Extension Brings Expansion

Since no one wants natural market forces to work these days, OPEC announced the extension of their already-in-place production cut. The response of crude oil has been steady all night, with prices ascending strongly, up over 3.5% as of this moment. To give this move some context, here’s the daily futures chart. The market is up about 10% since we bottomed earlier this month, but the multi-month trend still remains down.

This doesn’t alter the fact that I’ve got plenty of energy shorts (and my ERY long), and those will no doubt sting this morning. I might even getting stopped out of a few. An announcement like this, of course, can really only have impact one time, and the fundamental problems that have been softening prices up for months now remain unchanged. I’ll let my stop-loss prices do their work, but I’m not convinced OPEC has found the magical key to ever-ascending crude oil rates.

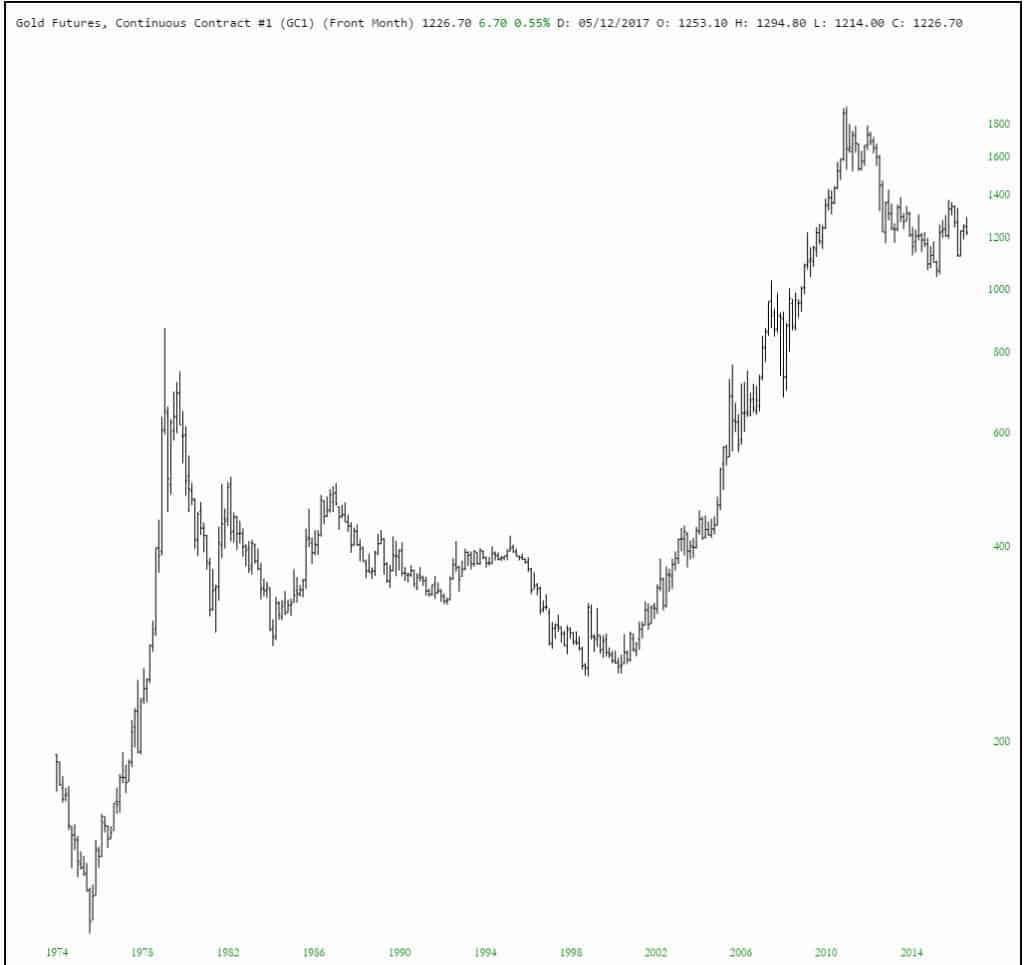

Oh, and speaking of futures, I’m pleased to tell you we were hard at work on SlopeCharts over the weekend, and it has futures now! Yes, you can type in such trusty symbols as /GC (gold), /CL (crude oil), /ES (the S&P e-mini), /NQ (the NASDAQ) and see a continuous contract. This data goes back for decades, and it’s all part of our never-ending quest to continue expand the data set and features of my beloved SlopeCharts. Keep in mind that the current-day quote isn’t showing on futures yet, but it’s coming very soon.

Disclosure: None.