Energy Stocks Have The Most Analyst Coverage

Last week we published a post looking at the number of analyst ratings per stock by market cap. On average, a large-cap stock has 21.2 analyst ratings per stock versus just 6.2 for small-cap stocks.

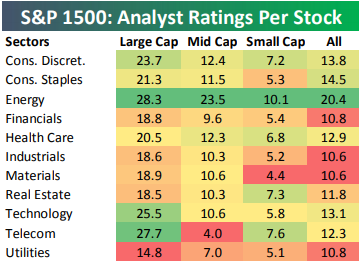

Below we take a look at average analyst ratings per stock by sector.If we had to guess which sector had the most coverage, we would almost certainly guess Technology. That’s not the case, though. In reality, the Energy sector has the most coverage, and it’s not really close. Across the S&P 1500, which includes large caps, mid caps, and small caps, the average Energy stock has 20.4 analyst ratings per stock. The Consumer Staples sector is the next closest at 14.5.

At the large-cap level, Energy ranks first with 28.3 ratings per stock. Telecom ranks second at 27.7, followed by Technology in third at 25.5.Utilities has the lowest coverage at the large-cap level at just 14.8.

In the mid-cap space, the average Energy stock has 23.5 analyst ratings per stock, which is more than 10 ratings higher than the next sector (Consumer Discretionary) at 12.4. While Technology has 25.5 ratings per stock in the large-cap space, it only has 10.6 ratings per stock in the mid-cap space.

For small caps, Energy once again has the most coverage at 10.1 analyst ratings per stock. Energy is the only small-cap sector with an average of more than 10. Telecom, Real Estate, and Consumer Discretionary all have more than 7 analyst ratings per stock, while Technology is only at 5.8. The Materials sector has the least amount of coverage in the small-cap space with just 4.4 ratings per stock.

(Click on image to enlarge)