Don’t Expect Fed To Cause Apocalypse

Don’t expect Fed to cause Apocalypse

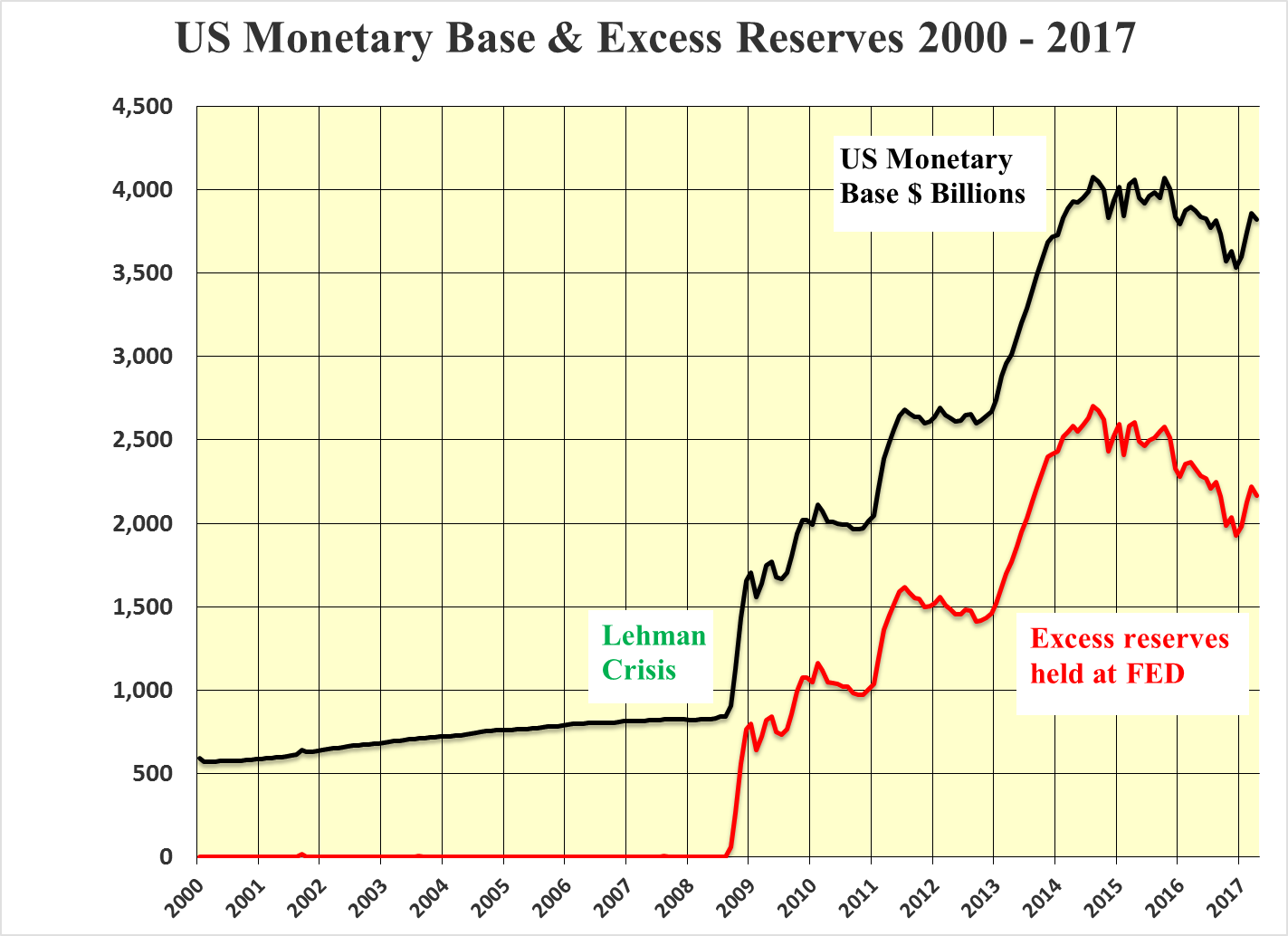

The Fed has ample room to shrink its balance sheet by draining excess commercial bank reserves held at the Fed without causing either the economy to crater or debt and equity markets to crash. Indeed this has been rapidly underway since the start of 2016.

As mentioned previously the Fed has been engaged in Quantitative Contraction, QC, from its post Lehman peak of US$4.075 trillion in August 2014. First gradually, then more rapidly in 2016, to the recent low of last December at US$3.532 trillion.

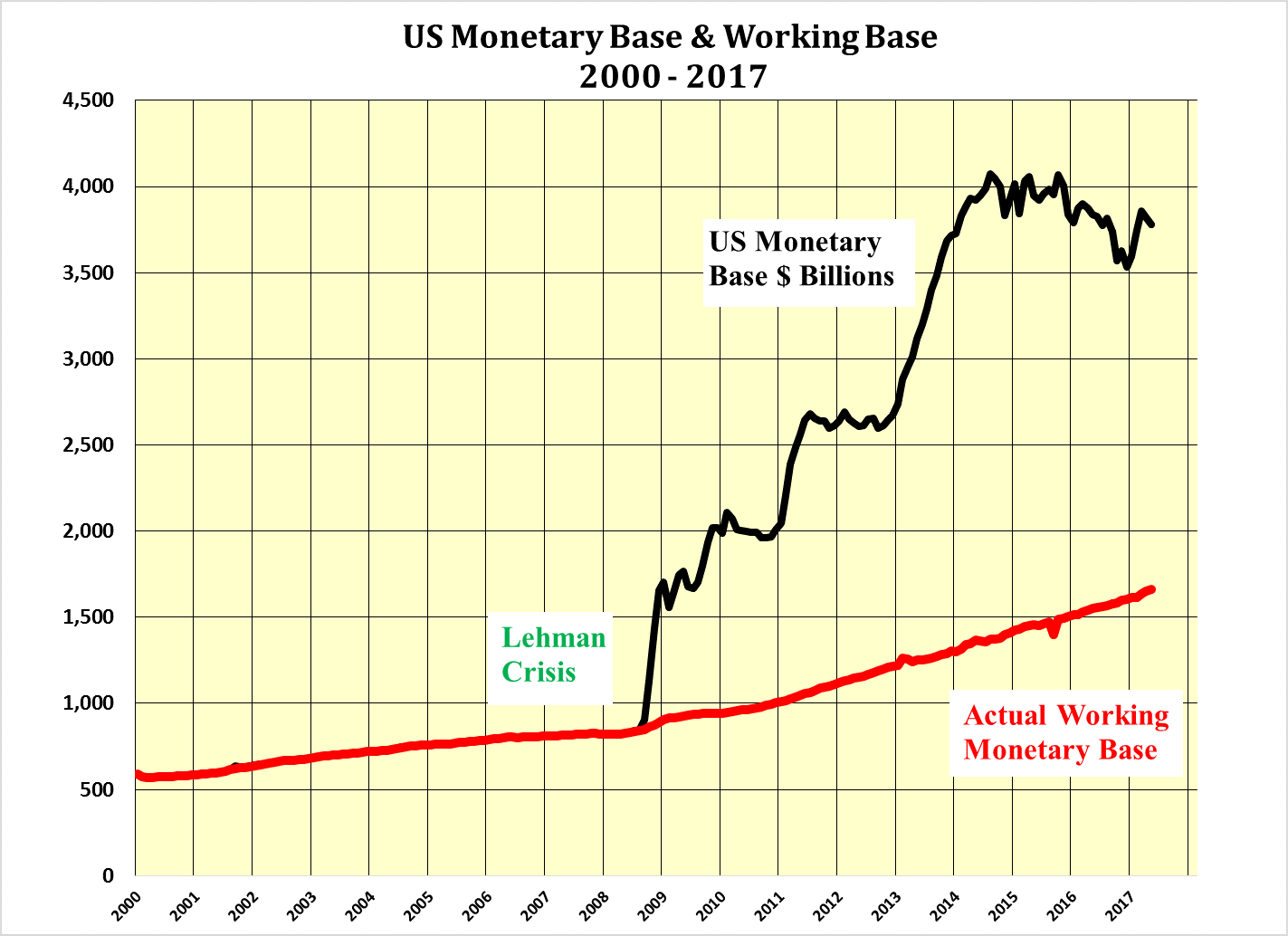

The 13% drop over the 16 months amounted to US$0.543 trillion. All of this was the result of a 30% reduction, US$0.775 trillion, in the excess reserves held at the Fed. The difference between these figures of US$0.232 trillion continued the movement of funds into the real economy with the Actual Working Monetary Base, AWMB, rising the same US$0.232 trillion.

Since the start of 2017 the Fed appears to have reversed its action evidenced by the rise in both the total monetary base and the continuing rise of the AWMB. From this it could be surmised that QC in 2016 was overdone with the rebound in the 30 year T Bond yield from its July low of 2.10% and the rise in the U.S. dollar above parity was accompanied by lower than expected growth of U.S. GDP.

The last things the Fed wants are:

- a recession;

- rising unemployment;

- inflation being either too low or too high;

- the US dollar being either too high or too low.

Despite the heavier than required action by the Fed in 2016, to avoid the above, the Fed’s watchword now appears to be “gradualism”. Hence, it is unlikely that there will be any more dramatic action to move short-term rates sharply higher any time soon.

Steady Fed and Record Dividends Point to Higher DJIA

Any gradual increase in rates will be to lean against the winds of inflation resulting from an overheating economy, which is not likely during the remainder of this decade. Rather a slow and steady reduction in the total monetary base over the next 5 years seems probable with the continuation of growth in the AWMB.

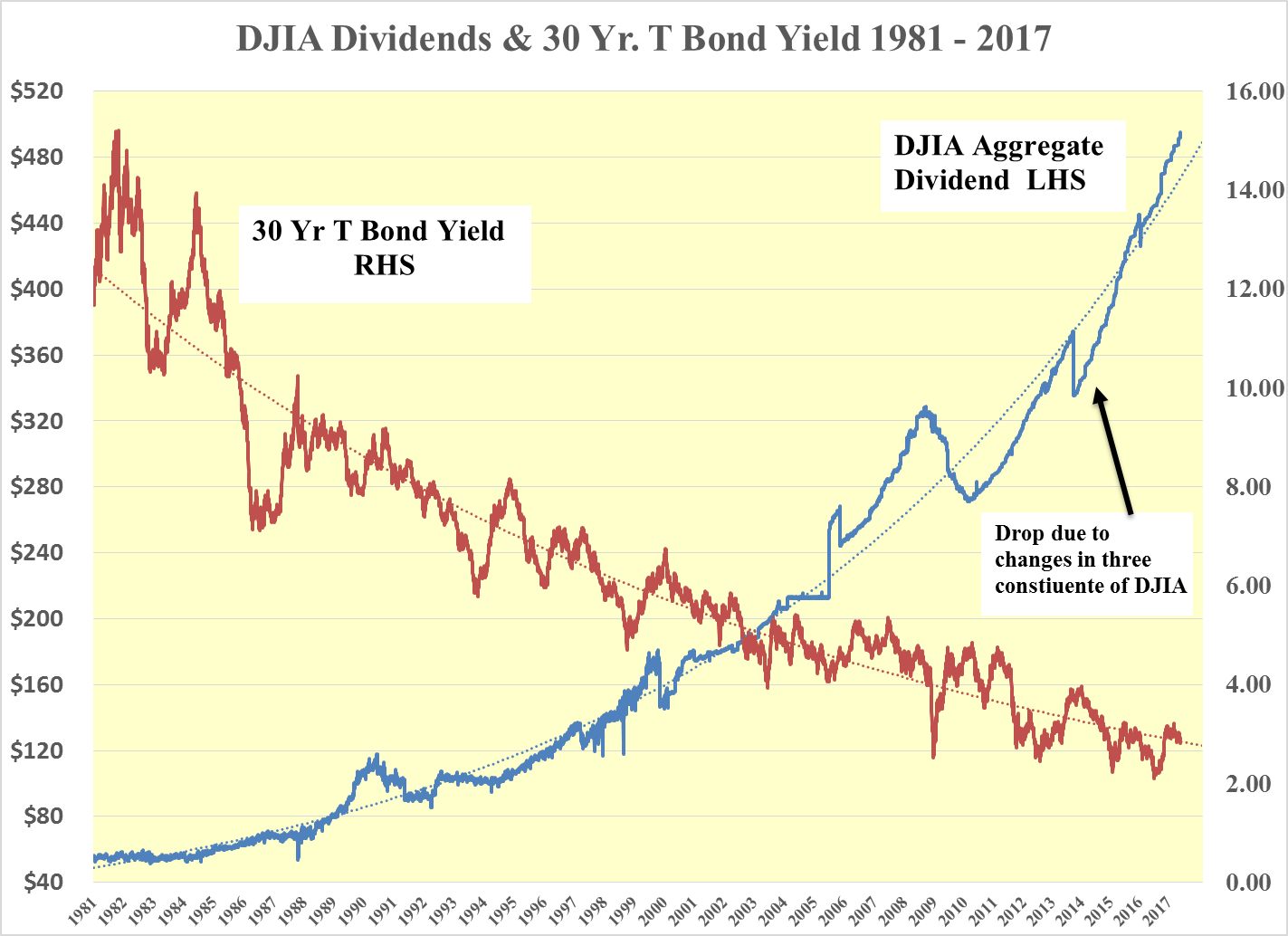

This should mean that the US 30 Year T bond yields will remain as previously forecast within 15 to 20 bps either side of 3%. Under such conditions the DJIA should continue to rise to new record levels, if only from the high probability of the DJIA dividend continuing to increase to new record levels from this week's current record of US$495.36.

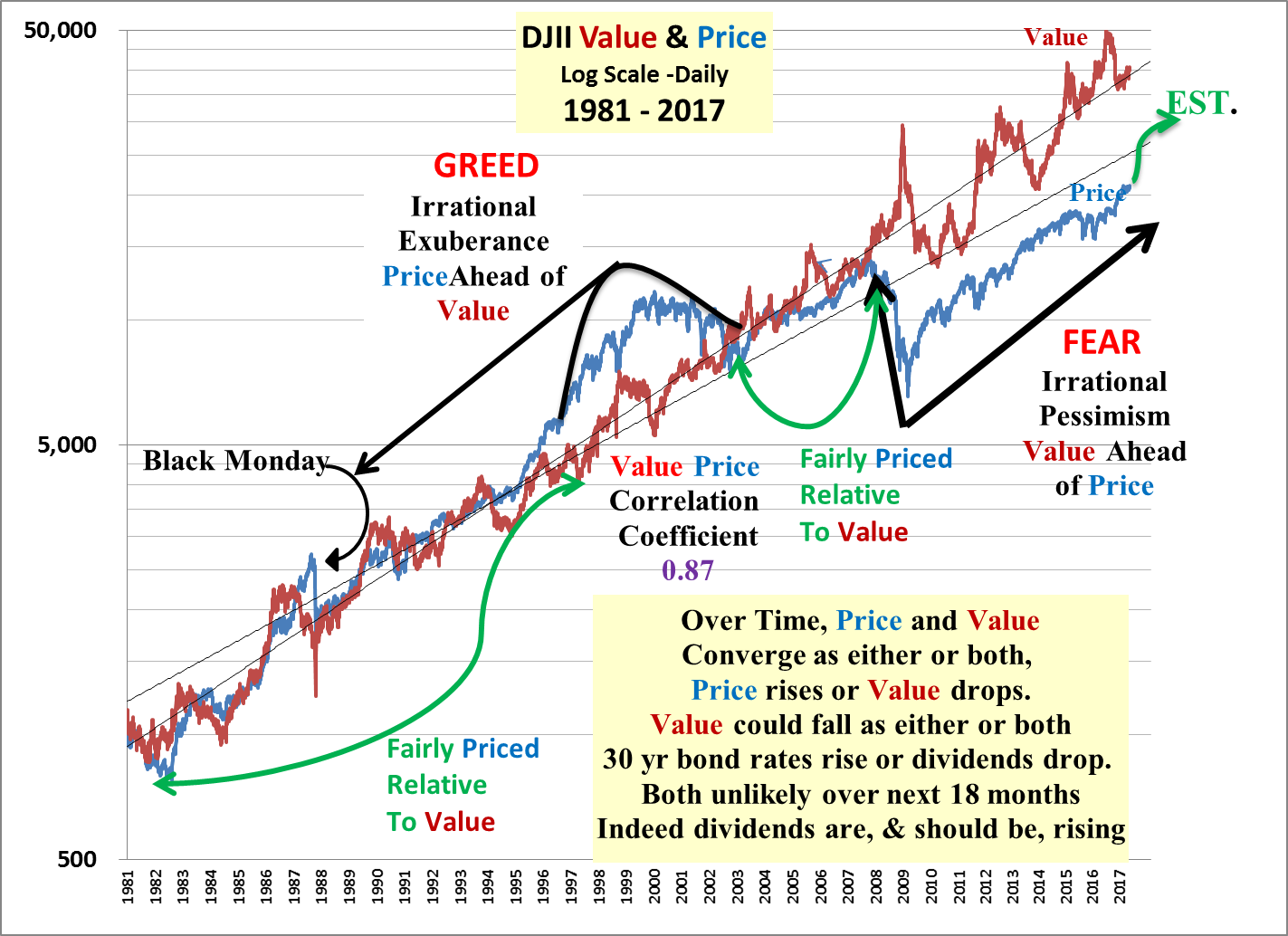

The combination of a falling U.S. 30 year T bond yield and rising interest rates have pushed up the dividend discount value of the DJIA over the past four decades. Until the Lehman fiasco the price and the dividend discount value of had a correlation coefficient of 0.93. Over the entire period the correlation coefficient has been 0.87.

Following the dislocation caused by the financial meltdown the price of the DJIA has remained well below its dividend discount value. The explanation may lie in the misplaced expectation that the Fed would quickly return to a, so far unstated, normalized rate and thereby push up long-term rates.

This notwithstanding, the DJIA price has been so far below its dividend discount value, which has continued to rise since Lehman, that the price of the DJIA has been under enormous upward pressure, despite all of the kicking and screaming from the bears. The pressure on the DJIA price remains up towards its value of 40,722. Hence, my continued, some say extreme, bullish stance.

Gold

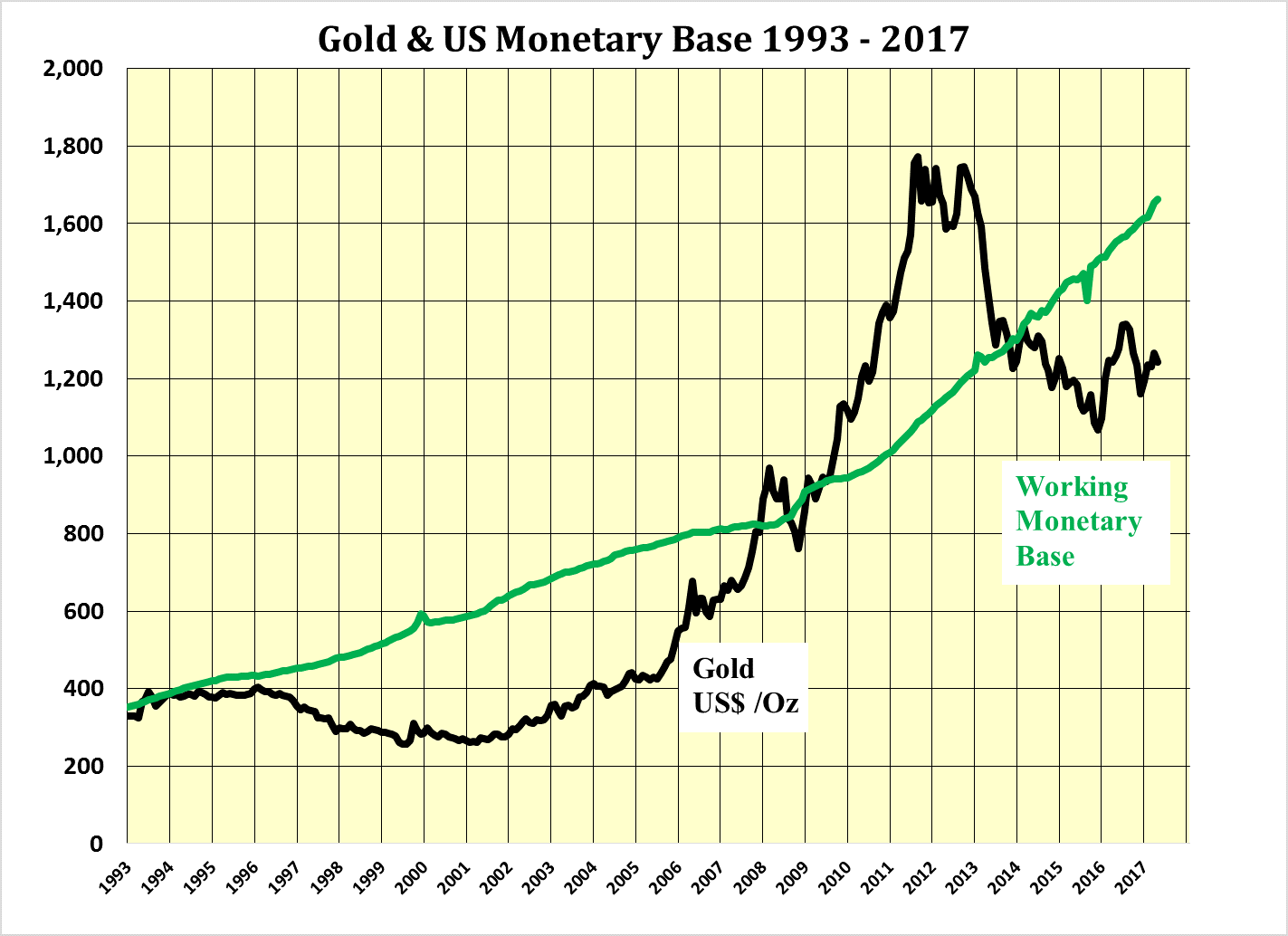

It continues to appear that the U.S. dollar price of gold is more closely tied to the U.S. actual working monetary base, AWMB, than anything else. With economic expansion projected to continue, albeit at a moderate pace, the AWMB should also continue to grow as it has been for the past four decades.

While it is difficult to predict when the price of gold will catch up with the AWMB, it is still possible to see the price of gold above US$1.600 per ounce within the next year if not by the end of 2017. Indeed the daily price seems ready to break above US$1,300 per ounce.

Disclosure: None.