Downtrodden ETFs Bounce Back With Vigor

The V-shaped price action in October has been met with a variety of emotions that range from excitement to disbelief. While investors have been expecting a 10% correction for some time, many were caught off guard with the swift downward price action followed by a tremendous rebound.

On an intra-day basis the SPDR S&P 500 ETF (SPY) lost 9.86% from high to low, which was accompanied by vicious price action in both directions that failed to consolidate near any popular trend lines. In fact, SPY careened through both the 50 and 200-day moving averages in both directions so fast that all but the most short-term traders were able to react.

The market has now recovered the majority of this decline and is once again sitting in positive territory for October despite calls for the demise of equities. However, not every ETF or industry group has recovered in the same fashion. The biggest winners on the upside appear to be those ETFs that were heavily beaten down and dismissed for dead.

This includes aggressively oversold areas of the market such as the iShares Russell 2000 ETF (IWM), Energy Select Sector SPDR (XLE), and iShares Transportation Average ETF (IYT). All three of these indices have been stronger relative performers since the October 15 low in SPY as a result of buyers stepping in and pouncing on the comparative value proposition to play a rebound.

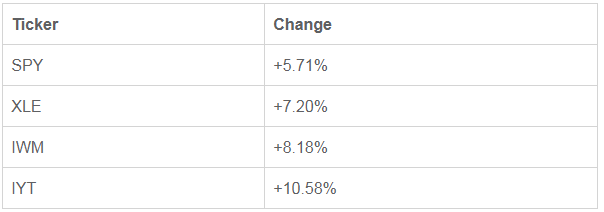

The following table notes the percentage change in value on a closing basis for each ETF since the low:

*Data through 10/28/14

Small cap, energy, and transportation ETFs have independently fallen out of favor in over the last several months as a variety of cyclical forces and headline risks have pervaded these sectors. However, their existing bearish sentiment combined with attractive risk to reward profiles made them excellent candidates for a strong bounce.

Conversely, it’s worth noting that low volatility ETFs such as the iShares MSCI U.S. Minimum Volatility ETF (USMV) has been underperforming on the upside as markets have recovered. This is not surprising given the heavy allocations to defensive sectors and stocks with a penchant for lower price fluctuations.

Active investors or those with cash on the sidelines should note these correlations as opportunities during market pullbacks. While every dip offers its own unique dynamics, this playbook is one that offers the potential to switch from conservative holdings to more aggressive or value-oriented sectors in the midst of a short-term decline with the expectation for higher prices on the horizon.

Taking advantage of these tactical setups is one way to enhance your returns above a traditional buy and hold approach and add alpha on a subsequent leg higher.

Disclosure: FMD Capital Management, its executives, and/or its clients may hold positions in the ETFs, mutual funds or any investment asset mentioned in this post. The commentary does not constitute ...

more