Does General Mills Have A Weight Problem? Here Is What To Expect From Tomorrow’s Result.

General Mills (GIS) will reports its FQ4 ’15 results before the opening bell tomorrow morning. Estimize are predicting an EPS figure of $0.72 and a revenue target of $4.528B. This is compared to Wall Street which predicts an EPS number of $0.71 and a revenue figure of $4.521B.

General Mills in currently in the middle of a global restructuring where management intend on laying off between 675-725 employees by May 2017. The restructuring has been designed to strip costs in an attempt to boost earnings. As an immediate result of the changes, General Mills is expected to take a hit to the value of approximately $62M caused mainly by the requirement to pay termination benefits. The benefits derived from the restructuring is expected to be between $45M-$50M in cost savings per annum.

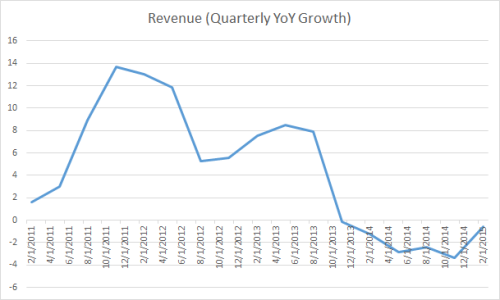

General Mills is facing similar challenges to companies such as ConAgra due to its product mix. As consumers continue to move towards healthier products, demand for General Mills products including Cheerios and Betty Crocker cake mix is waning. This is reflected in the company’s diminishing sales growth rate, as demonstrated below.

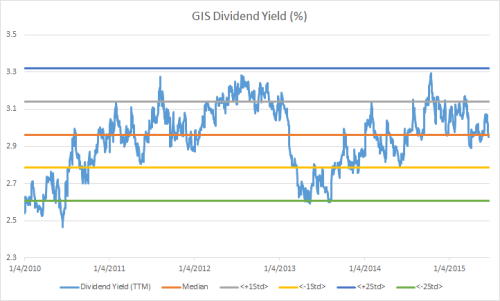

Historically General Mills has returned solid income to investors through dividends. General Mills consistently pays a substantial portion of its cash profits in dividends. The chart below represents the stocks dividend yield over time. Currently, General Mills is trading at the mid-point of its range bound trading activity.

The benefits as a result of the restructuring are material and will almost certainly have a positive impact on General Mills EPS in the medium term. However, concerns surrounding General Mills ability to produce long term revenue growth as changing tastes and smaller competitors increase competition still persist. The outlook from management and the growth strategy outlined in tomorrow’s report will be crucial.

Disclosure: There can be no assurance that the information we considered is accurate or complete, nor can there be any assurance that our assumptions are correct.