EUR/USD Forecast: Waiting For A Catalyst To Resume Selling

The EUR/USD pair holds steady around the 1.0900 level, with no major developments having took place during the Asian session. Stocks remain weak, although far from their early low, led by earnings reports. There were no relevant releases in Europe, with the market waiting for US data, as the country will release its September Durable Goods orders and Pending Home sales later on the day. On Friday, the US will release the first estimate of its Q3 GDP.

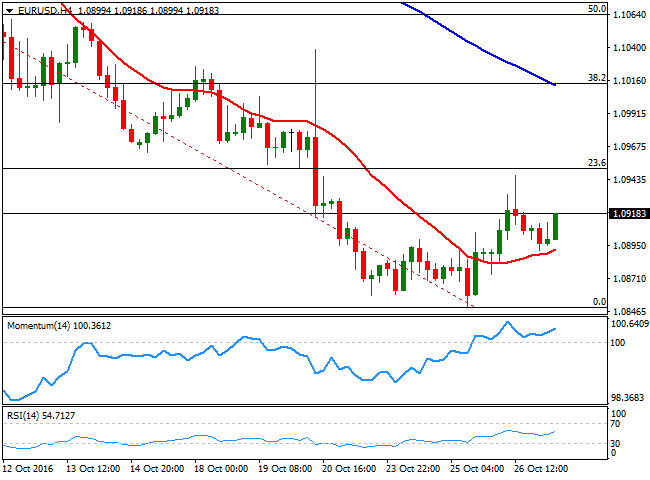

The dominant bearish trend remains firm in place, given that the upward corrective move seen on Wednesday, was rejected at the 23.6% retracement of its latest slide around 1.0950. The 38.2% retracement of the 1.2789/1.0850 decline stands at 1.1010, which means that only above this last, an upward corrective movement could be more sustainable. Still, there are no reasons for the EUR to strengthen, considering the increasing imbalance between Central Banks' policies.

In the meantime, and in the short term, the downside seems limited, as in the 1-hour chart, the pair presents a modest bullish tone, with the price developing above its 20 and 100 SMAs, both horizontal, and technical indicators entering bullish territory. The 200 SMA in this last time frame has contained the upside on Wednesday, now standing around 1.0935. In the 4 hours chart, the price is finding support around a slightly bullish 20 SMA, now in the 1.0890 region, whilst technical indicators aim higher within positive territory, although below previous lows.

Above 1.0950, the pair can extend up to the mentioned 1.1010 level, whilst beyond this last, the next short-term resistance stands at 1.1045. Below 1.0890 on the other hand, the pair will likely extend its slide towards the 1.0840/50 price zone.

View live chart of the EUR/USD