goldman, Sachs research (GS):

“Our base case is that above-trend economic growth will eventually push inflation higher, prompt an accelerated pace of Fed tightening, and lead to higher bond yields that will reduce equity valuations.”

Either the stronger growth causes the Federal Reserve to tighten more aggressively, reducing equity valuations or the current low-rate environment is "proven correct" and the pace of economic growth experiences a "significant slowdown."

Kostin predicts the S&P 500 will be 4 percent lower from here to 2,325 by the end of the year.

FANG:

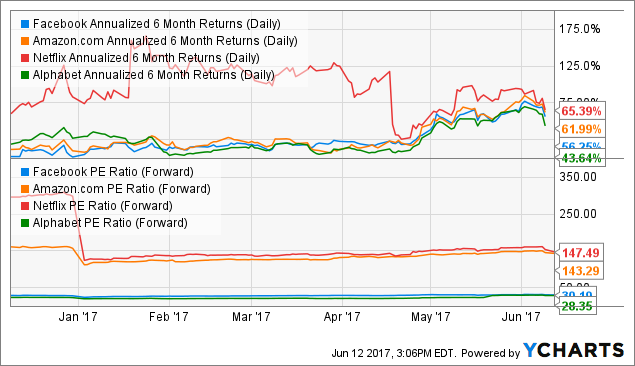

FB Annualized 6 Month Returns (Daily) data by YCharts

Market leading stocks: Facebook (FB ), Amazon (AMZN), Netflix (NFLX), and Google (GOOGL) have been sold as investors re-evaluate whether this is a typical summer correction or something more significant. The gains over the past few months have been significant and a pullback is warranted.

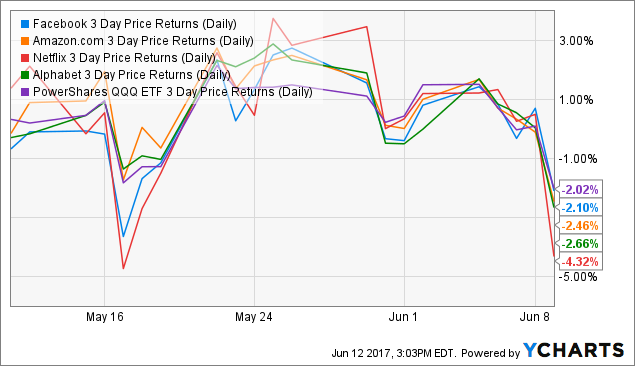

FB 3 Day Price Returns (Daily) data by YCharts

Apple

The stock has been producing extraordinary returns for some time. However, the shares have been hit hard over the past two days.

A financial journalist summed up the anger of Apple shareholders by criticizing an analyst who chose to downgrade the stock based on valuation.

The downgrade was from buy to hold with a $150 price target. Investors could easily have ignored the report. The stock reaction shows more about the nervous psychology of Apple shareholders than anything else.

AAPL Price data by YCharts

Cramer tells analyst his Sunday night Apple downgrade was 'showboat' call

For a stock like Apple that is loved by Wall Street analysts, it shows how quickly losses can affect psychology.

Technical Overview:

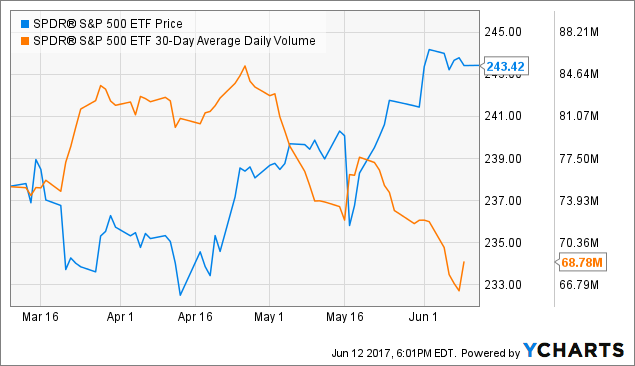

As we see, the market reached new highs on much lower volume. This shows a lack of buying conviction from institutions.

However, over the past couple of sessions, we have seen a significant spike in volume across the board. This represents fear and institutional selling.

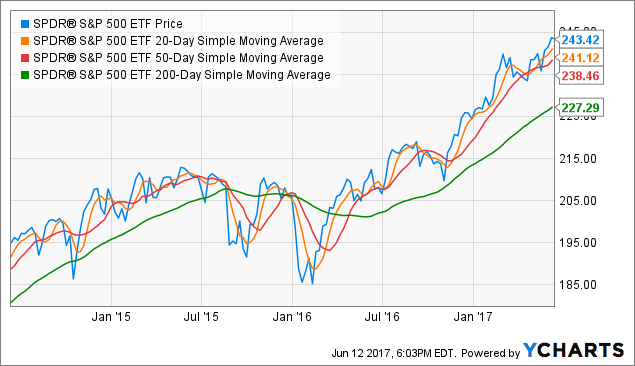

As we see from the moving averages, the market is very overextended on a short-term basis. Major support would come in at the $238.46 level.

Rotation:

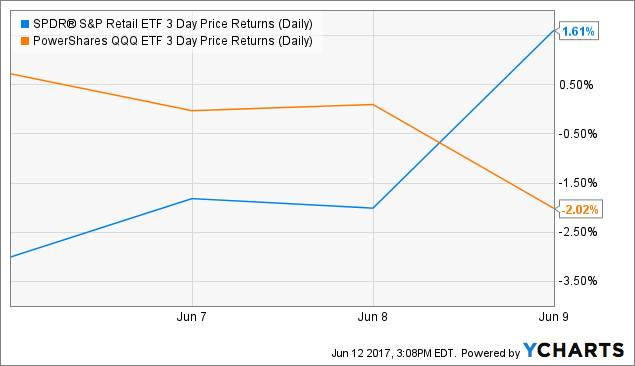

We see the beginning of a rotation out of tech names and into beaten down sectors. The worst performers like retail (XRT), have been bid up from extremely oversold levels.

Undervalued retail stocks like Dillard's (DDS) have had huge rallies as money rotates out of what has been working towards oversold and undervalued names.

XRT 3 Day Price Returns (Daily) data by YCharts

Fear:

Fear (VXX) has come back from historic lows.

Of course, actual fear has been absent from the market for a long time.

Investor reaction:

We have yet to see new investors get tested by fear or losses. The pain of loss is inherit in investing. The slow, steady gains of the last few years are abnormal. One could argue that complacent new investors make the market more likely to suffer panic selling in a correction than ever before.

(SPY)

Conclusion:

The market has been overdue for a correction for some time. Investor psychology seems to be shifting in market leaders like Nvidia, Apple, and FANG stocks. We will see how well margin investors react to losses. It's only been a couple of days, but it seems like much has changed.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.