Earnings Look Good For Now: Q3 Headwinds Coming

The great Q1 earnings season is driving the bullish narrative as investors see this as an all clear sign to buy stocks hand over fist. However, the bulls argued during the earnings recession that the temporary blip lower was because of energy. Now, the temporary blip higher is driven by energy, but they are still very optimistic. They want to have it both ways. As I have said, the total S&P bottom up earnings is driven by technology. However, the swings in energy make it an important sector to watch. For example, in Q4 2015 energy contributed -10.53% to the S&P bottom up earnings. In Q2 2018, energy is expected to contribute 5.05% to earnings. That’s a major swing. International tech earnings and energy are what drove the great Q1 results. As you can see from the chart below, the S&P 500 is expected to grow earnings 6.5% in Q2. However, it’s only going to grow 3.6% excluding energy (energy made up 4.08% of earnings). For the full year, earnings will grow 9.9% and only 7.0% excluding energy.

(Click on image to enlarge)

As you can see from the chart below, the implied assumptions for oil prices embedded in energy earnings estimates are in the mid to high $50s. Energy analysts aren’t experts at predicting oil. This isn’t a knock on them because it’s a tough commodity to predict as it has wild swings. The analysts look at current front month contracts and extrapolate that to be the assumed price. That assumption method is proving to be futile as oil prices have fallen in the past few weeks. In Q1 the average price of WTI oil was $51.88. The average expected price for Q2 is $51.96, but the actual price won’t meet that guess. The current average price for Q2 is $49.06; that will surely go down by the end of the quarter as oil fell to a 7-month low on Monday, closing at $44.20. It looks even worse for Q3 as analysts are expecting oil to be $54.29. With oil starting the quarter in the low $40s, it’s likely that analysts will lower their estimates in the next few weeks. This is why I said the latest boost in energy earnings is transitory, just like the downturn was. It’s tough to figure out what normalized earnings will be for the energy sector because conflict in the middle east could cause prices to rise and shale producers’ breakeven costs are always changing. Rising interest rates for high yield energy debt could hurt shale profitability; this factor combining with lowered prices form a double whammy effect.

(Click on image to enlarge)

It’s important to understand the distinction between predictions and likely expectations. It’s very likely oil will be lower than the Q2 estimates; it’s also very likely analysts will lower their Q3 assumptions for oil prices. Even if oil rallies to meet or exceed the current Q3 estimates, unless it does so in the next few days, analysts will be pressured to cut their outlooks because they’re so far from reality. My prediction is for oil to fall into the high $30s. That is an opinion which may or may not come true.

The chart below shows the bottom up earnings expectations for Q2. The good news is that in the past few days, earnings expectations have been steady. The bad news is that the inevitable deceleration in earnings growth is here. According to the S&P Dow Jones numbers, last quarter year over year as reported earnings grew 26.4%, while Q2 is expected to see 21.3% growth. While that growth is still good, if energy earnings disappoint, it could weaken further. The nirvana of strong accelerating earnings growth has ended.

(Click on image to enlarge)

As you can see from the chart below, energy sector earnings estimates have already come down since March 31st as growth has fallen from 474% to 401.3%. This quarter will be the last quarter to lap year over year losses in the sector. Information technology sector earnings have fallen slightly, but they’re still at a strong 9.4%. Whichever earnings period the new Apple iPhone is released in will be the most pivotal quarter for the sector. With energy earnings growth pressured in Q3 and Q4, the bottom up estimates may need a strong result from Apple. I have no insight into whether the new iPhones’ features will be good enough to generate incremental sales growth, so I’m not saying it’s unlikely to deliver.

(Click on image to enlarge)

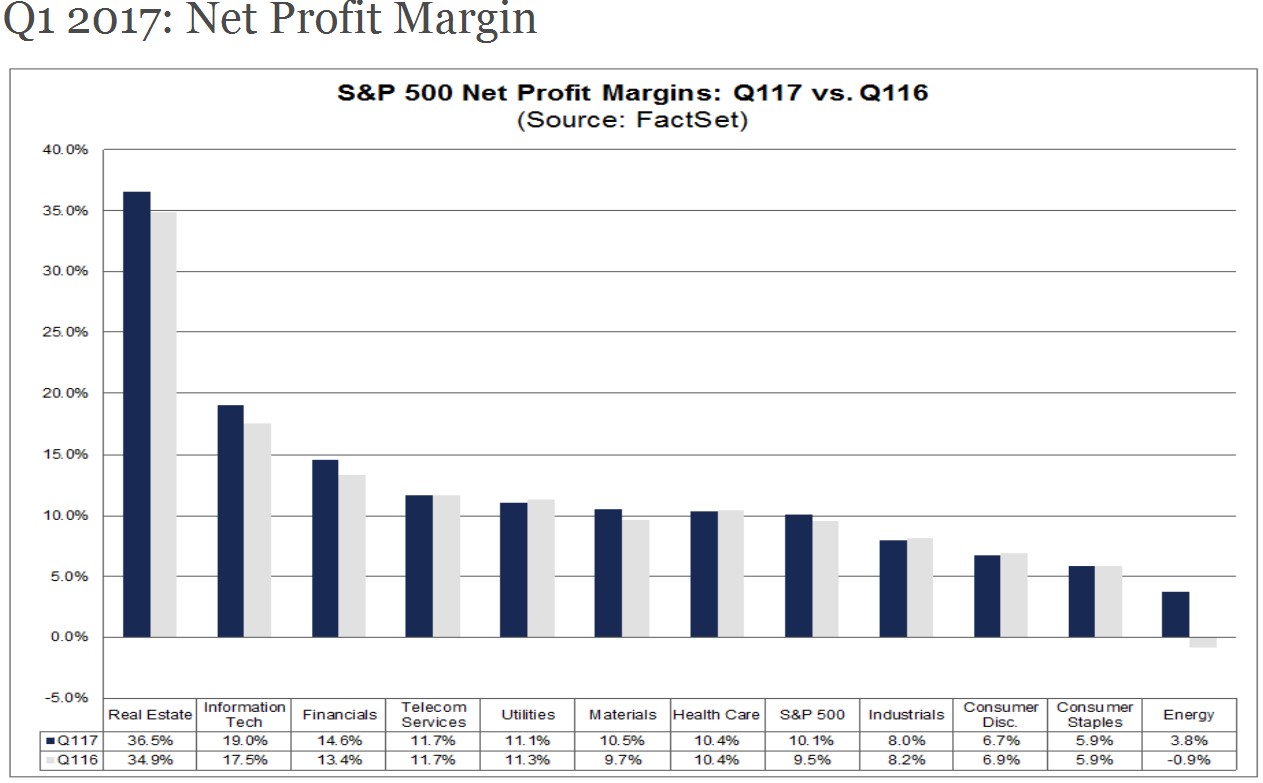

As I have been mentioning, profit margins are about to hit a ceiling in the next few quarters. They were 9.84% on a bottom up basis in Q1. As you can see from the FactSet chart below, the top down profit margins for Q1 on a year over year basis increased for most sectors. The biggest winners were energy, information technology, materials, and financials. According to S&P Dow Jones, operating margins for technology in Q1 were 18.17%. Since Q4 2010, the highest operating earnings were last quarter at 19.45%.

(Click on image to enlarge)

As you can see from the purple line in the chart below, information technology margins have been on a secular growth trajectory. The question is where the ceiling is. If the industries shown below all simultaneously hit their previous record highs, margins could increase a few more percentage points, but that’s unlikely.

(Click on image to enlarge)

The industries shown in the chart below, show a much more of a coordinated cyclicality. The semiconductors and semiconductor equipment firms are the most cyclical. This chart makes it look highly suspect to buy NVIDIA stock with its valuation reaching lofty levels combined with the sector operating near peak margins.

(Click on image to enlarge)

![]()

Conclusion

Some areas within tech have very high profit margins already, making it tough to predict even higher margins for the sector. The bulls will argue that the sector is in a secular growth trend, but that trend cannot last forever in my view. The behemoth tech firms are now reaching out to new areas as Amazon bought Whole Foods. The question is whether Amazon can reinvent the supermarket industry or if this acquisition will dilute the company. With energy lagging, the market’s performance will be up to stocks like Amazon and Apple.

Disclaimer: Neither TheoTrade or any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial adviser, ...

more

thanks