Eurodollar Decay, What’s Missing?

Earlier this week Bloomberg published an absurd story trying to claim that Donald Trump is being warned by foreign holders of US debt. Warned about what, the article didn’t say, so we can reasonably speculate (unlike the article) it was about politics. Bloomberg never did seem to report any such spreading alarm throughout the last Obama years even though selling was heavier during them than recently. The narrative shifts with regard to all that, but what’s going on overseas has not.

It’s completely insane in so many ways, not the least of which is the two greatest stories of this century nobody in the media apparently wants to write. The first and primary is about a global monetary system that is unlike anything described of it, and the second is why there is so little curiosity so as to try to actually describe it properly. We know the answer as to the latter, since orthodox economics dominates the media and therefore imposes an almost religious test upon commentary.

I had a correspondent write to me not long ago and relate a story of a graduate student working for him. Having obtained an interest in the eurodollar system, the student went back to his professors for advanced study and asked if the eurodollar was going to be covered in the class. The answer he got was the one you expect, a complete dismissal not just of the subject but that the student would bother to ask about it.

It’s an enormous shame because though much remains hidden with regard to the eurodollar system it’s not as if we are starting from nowhere. As I wrote yesterday, what needs to be done is more about reclassification than identifying and studying an entirely new discipline of monetary genus. Though the eurodollar may be nothing like a dollar, the functions of it are often immediately recognizable once you step through the looking glass and leave orthodox expectations behind you.

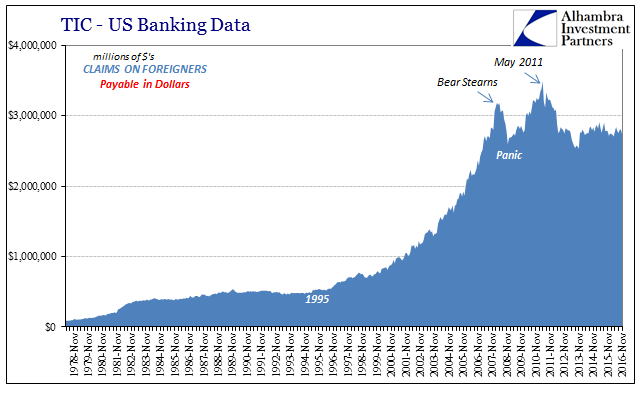

A good place to start doing that is the Treasury International Capital (TIC) data. Of all the figures that relate to what is really a parallel offshore dollar system the TIC data is the easiest to comprehend and maybe even the best overall proxy even though it remains far from comprehensive. The “selling UST’s” being done overseas is clearly established in the mainstream, and just as clearly shows up in the top level TIC figures. But it also apears in the underneath details, and there illuminates the nexus of all these important conditions (that have nothing to do with Trump, or Obama).

Down deeper in the vast array of numbers collected under TIC you will find tabulations on US bank reportings. Some of it is quarterly but mostly by month. There are two major categories of these figures corresponding to two related but different processes. The first is US Claims on Foreigners; these are bank assets and therefore US banks delivery and supply of various traditional dollar formats like CD’s and short-term money-like securities.

(Click on image to enlarge)

The overall shape of the data is immediately recognizable in correspondence with other non-related data like gross derivative exposures. The level rises geometrically until the troubles related to the Great Financial Crisis; in these specific figures the dramatic interruption dates to the month of Bear Stearns’ near failure. Thereafter, there is a partial rebuild but only until the middle of 2011.

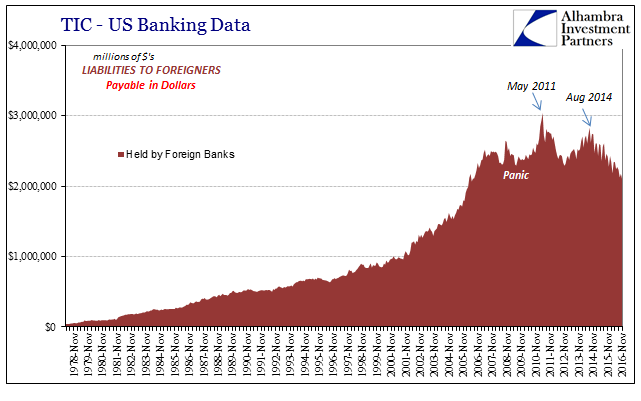

The same category on the other side is Liabilities Held by Foreigners. These include the same kinds of instruments, with only the direction reversed; meaning foreign entities supplying these dollar formats to US banks.

(Click on image to enlarge)

The pattern is nearly the same, especially the same inflection points. This is unsurprising because there will always be some relationship in outline between the two directions, as there cannot be any other condition (under the current eurodollar framework; see below). If you knew absolutely nothing about the details of either of the two charts above apart from their generic relationship with global dollars and money, you would be struck anyway by how much it would seem to explain or at least correspond to our global economic predicament. In other words, like the global economy, there was growth until around 2008 and then there wasn’t. The Great “Recession” being itself inextricably related to money and finance, it is easier to accept why it might never have been a recession.

The lack of growth after 2008 is what matters in terms of lack of recovery. The eurodollar decay, as I often call it, isn’t a direct contraction or an enormous and sustained shrinking of capacity. It is simply the transition from growth to its absence, perfectly represented by the general contours described above. On this side of the panic, there is sometimes growth but never sustained and far more irregular and localize; again, the perfect monetary representation of the lack of recovery.

The rest of the TIC data within these subcategories points us in the direction as to why. Taking the inbound foreign dollars first (the red series), breaking it down by specific classification of holder what you find is a couple of data points that stand out. The first is the growing proportion of them issued (meaning US bank liabilities to) by what the Treasury Department classifies as FOI’s – Foreign Official Institutions.

(Click on image to enlarge)

It is not the largest category nor would it be. The issuance of dollar liabilities by FOI’s would be more so an emergency bypass where we find greater quantities.

(Click on image to enlarge)

That was the case in the surge of dollar liabilities provided from this sector throughout the panic and its immediate aftermath. The bulk of that assistance was categorized here as in Short-term UST Bills and Certificates. That makes sense given the repo market freeze after Lehman where any collateral of any usable kind was in desperate demand.

(Click on image to enlarge)

In the years after the panic, particularly those more recent, the bulk of dollars from the sector has been related to, as is often the case, “Other” liabilities.

(Click on image to enlarge)

From October 2014 through February 2016, FOI’s, a category that includes foreign central banks, were providing what amounted to a surge in dollar liabilities to US banks throughout a period that encompassed the US Treasury buying panic on October 15, 2014, at the start and the second devastating global liquidations through February 11, 2016, at its end. It is a parallel corroboration of the “selling UST’s” via the official sector in the upper level TIC data. The absolute increase here was but $138 billion, October 2014 to February 2016, less than half of the $322 billion in official net US dollar asset “selling” indicated in that other part of the TIC release, suggesting that which remains unseen through all of this – dollar demand among purely eurodollar relationships, such as foreign bank to foreign bank, or foreign central bank to foreign bank.

Those kinds of interbank transactions would not show up here, but are detectible still by these systemic proxies. In other words, if a foreign eurodollar bank were reticent about lending dollars it never had and never will to another foreign eurodollar bank we can reasonably assume that they might have the same reservations about sending dollars to any eurodollar bank including those domiciled or owned by US banks where the transaction (and its absence) would show up in the TIC data. It is very nearly like detecting a black hole by the after effects of the tug of its gravity on nearby stars rather than in directly observing it (which is impossible).

(Click on image to enlarge)

You can also see it in earlier episodes, such as the period immediately following the 2011 crisis that led to the global growth slowdown around March 2012. Rather than what happened during the “rising dollar”, FOI’s were providing more traditional formats of dollar exchanges, classified in these instances under the usual Non Negotiable Deposits.

(Click on image to enlarge)

So if we can see what central banks have been doing we might also find why they may be so possessed of dollar interventions. Our answers start to appear in the very next broad classification: foreign banks. It is not a circumstance unique to them, however, for when we examine the other side (outbound dollar claims from US banks) we find exactly the same deficiency.

(Click on image to enlarge)

US banks have been unwilling or perhaps unable to transfer dollars to foreign banks, as well. As you can plainly see above, that was especially true following the 2011 experience to a degree far greater than even in 2008. From that, we can surmise why foreign central banks may be so busy under the “rising dollar”, given that the banks in their jurisdictions are finding bank-drawn dollar supplies increasingly hard to come by.

Some further detail of outbound dollar flows also highlights this enormously important central deficiency. Breaking down US bank claims by instrument, the traditional format of deposits is clearly being replaced by, what else, “other forms.”

(Click on image to enlarge)

The data for this disaggregation only goes back to 2003, but that is more than sufficient to further corroborate our global dollar story, and thus give us great insight into the global “dollar” story that truly matters. The decline of “Non Negotiable Deposits” speaks to the decline of banking in the dollar flow system, whereas the relatively unbroken string of “All Other” indicates the various alternate channels from which global money may operate.

The banking channel is but one of these, and up until August 2007 it was the most important one. PBOC Governor Zhou Xiaochuan in March 2009 correctly identified the global reserve currency as “credit based.” What happens to a credit-based currency regime where banking is no longer the central part of it? We know the answer since we see it in all the data above. The system no longer grows but is occasioned, too often, to stumble, into which central banks are compelled to respond if however incompletely, accidental, and badly.

If banks are absent in dollars of the TIC data, it is no surprise then to see that banks are absent in other facets like their gross derivative exposures. If the problem was merely banking, solutions would be easy – remove the banks, or just allow them to continue on doing it themselves. We would rejoice at such prospects, except that we cannot since banks remain an integral part of the system. It is still the eurodollar system as nobody with any standing has thought about a migration to something not credit-based. Because of that, as they pare back the eurodollar only decays.

(Click on image to enlarge)

Only few have pondered what happens when banks (money dealers) retreat from their central role. It is a question I examined in May 2015, foreseeing, correctly I might add, the difficulties of having banks steadily withdraw capacity from a bank-centric monetary system.

I personally find way too much complacency in blindly believing that going from B to C will be only a minor inconvenience. It would be dangerous even under the circumstances where the system shifted from the dealers to the Fed and back to the dealers, with an infinite series of potential dangers even there. But to undertake a total and complete money market reformation from dealers to the Fed to money funds? There are no tests or history with which to suggest this is even doable under current intentions. Poszar and Mehrling’s contributions more than suggest that difficulty, but I think that still understates whether or not we ever get that far.

It was merely wishful thinking then, and was mercifully finished off by the opposite 2a7 hysteria the following year (2016). The “global turmoil” of 2015-16 was just another ugly episode in what looks to be an ongoing string of them. Banks are continuing to pull back and there is just nothing in the system willing and able to fill the “dollar” gap they leave behind. Because of that framework, this will just keep going until it can’t; either financially, economically, politically, or socially. It is nothing more than the space in between these ugly episodes that we today call “reflation.”

Disclosure: This material has been distributed fo or informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any ...

more