Fast Casual Restaurants Have A Terrible 2017

Restaurant Sales Sag

The restaurant sales growth has been rough in 2016 and 2017. Previously, restaurant sales were thought to be an indicator of future economic growth. This is why you need to always question every indicator. There’s no full proof method that will give you results when it comes to trading, investing, or predicting the economy. You need to use critical thinking skills and do deep research dives to get an idea of what the truth is. From reading a few economic reports, you could see that the economy hasn’t been faltering. It’s difficult to go against a previously reliable indicator, but it must be done. Frankly, even if the restaurant sales growth wasn’t a good indicator, it would still cause economic forecasters to question their bullish thesis on the consumer. As you know, the consumer drives GDP growth. If spending was shrinking across the board, America would be in a recession.

The chart below is interesting because it breaks down the types of restaurants: full service, fast casual, and quick service restaurants. As you can see, the big change in the past couple of years is fast-casual restaurants have taken a hit, while QSRs have taken back lost share. My theory on this trend is twofold. First, the fast-casual space got too crowded. Everyone saw how great Chipotle was doing. This inspired firms to emulate Chipotle’s success. Investors gave capital to firms who claimed they were the next Chipotle even though they were just normal restaurants with subpar themes (think Noodles). Now we’re seeing that Chipotle isn’t even doing well because of a few health scares. The biggest success story in the fast casual space in the past couple years, in my opinion, is Shake Shack. It experienced fad-level craze which has died down in 2017.

The second aspect of this switch in market share is McDonald’s improvement; it emulated restaurants like Shake Shack. McDonald’s is a large, slow-moving company, but a few years of underperformance caused a management change. The new leadership learned from the firm’s mistakes and the successes of Chipotle and Shake Shack. The key is to provide customization and better-sourced meat and poultry. With McDonald’s back in the competitive fold, fast casual restaurants have suffered. The full-service restaurants have done fine, relatively speaking, since they don’t compete with McDonald’s.

Small Businesses Are Optimistic

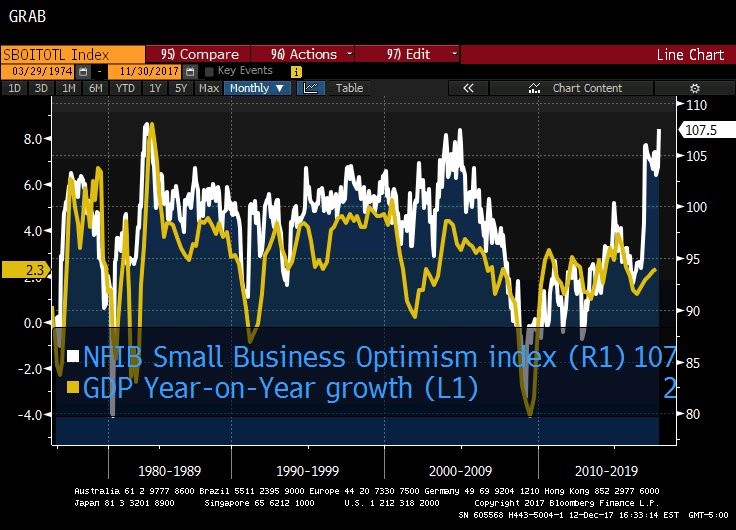

The small business optimism index has been showing strength this whole year. It’s interesting to see it plotted against year over year GDP growth. Not surprisingly, GDP growth hasn’t caught up with small business optimism. This might be because population growth prevents GDP growth from getting as high as it has in the past. There was a big separation between small business optimism and GDP growth right before the financial crisis. This chart is support for the theme of the year which was surveys exceeding hard data. The theme wasn’t as strong at the end of the year as GDP growth was solid in Q3. It partially depends on which hard data and which soft data you look at. Most sentiment indexes have soared this year. It’s arguably impossible for growth to meet those levels of hype.

One potential explanation for the bifurcation between GDP growth and small business optimism can be seen below. The non-financial non-corporate capital expenditures have been increasing steadily this cycle. On the other hand, the capital expenditures of corporations have been moribund. Interestingly, they haven’t recovered from the weakness caused by the manufacturing recession in 2015-2016. Some economists believe capex investments could help productivity growth which would boost the long run GDP growth potential.

Wage Growth In Security But Not Much Elsewhere

The wage growth conundrum continues to perplex investors and economists. It’s great to look at which segments are seeing growth and which aren’t because it helps answer the question of why overall wage growth isn’t meeting expectations. The chart below shows that the bottom quintile of workers is only seeing accelerated wage growth when you include security jobs. The security segment is 0.6% of the labor market. However, it has been able to push the entire quintile higher because security wages are up almost 20% this year. The bottom quintile of workers saw a nominal wage increase of 3.4% in the first 10 months of 2016 and a 3.9% increase in the same period this year. Without security, that growth drops down to 3.3%, meaning there has been decelerating wage growth. Looking at the other details of the wage growth, general merchandise stores only gave 1.4% raises to workers this year. That’s not surprising given their struggles to compete with online retail. Restaurants doled out 4.4% wage hikes, but the wage growth in that segment has been declining this year.

Rate Hike?

For the first time in 9 months, the Fed is expected to raise rates twice in 2018. The decline in those odds earlier in the year is likely because of the lack of inflation. The slight pickup in inflation at the end of the year has been enough to push the market towards expecting more rate hikes. The reason the odds have spiked quickly on a modest inflation increase is that the economy is at the end of the business cycle and growth is starting to pick up. If inflation were to stay at the rate it’s at now, there wouldn’t be much urge to raise rates. However, the market doesn’t expect stagnant inflation. The question is what point inflation will cause investors to sell stocks.

Conclusion

I broke down some of the trends which I have been discussing in past articles. It’s great to see what is driving restaurant sales lower and which segments of the bottom quintile of the labor market are seeing accelerated wage growth. It’s also interesting to see how small-cap firms are investing more in capex than large-cap ones, relatively speaking, even though international earnings have been driving big corporations’ profits higher. The hope small businesses have is a greater catalyst for capex than the international profit growth corporations have had this year.

Disclaimer: Neither TheoTrade or any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial adviser, ...

more