Facebook Stock Rallies On EPS Beat

Facebook Stock - Correction Allowed Facebook To Rally

Facebook reported a similar quarter to its last quarter. It beat EPS estimates, missed revenue estimates, and missed user estimates. The difference between this quarter and the last quarter is the price of the stock. Its stock was at $217.50 on July 25th.

Heading into this report, Facebook stock was at $146.22. Investors don't like uncertainty about an area of a firm’s business. Either they must solve that problem or the stock price craters.

Facebook stock cratered to where it became too cheap. The stock rallied 3.01% after hours. It did not collapse as it did after last quarter.

Investors expected 2018 to be a challenging year for Facebook. The ad load on timelines and the number of North American users reached saturation.

Also the controversies about the way Facebook handles user data and how it monitors the platform made the stock crash. I think it’s primed to rally in the next 12 months.

Facebook Stock Beat EPS & Misses Revenue Estimates

First, let’s get into the headlines from the report. EPS came in at $1.76 which beat estimates for $1.47.

Regardless of the slowing growth, each time estimates are beaten, the PE multiple shrinks. The stock can’t keep falling while EPS keeps rising for much longer. The stock has transformed from a momentum growth name to a GARP (growth at a reasonable price) play.

Revenues were $13.73 billion which missed estimates for $13.78 billion. If this were a stock like Netflix or Nvidia, that would be enough to cause it to plummet. But the stock has already fallen enough.

Total daily active users were 1.49 billion which missed estimates for 1.51 billion. Monthly active users were 2.27 billion. This missed estimates for 2.29 billion.

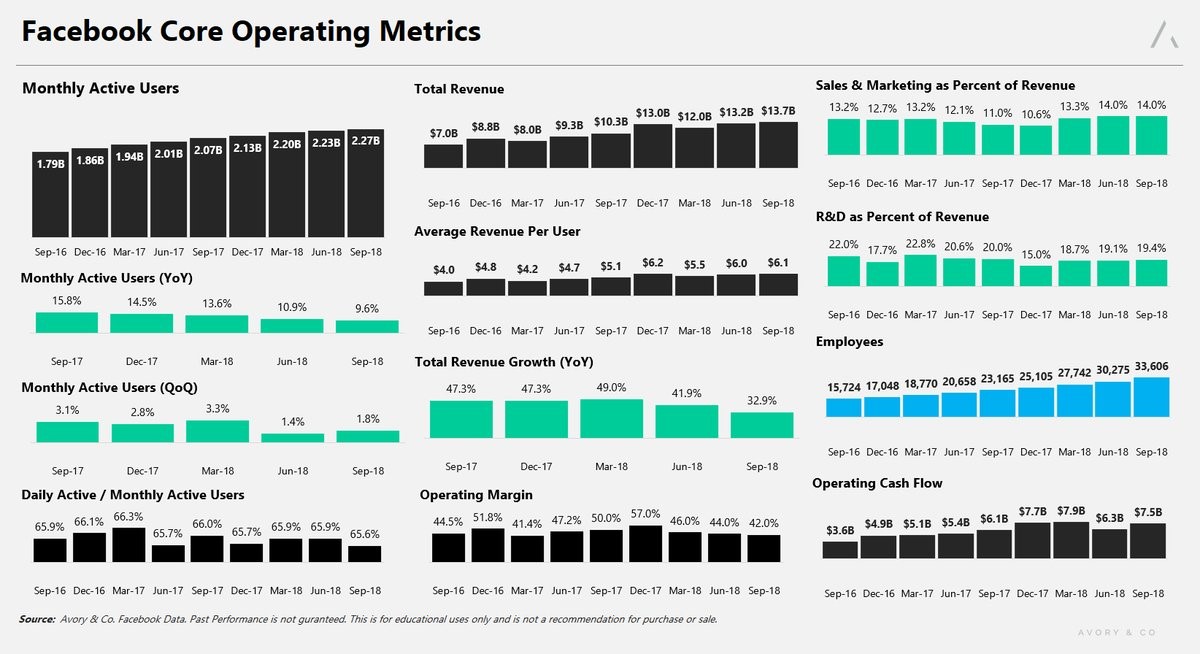

As you can see from the chart below, the monthly active user growth rate fell from 10.9% to 9.6% on a year over year basis. It increased from 1.4% to 1.8% on a quarter over quarter basis.

(Click on image to enlarge)

The big takeaway on the user growth front is that the product is sticky. This is even though there are many negative headlines about it. The ratio of daily active users to monthly active users only fell from 65.9% in September 2016. Then it fell to 65.6% in September 2018.

Growth is slowing because of high penetration. This growth decline doesn’t imply a decline in total users will follow. Daily to monthly users ratio is still high. Stories about people deleting the Facebook app are wildly overdone.

Facebook Stock - Average revenue per user was $6.09 - met estimates.

The growth in revenues per user will be limited by the stalled growth in North America. That’s where the most valuable users reside.

As you can see from the chart below, the number of daily active users in Canada and America haven’t changed in the past 2 quarters. It’s stuck at 185 million.

Specifically, American and Canadian users generate $27.61 in revenue. European users only add $8.82 in revenue. Asia-Pacific users add $2.67 in revenue. And the rest of the world has an ARPU of $1.82.

Facebook Stock - Facebook Is A Utility Company

One of the biggest concerns investors have about Facebook is how it will deal with the controversies it has generated.

As the first chart above shows, the total number of employees increased from 30,275 to 33,606. Operating margins fell from 44% to 42%. That's the painful reality of decelerating revenue growth combined with accelerating costs.

Operating margins are down an enormous 8 points in the past year. Furthermore, CFO David Wehner stated total expenses in 2019 will increase 40% to 50% as compared to full year 2018.

Facebook Stock - Going From a Fast Growing Internet Growth Name to Regulated Utility Company

The product is sticky like utilities and has little competition. Snapchat used to be considered Facebook’s top threat. But it’s now losing users as Instagram’s stories feature stole its thunder.

The unfortunate part of being a utility is government regulation and taxation.

Europe is leading the charge on that front. That makes sense because it has more socialist tendencies than America. And the big tech names are mostly located in America.

Europe sees less of a benefit from big tech firms in terms of employment and government revenues. The latter point is about to change with the new policies being proposed.

Latest news on taxation is the U.K. is planning a 2% digital services tax. That tax will be on the domestic revenue of the established tech giants. These likely include Facebook, Amazon, and Alphabet.

This tax will start to be implemented in April 2020. It’s expected to generate $384 million for the U.K. government in its first year. And generate $512 million in its second year.

This wouldn’t be a huge deal if the U.K. was alone. But Europe is also working on a similar proposal which will tax local tech revenue at 3%.

Facebook Stock - Growth Areas

The negativity surrounding regulations and the high penetration in North America are already priced in the stock. There are many growth drives with untapped potential.

The biggest areas are the new Instagram shopping feature, monetization of WhatsApp, and video through IGTV and Facebook Watch.

Amazon is moving towards advertising. While Facebook is moving down the sales channel. It's doing this by using its apps to sell products directly to customers.

The quote shown below explains the potential of Facebook Watch according to Mark Zuckerberg. He stated Watch is up 3X in the last few months in America alone.

Facebook Stock - Conclusion

Facebook has a 19.27 PE multiple on 2019 earnings. This is no longer a momentum internet name with accelerating revenue growth.

It is a reasonably priced growth stock with many untapped areas. Negative news stories make this stock probably the worst sentiment of any profitable big cap company in America.

The best profit opportunities occur when a company is hated while it still has a strong business model. I think of Facebook as a sin stock which appeals to people’s vanity. Instagram and Facebook are partially about trying to make yourself look the best to your friends. The stock is a strong buy.

Disclaimer: Neither TheoTrade or any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial ...

more