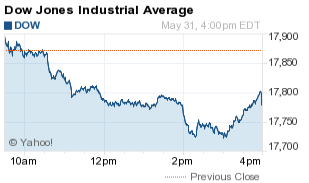

Dow Jones Industrial Average Loses 86 Points On Rising Rate Hike Expectations

The Dow Jones Industrial Average today (Tuesday, May 31) fell more than 86 points as traders' expectations for a rate hike in June accelerated. A massive increase in consumer spending levels and a tightening labor market put the U.S.Federal Reserve back in focus. According to CME FedWatch, there is now a 61% probability the Fed will increase interest rates at its July policy meeting.

Of course, Money Morning's gurus have been well ahead of this story, explaining that rate normalization will have harsh consequences for a nation with $19 trillion in debt. In addition, Chief Investment Strategist Keith Fitz-Gerald has explained it doesn't matter if rates go up or down. You simply need to follow this simple strategy that provides long-term profit potential by focusing on companies that manufacture "must-own" products.

Here's what else you need to know about the markets on May 31, 2016.

First, check out the results for the Dow Jones, S&P 500, and Nasdaq:

Dow Jones: 17,787.13; -86.09; -0.48%

S&P 500: 2,096.95; -2.11; -0.10%

Nasdaq: 4,948.06; +14.55; +0.30%

Now, here's the top stock market news today…

DJIA Today: Traders Expect a Rate Hike by Late July

First up, the case for another interest rate hike was bolstered on news that consumer spending levels recently saw the largest monthly increase in six years. Consumer spending – which fuels roughly two-thirds of the U.S. economy – increased by 1% in April. This rise adds greater justification to Fed Chair Janet Yellen's statements on Friday that an interest rate increase this summer would be appropriate.

Next, Apple Inc. (Nasdaq: AAPL) is in focus on reports it will be shifting to a three-year product cycle for its iPhones. That's a year longer than its current cycle of product upgrades. Analysts expect the decision was based on the lack of dynamic upgrades and new features that can be added to a phone. Japan's Nikkei reports a slowing market for new phones is also a big factor in the firm's decision. However, RBC Capital Markets analyst Amit Daryanani raised some doubts about the reports during an interview on CNBC.

Shares of AAPL stock slipped back below $100 today after a strong two-week stretch. The firm has been tied to rumors that it could purchase Netflix Inc. (Nasdaq: NFLX) and received a big boost after Berkshire Hathaway Inc. (NYSE: BRK-A) announced a massive stake in the technology giant.

Crude oil prices retreated slightly today after the oil minister of the United Arab Emirates Suhail Al Mazroui voiced his pleasure with the recent uptick in prices over the last three months. His statement indicated OPEC producers – which will hold a meeting this week in Austria to discuss prices – are increasingly optimistic that crude has found a support level. The markets have generally shunned concerns about Iran's unwillingness to curb production as it brings its crude oil back onto the market.

WTI fell 0.5% to $49.10 despite heightened demand expectations in the United States. The U.S. benchmark posted its fourth monthly gain in a row. Meanwhile, Brent crude dipped 0.1% to $49.69 on the day. The $50 mark has been under significant pressure. That's the psychological barrier expected to push U.S. shale producers back into operations after months of being shutdown.

But the big news today – aside from the surge in interest rate expectations – was the massive deal on the table for global agricultural giant Monsanto Co. (NYSE: MON). According to reports out of Europe, German drug and chemical giant Bayer AG (OTCMKTS ADR: BAYRY) is expected to hike its offer in the coming week. Monsanto recently turned down an offer of $122 per share. Shares of MON stock gained another 2.6% as traders speculate on just how much the German firm is willing to sweeten the deal.

Now, let's look at the day's biggest stock movers and the must-own stock for today…

Top Stock Market News Today

- On the earnings front, shares of Medtronic Plc. (NYSE: MDT) were off roughly 1.5% despite news the company's top-line and bottom-line figures came in around analyst expectations. The firm reported per-share earnings of $1.27, matching Wall Street projections. The firm's revenue report came in at $7.56 billion, beating expectations of $7.48 billion. So, why the downturn? Investors are not very happy about its 2017 profit outlook, which fell below Wall Street's consensus expectation.

- The deals keep coming: Shares of Celator Pharmaceuticals Inc. (Nasdaq: CPXX) surged 71.6% after the firm agreed to be purchased by Jazz Pharmaceuticals Plc. (Nasdaq: JAZZ) for roughly $1.5 billion.

- Meanwhile, Great Plains Energy Inc. (NYSE: GXP) – the firm that owns Kansas City Power & Light – announced plans to purchase Westar Energy (NYSE: WR). Westar is the largest utility firm in Kansas, and the deal was worth roughly $8.6 billion. The announcement pushed shares of Westar up 6.4%.

- Sometimes it pays to underperform as an executive. Earlier today, the separation agreement between Valeant Pharmaceuticals International Inc. (NYSE: VRX) and its former CEO Michael Pearson was released through a regulatory filing. According to the report, Pearson will receive a whopping $83,333 per month for the rest of the year. He will be expected to act as a consultant for the firm and will receive an additional $15,000 per month in consulting fees should he continue to assist the firm after 2016.

- Meanwhile, shares of Verizon Communications Inc. (NYSE: VZ) were up 0.6% after striking union workers ended the work stoppage and struck a deal with the telecommunications giant. According to reports, the firm will create at least 1,400 new jobs and hike pay by roughly 10%.

Disclosure: None.