Einstein Not Newton More Helpful To Understand Equity Markets

In Measuring Equity Performance Picking a Reference Point is Crucial

The price performance of the DJII over the past five and a half years has been stellar. By comparison the performance of the economy has been has been dismal. From this arises worry among many commentators that the price of the DJII cannot continue to rise as Newton’s law of gravity must surely be invoked, even though physical laws have little to do with financial markets. Furthermore, Newton’s work has been long superseded by Einstein’s work on relativity. The importance of the latter is the point against which various measurements are calibrated.

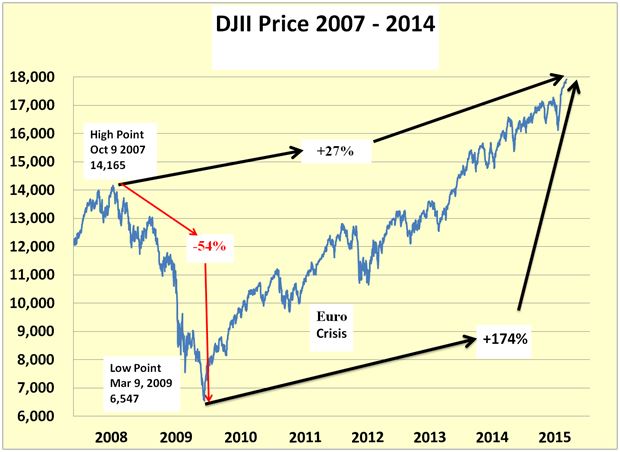

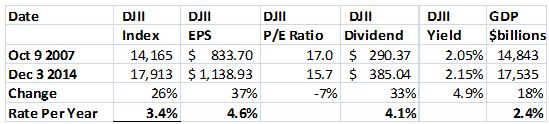

From the March 2009 low until the end of October 2014 the DJII is up 174% or 22.5% per annum. However, most of this improvement is just a recovery following the 54% decline from the previous peak of 14,165 in October 2007. From that point the price of the DJII is only up 27% or a much more modest 3.4% per annum.

2007 Peak based on Dividend-Discount Model

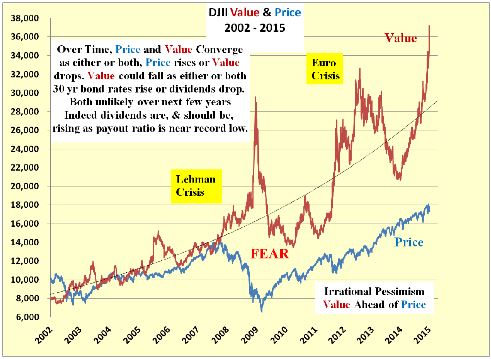

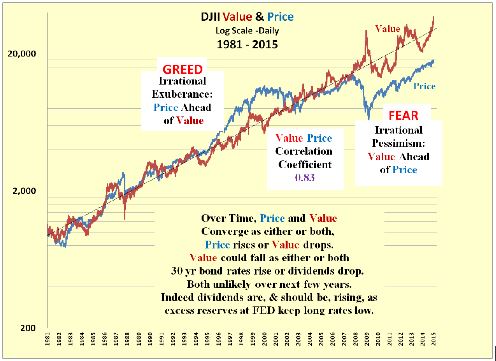

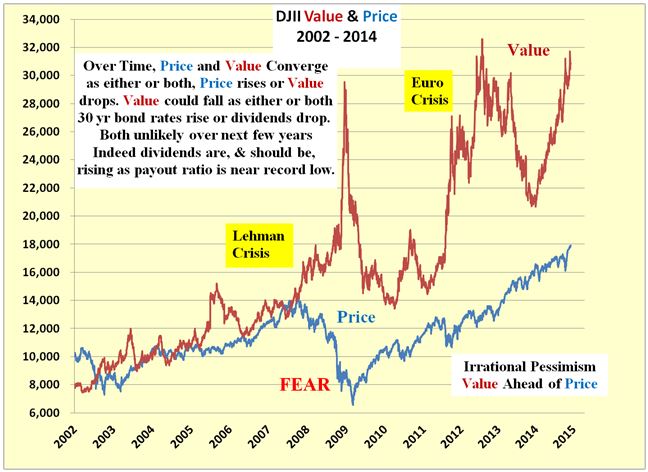

The choice of the 2007 peak is not arbitrary. It is based on the dividend-discount value of the DJII which stood at 14,196 which was very close to its price of 14,165. The subsequent drop in the DJII price was triggered by the ending, in sorrow and tears, of disastrous sub-prime loans, the collapse of earnings in the latter part of 2007, the collapse of Lehman and the ensuing financial meltdown.

Between 2007 and 2009 the DJII dividend was cut, but by only 24%, rather than being entirely wiped out like earnings. Interest rates fell simultaneously and pushed up the dividend-discount value of the DJII to a then record high while the DJII price fell as market participants wallowed in a mire of irrational pessimism.

The collapse of earnings was probably the main contributing factor for aversion to equities.

The Seven Years following the Reference Point

Over the period from October 2007 until December 2014 the performance of the U.S. economy, the EPS and the dividends of the DJII have been in equilibrium with the price rise of the DJII.

The P/E ratio is 7% lower today than it was in 2007 while the dividend yield stands at 2.15% up 4.9% from 2.05% in 2007. This counters the argument that on broadly accepted measures of valuation the market is expensive and the DJII is in “Bubble” territory. The dividend-discount value of the DJII of 31,000 is well in excess of its price of 17,900. Even at 31,000 the DJII would be only fairly priced

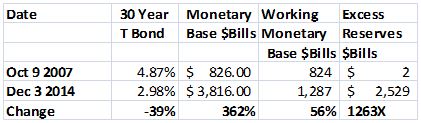

In addition, there have been huge changes in the monetary base and long-term interest rates, which have yet to show up in either the U.S. economy or the DJII price:

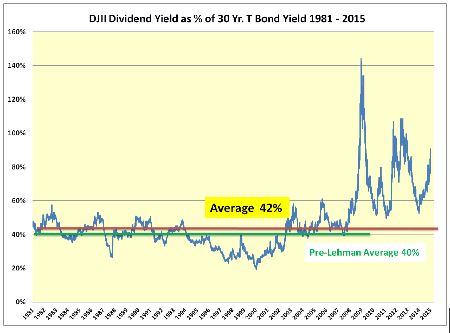

A 39% drop in the yield of the 30 year T bond since 2007 results in a 63% increase in the price of the long bond. This has shown up in the dividend-discount value of the DJII. To this must be added the impact of the 33% increase in the DJII dividend to arrive at the full dividend-discount the value of the DJII of approximately 31,000. This has yet to be reflected in the DJII price.

It might be argued that interest rates are artificially low as a result of the 379% rise in the U.S. monetary base stemming from multiple QEs. However, the bond market has not collapsed with the end of QE. In fact the demand at auction for U.S. treasuries this year has been 3 times the supply.

Corporations are still flush with $2 trillion surplus cash and the demand from consumers for housing is decidedly muted. Be this due to the changes in regulations that are holding back action by the commercial banks, or the banks’ unwillingness to do anything other than sit on their excess capital that has grown 1,229 times over the last seven years.

DJII Price still well below its Dividend Discount Value

The DJII price rebound from its October 15 trough has been so fast that it could be interpreted that investors, waiting for a pullback (self-fulfilling expectation?), missed the opportunity to buy and are now desperate to deploy funds to avoid missing the continuation of the bull market as the price of the DJII moves to catch up with its value.

Data Sources: US Federal Reserve, Dow Jones and the London Bullion Market

Basic report plus quarterly updates are available for $100 per annum.

Please contact me by phone or by email.

Tony Hayes CFA

Ashton Consultancy ...

more

Tony, how is the dividend discount value of the DJIA calculated?

Mike

The current problems started when Bush spent 6 trillion dollars on Iraq war. Obama's approach is better, more peaceful and diplomatic.

I do not apportion blame for the amount of debt or QE. I am merely trying to point out the consequences and their impact on the dividend discount value of the DJII that today is in excess of 32,000.

Over the past 35 years the price and the value of the DJII have had a correlation coefficient of 0.83. From this I suggest that price and value will move back into equilibrium and the pressure is on the price to move up.