Fear Has Left The Building

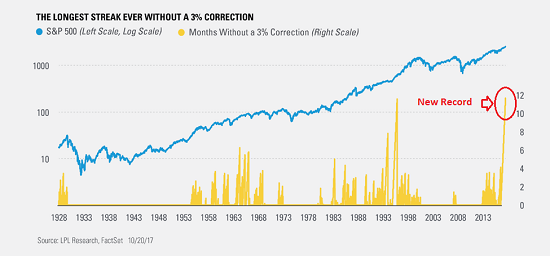

Although the S&P 500 finished the session with the biggest decline in nearly two months, the fact that the venerable index didn’t fall 3% yesterday meant a new record for the longest period of time without a 3% correction in the stock market. According to Ryan Detrick, Monday marked the 242nd trading day without a decline of 3% or more, which eclipsed the old record of 241 days set back in 1995.

And for those keeping score at home, this is not one of those records that is measured over the last 5 or 10 years. No, this data goes back to 1928. Impressive, eh?

(Click on image to enlarge)

In his research post dated 10/22, Mr. Detrick goes on to point out that (a) the S&P has now gone 33 sessions (34 after Monday) without so much as a decline of -0.5%, which is the longest such streak since 1995, (b) the index’s average daily change on an absolute basis in 2017 has been just 0.3%, which would be the smallest for a calendar year since 1965, and (c) the S&P has experienced daily losses of 1% or more only 4 times this year, which is the fewest during a calendar year since 1964.

The point on this fine Tuesday morning is that fear appears to have left the building as everyone on the planet is now a dip-buyer. The bottom line is there doesn’t appear to be any good reasons to sell stocks for more than a day or two. (Oops, I meant an hour or two.)

I started this morning’s meandering market missive by highlighting the new record for the period of time without an itty-bitty correction and some other fun facts to know and tell in the hope it becomes clear that the current market environment just isn’t normal. As such, we probably shouldn’t be surprised if stocks suddenly and without much of a reason, start to decline for more than a few hours.

I know what you’re thinking. Something along the lines of, “Yea, right; like that’s gonna happen!” Am I right?

In behavioral finance, there is a little something called “recency bias.” This theory suggests folks tend to believe that whatever has been happening recently is likely to continue. And while most traders are ready for a pullback, nobody is really expecting one.

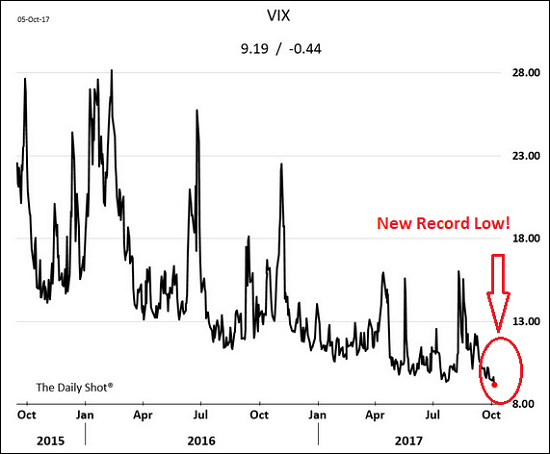

This mentality is on display via some of the fancy indices and options games that traders play. For example, below is a chart of the CBOE Volatility Index (aka the VIX, or “fear index”) which just hit another all-time record low on October 5th.

(Click on image to enlarge)

For the record, the WSJ’s Daily Shot dated October 6 tells us that the prior record low for the VIX was set on September 31, 1993, which was more than 24 years ago.

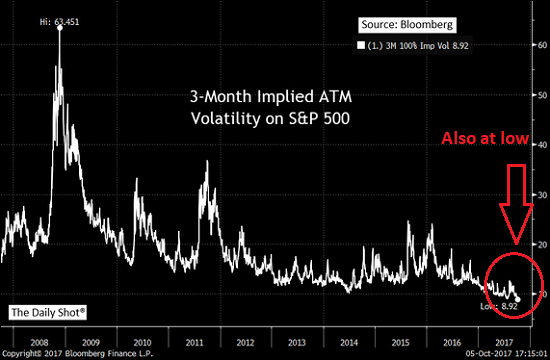

Next up is a similar analysis that shows the implied (or estimated) at-the-money volatility for the S&P 500. And yep, that’s a new low.

(Click on image to enlarge)

What is interesting (well, at least to me) is that although we are seeing record lows for this and the longest period of time for that, the fast-money types continue to bet against market volatility. And yes fans, this too smacks of that “recency bias” thing.

Take a look at the next chart – which shows the price action of the Velocityshares Daily Inverse VIX ETN (NYSE: XIV).

(Click on image to enlarge)

Granted, this highly levered way to play the stock market (from a slightly different angle, of course) has only been around since 2011 (where the initial price was $10). But since the prior all-time high was set in the summer of 2015 at around $50, it will suffice to say that traders continue to bet against the VIX in a big way.

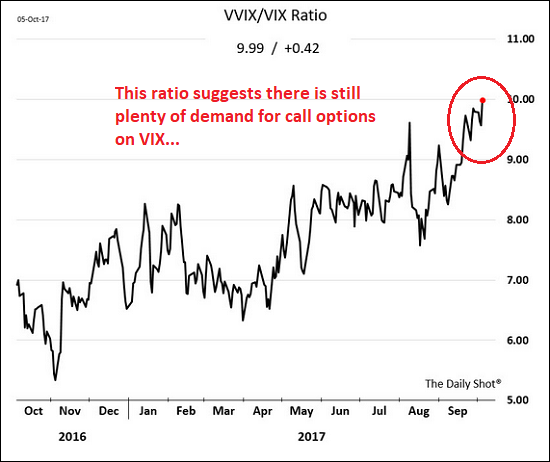

And in case you think that this game is only being played by the “dumb money,” think again. The final chart this morning is a ratio of the VVIX (the volatility of volatility) to the VIX, which is at the highest level in years. In short, this means that despite the record lows, there is still plenty of demand for call options on the VIX.

(Click on image to enlarge)

Yes, it is true that today’s stock market game is MUCH more sophisticated than it was even 10 years ago – and that today’s portfolio managers do indeed use these types of securities in ways other than to make a directional bet on the market. In addition, using options and other fancy trades has become a very cheap/popular method for fund managers to hedge long positions quickly and easily. As such, IMO, the VIX may reflect something of a new world order for volatility – and this may wind up being another example of “lower for longer” playing out in today’s market.

However, the final point this morning is while things can always be “esplained” away in this business, the preponderance of data points coming in at new records should tell us to, at the very least, “look alive” here. Because if there’s one thing to know about “recency bias,” it is that the current trend in the stock market isn’t likely to last forever. So, I for one, will be on the lookout for anything that might crawl out of the woodwork upset the apple cart here.

And no, this does NOT mean that I’m wearing my bear costume this morning. I’m simply suggesting that, in my experience, periods of low volatility tend to be followed by periods of high volatility and that we need to be prepared for this shift. Unless, of course, it’s different this time!

Thought For The Day:

Life, like photography, is developed from the negatives. -Unknown

Current Market Drivers

We strive to identify the driving forces behind the market action on a daily basis. The thinking is that if we can understand why stocks are doing what they are doing on a short-term basis; we are not likely to be surprised/blind-sided by a big move. Listed below are what we believe to be the driving forces of the current market (Listed in order of importance).

1. The State of Tax Reform

2. The State of the Earnings Season

3. The State of Fed Policy/Leadership

4. The State of the Economy

Disclosure: At the time of publication, Mr. Moenning and/or Sowell Management Services held long positions in the following securities mentioned: none. Note that positions may change at any ...

more