Earnings Magic Exposed

Following the end of each fiscal quarter, SEC registered corporations release their financial statements. Typically, investors and the media place a lot of importance on these results. Consequently, stock prices tend to rise or fall based on how the financial results compare to a consensus of estimates made by Wall Street analysts.

Since the beginning of the current quarter (10/1/2016), 76% of the 113 S&P 500 companies that have released earnings results have exceeded expectations. Like so many quarters before, many investors and media pundits are supporting the naïve conclusion that earnings are better than expected. Unfortunately, few investors are paying attention to the measurement tool, expected earnings, to gauge its usefulness as a measure of earnings quality. In this article we uncover the crafty game that Wall Street and corporate investor relations departments’ play to put a positive spin on earnings releases and at the same time give the impression that stock prices are cheap based on forward looking earnings expectations.

Miraculous Results

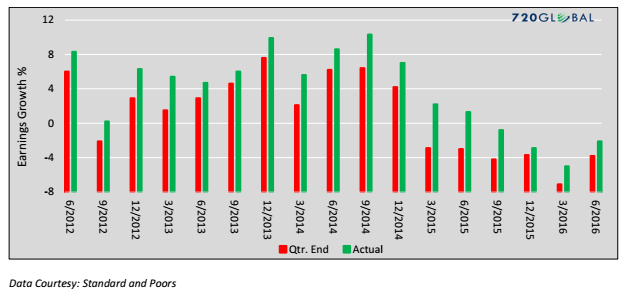

The graph below shows that actual aggregate earnings growth for the S&P 500 has exceeded the corresponding consensus final expectation for earnings growth without fail since at least the second quarter of 2012. Not once has a quarter’s earnings (green bar) been lower than the most recent earnings expectation (red bar).

Final Earnings Expectations versus Actual Earnings

To comprehend how corporate earnings can regularly exceed respective expectations quarter after quarter, one must recognize how earnings forecasts are used to manipulate investor expectations. When one studies the trend of earnings forecasts from a year preceding the results to the weeks prior the results, one will notice two things. First, initial earnings forecasts, are crafted to tell a bullish long term story of strong earnings growth. Second, over the course of the ensuing year, the estimates are adjusted significantly downward to temper expectations and therefore make actual earnings that fall far short of the original forecast appear pleasantly surprising.

Consider that since the second quarter of 2012, earnings growth forecasts made a year in advance averaged 14.76%. Over the same five year period, actual earnings growth was 3.82%, or 75% below the original estimate. Of the last 17 quarters the best one year advance estimate of earnings growth was overstated by 25%. Astonishingly, this period includes quarters where economic growth exceeded forecasts, so a worse than expected environment cannot always be blamed. The last four quarters have seen actual earnings growth (-2.70%) fall grossly short of one year advance forecasts for growth (+14.30%) by over 100%.

As time progresses from one year prior to any earnings release to three months, we find that earnings expectations were still grossly overestimated. At the three month time frame analysts should have a much better grasp of the factors that drive corporate performance. Despite the additional clarity, three month prior earnings expectations still averaged 32% higher than actual earnings from 2012 through the most recent quarter.

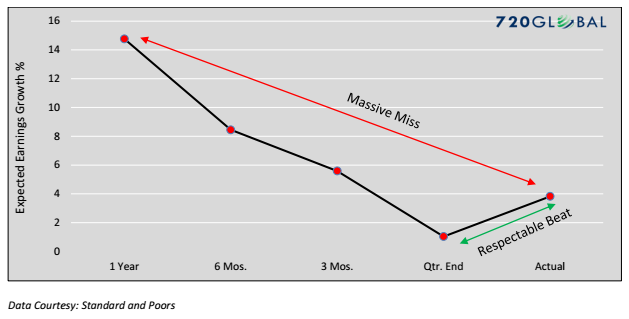

The following graphs illustrate the “earnings game” being peddled by corporate America through their Wall Street enablers. The first graph shows the average migration of earnings expectations over the course of the year preceding the actual results. The data covers the 17 quarters from the second quarter of 2012 to the second quarter of 2016. Note the large forecasting error (labeled “massive miss” below) between expected results a year in advance and actual results. Also, notice the better than expected results (“respectable beat”) when compared to expectations at the end of the quarter immediately prior.

Earnings Expectation Migration

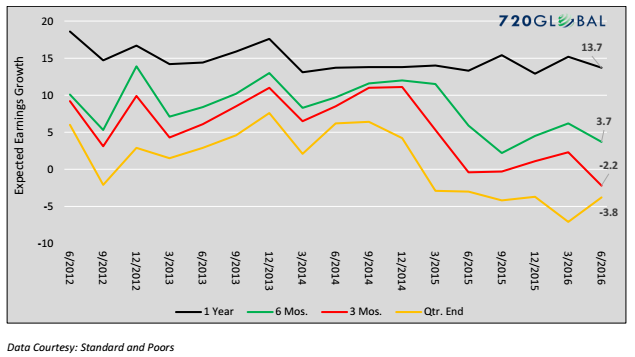

The graph below highlights the consistency with which average earnings expectations have trended lower in each of the last 17 quarters.

Earnings Migration by Period

The black line represents quarterly forecasts of earnings growth one year in the future. The green line shows that, six months later, earnings growth has been revised downwards in every instance. Earnings expectations continue to get revised lower as shown by the red line, which represents earnings expectations three months prior to their release. The yellow line shows expectations in the quarter that earnings are due to be released. As you can see in every instance, earnings expectations are at their highest a year in advance, and lowest in the quarter they are due to be reported. Hardly a coincidence, we suspect. In Q2 2016 notice how earnings expectations declined from +13.70% a year ago to the final estimate of -3.80%.

Summary

Consider the ploy that companies and Wall Street are using to fool the investing public.

- First, they grossly overestimate earnings for the upcoming year. By overestimating earnings, they tout financial ratios based upon inaccurate expected earnings and sell investors on a bright future. How many times have analysts claimed that forward looking price to earnings ratios are constructive for price gains? How “constructive” would they be if the expectations were reconciled to reality and lowered by 75%?

- Second, they progressively lower expectations prior to the earnings release so that financial results are effectively underestimated. The same analysts that peddled double digit earnings growth a year earlier somehow can now claim that earnings are better than they expected.

If actual earnings varied somewhat randomly from above expectations to below expectations, we would likely fault the analysts and corporations with being poor forecasters. But when such one-directional forecasting errors routinely and consistently occur, it is more than bad forecasting. At best one can accuse Wall Street analysts and the companies that feed them information of incompetence. At worst this is another pure and simple case of institutions gaming the system through a fraud designed to prop up stock prices. Take your pick, but in either case it is advisable to ignore the spin that accompanies earnings releases and apply the rigor of doing your own analysis to get at the veracity of corporate earnings.

Disclosure: Opinions expressed herein are current opinions as of the date appearing ...

more