Don’t Be A Stock Market Victim

Introduction

The primary objective of this article is to help the reader put this recent bad market in perspective and simultaneously provide lessons in valuation and how to think about stock prices. There have been many sage pieces of wisdom that have been provided to investors by investing greats. For example, in 1995 Peter Lynch wrote this in Worth Magazine: “what makes stocks valuable in the long run isn’t the market. It’s the profitability of the shares in the companies you own. Corporations become more valuable and sooner or later, their shares will sell for a higher price.”

Nevertheless, my own personal anecdotal experience indicates to me that people react to stock price movement and rarely, if ever, compare that movement to the profitability of the companies they own. I consider this a mistake, but also at the same time recognize that it is only human nature.

Consequently, the emotional response to the stock market is extremely strong. When markets are rising people are likely to get more confident and unfortunately even complacent. In contrast, when markets are falling people are likely to become fearful with doom and gloom scenarios replacing “sugar plums dancing in their heads” even during the holiday season. However, it is my contention that it is rarely as simple as prices are rising or prices are falling. Most importantly, I make it a practice to never react to price action. Instead, my approach is always to analyze and evaluate whether price volatility is justified – or not. In other words, my approach is intellectual rather than emotional.

As a registered investment advisor with more than 45 years’ experience, I have often lamented that I live in money manager hell. When my clients are giddy with enthusiasm about the market, I tend to be morose and gloomy. In contrast, when my clients are miserable and frightened, I tend to be ecstatically optimistic. My experience has taught me that bull markets eventually bring risk, while bear markets bring opportunity. Therefore, instead of being caught up in the moment, I tend to be focused on what the future is likely to bring. Bad markets bring long-term profits; good markets bring risk and overvaluation. Consequently, I love bad markets and hate good ones. However, my approach and attitude are predicated on understanding, within reason, what the true value of each of the companies I own truly is. Therefore, I can recognize both rational and irrational market behavior as it occurs. In my opinion, nothing is more calming during turbulent times.

I Just Don’t Understand Why Investors Get So Upset by A Market Behaving Badly

Because of my perspective, I often find it difficult to understand why long-term oriented prudent investors get so concerned when the market is down like it has been this December. From my perspective as a long-term investor in great dividend paying stocks, short-term price volatility seems totally irrelevant. Why? The answer is simple, if I do not intend to sell my dividend growth stocks today, or for that matter for many years to come, why should I worry about what the prices of the stocks are today? Nevertheless, a falling stock market, like we are seeing this December, causes a significant amount of investor angst.

Furthermore, this worry seems especially irrelevant to me when the dividend growth stocks I own continue growing their earnings and raising their dividends. People tend to be overly concerned about the performance of their portfolios based solely on price action even when their businesses are performing fantastically. Somehow, they only consider the price movement as indicative of how their portfolios are performing.

In my experience, most investors seem incapable of even considering the operating performance of the businesses they are long-term investors in. In other words, their businesses can be doing great and their dividend income increasing, but if the prices are down, the investors are upset. To me this is backwards, because I only care about how my businesses are performing because I am confident that in the long run this is the only thing that will produce the rewards that I am seeking through investing in great dividend paying businesses.

To summarize, measuring the performance of my portfolio or any of my individual holdings based solely on what the price has recently done or is doing is just wrong in my opinion. Nevertheless, this is precisely what most investors do. I can’t tell you how many times I’ve had an angry or concerned client call me complaining about how poor a certain stock is performing when, from my perspective, it is performing fabulously. The client is measuring price action, whereas I am measuring earnings, dividend and revenue growth. To me, the only performance that truly matters is how the business is doing.

AbbVie Inc. a Case in Point

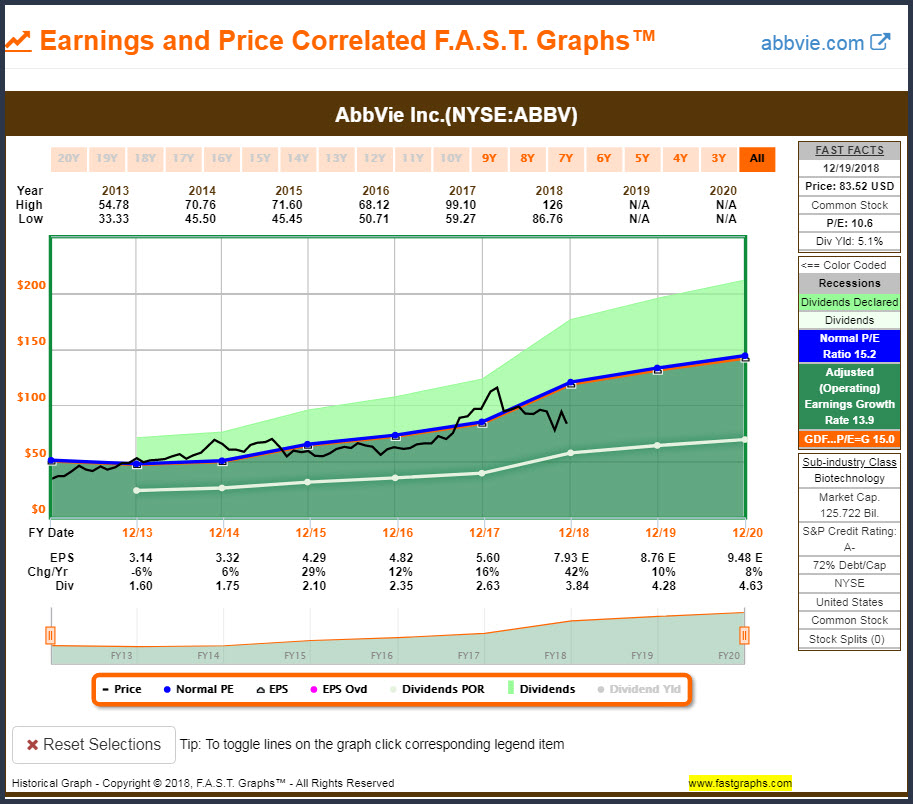

The biotechnology giant and spin off from Abbott Labs represents an excellent case in point. For all of 2018, the stock price is down almost 14%. From its peak in the spring of 2018, AbbVie’s (ABBV) stock price is down more than 30%. Consequently, most investors would call AbbVie a performance dog for calendar year 2018. However, from my perspective as a shareholder, I consider it one of the best performing stocks that I own for 2018. The company’s earnings are forecast to increase approximately 40% by the consensus of leading analysts following the stock, and thus far they have beat estimates of both earnings and revenues for each of the last three completed quarters.

Additionally, AbbVie announced that they increased their dividend by 35.2% on February 15, 2018. Consequently, their 2018 quarterly dividends of $0.96 a share are on track to produce a $3.84 dividend for fiscal 2018 which is approximately 46% higher than the $2.63 dividend they paid in 2017. To me, this is simply spectacular performance – and I couldn’t be happier with my holding. The fact that the price is down for the year is just typical market foolishness to me. In other words, I am ecstatic with my AbbVie holding and its true performance for fiscal year 2018. Nevertheless, it never ceases to amaze me how blinded people are regarding their true portfolio performance when short-term prices are weak.

Not all Price Drops Are the Same

Another important aspect regarding short run stock price volatility is the reality that not all price drops are the same. Investors need to understand and consider that some price drops are justified while others are not. Sometimes the company’s stock price falls simply because the market was pricing the fundamental value of the company too high. This is one example of a justified price drop. In another case, a company’s stock price might fall because the company’s fundamentals have deteriorated. This would be another example of a justified price drop.

In contrast, a company’s stock price can be fairly valued or even attractively valued and drop nevertheless because of a major market selloff. This would represent an example of an unjustified price drop that is, in reality, an opportunity rather than a crisis. In other words, a great company that has gone on sale. These are important distinctions that most investors seem either incapable of or unwilling to make or consider. The price drops, the investor panics – and that is typically the end of the story.

CVS Health Corporation a Case in Point

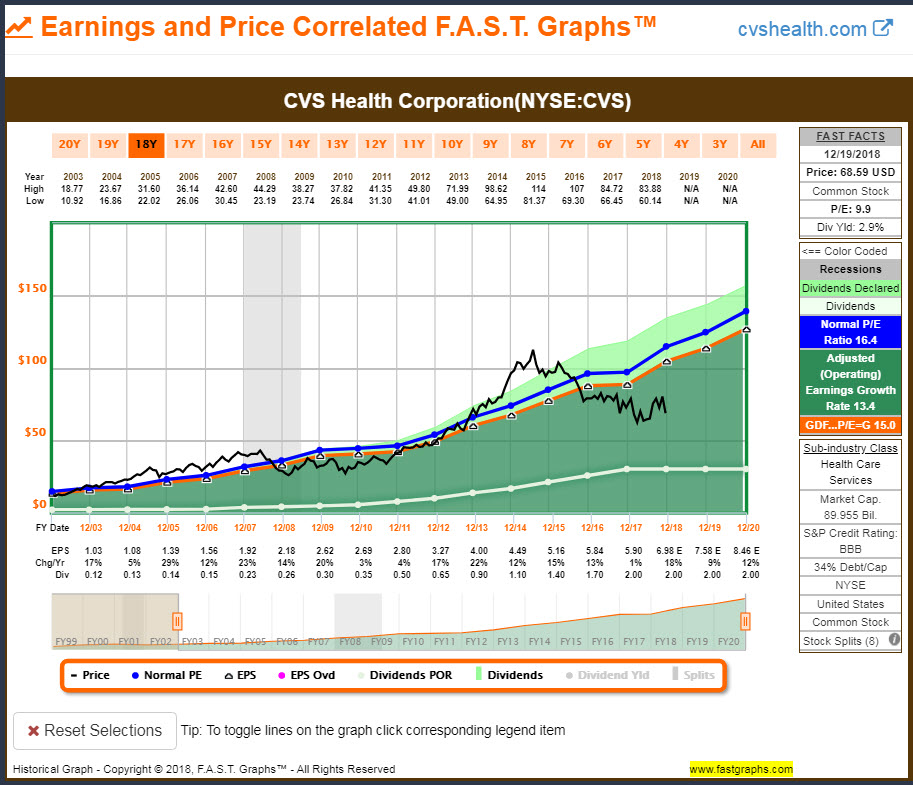

In the summer of 2015, CVS Health Corporation’s (CVS) stock price was significantly overvalued as seen on the following earnings and price correlated graph. Earnings growth was very strong for 2012, 2013, 2014 and 2015. Nevertheless, the headwinds of overvaluation soon took its toll and by October 2016, CVS’s stock price fell approximately 25%. However, based on previous overvaluation, I believe the correction was clearly justified.

Then along came 2017, which delivered very anemic growth relative to recent history. Consequently, with investor sentiment already negative for the past year and-ca-half or so, CVS’s stock price has continued to slide another 18% on top of the original 25% drop. With earnings growth reemerging in 2018 stock price has recovered somewhat. Nevertheless, I would consider this company significantly undervalued based on current and expected future operating results.

It’s a Market of Stocks Not a Stock Market

Recently I’ve been hearing a lot of “wow the market is tanking – what do you think it’s going to do?” My answer is always the same; I think it will continue to fluctuate as it always has. However, I think the most important message that I want to convey is that it is a market of stocks and not a stock market. Just as all price drops are the same, not all stocks in the market are the same. They all have different operating histories and potentials, different valuations, and different reasons for whatever their prices are doing. Of course, it is certainly true that a rising tide lifts all boats and a falling tide sinks all boats – at least in the short run.

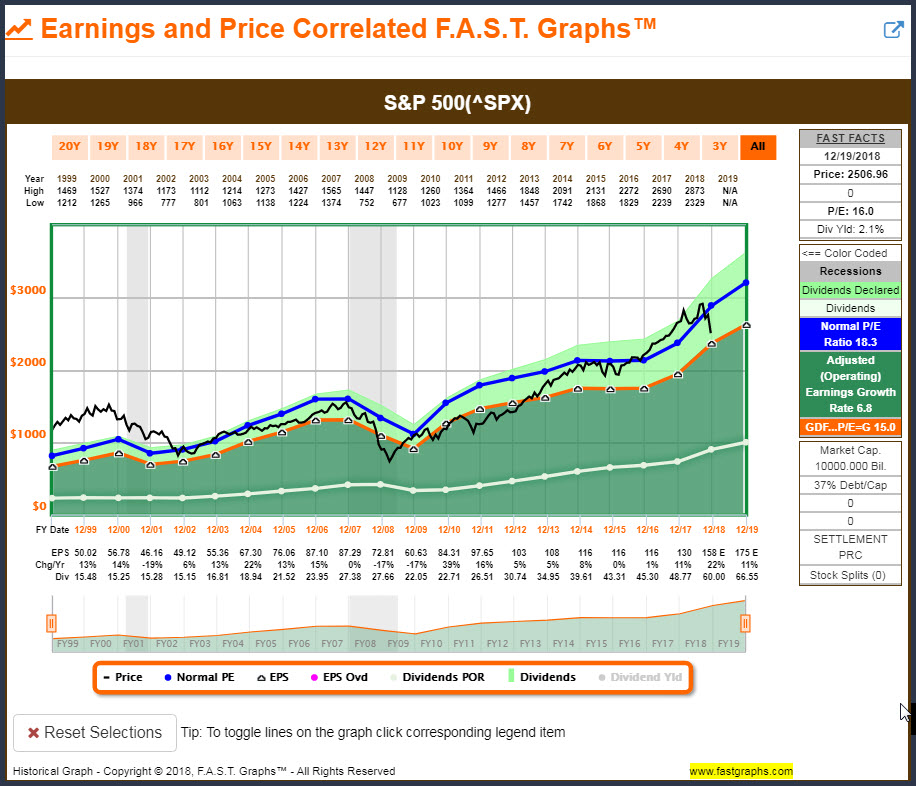

The following earnings and price correlated graph with valuation references on the S&P 500 clearly illustrates that this market index has been significantly overvalued since 2014. Consequently, the recent correction has not been a surprise to me, because I have been expecting it for some time. Moreover, I think the S&P 500 is now reasonably priced after this correction. However, that is not to say that it won’t overshoot in to undervaluation territory if sentiment remains negative.

FAST Graphs Analyze out Loud Video Summary

The following video summarizes and elaborates on the important messages I am offering with this article.

Conclusions

If you are a long-term investor, then my advice is to never let the stock market or short-term price volatility impact your investment decisions. However, I understand the difficulty of watching your portfolio value get smaller even if it’s only temporary. In my experience, for most people their financial situation comes only second to the health and welfare of their families. In other words, a person’s financial security is extremely important. Consequently, it’s easy to be a victim of volatile markets.

Therefore, it is also my experience that more people have had their financial situation severely impacted by reacting emotionally to markets. In other words, in too many cases I have seen people sell when they should buy and buy when they should sell. The powerful emotional responses of fear and greed are powerful adversaries to our financial health. However, when we can understand and embrace the reality that – as it relates to investing in stocks – operating performance is significantly more important than price action, only then can we protect ourselves from volatile markets. Healthy earnings, cash flows, revenues and dividend growth will eventually lead to healthy returns. Don’t be a stock market victim!

Disclosure: Long ABBV and CVS.

Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or ...

more