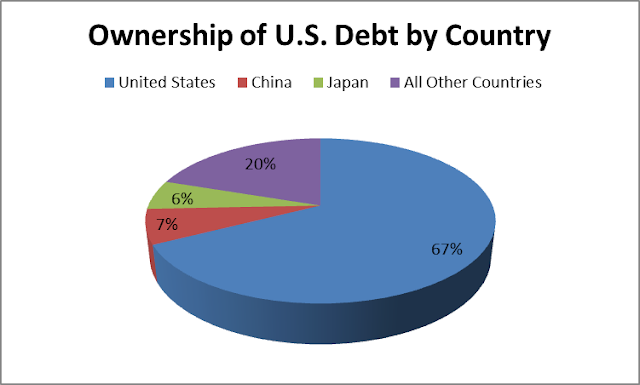

Does China Own All Of Our Debt?

China gets a lot of attention for owning a big chunk of the debt issued by the U.S. government. The truth is that China owns a relatively small share with U.S. investors themselves owning the vast majority of the debt – just over two-thirds (about 67.5%) to be precise. Foreign nations own the remaining 32.5%. China is, however, the largest foreign holder of the debt, but those holdings make up only 7% of the total holdings across foreigners and domestic owners. The domestic holders include banks, wealthy individuals and families, pension funds, state governments, municipal governments, social programs, and the Federal Reserve.

Although Japan doesn’t get a lot of attention for it, Japan follows closely behind China in ownership of U.S. debt at $1.13 trillion compared to China’s $1.25 trillion. After China and Japan, however, the number of holdings by foreign countries fall off with Ireland coming in at third with $271 billion – that’s billion, not trillion this time. Here is how the top three holders shake out:

In total, people and institutions in the U.S. command about $13 trillion of the debt. The Social Security trust fund holds a massive chunk, $5.3 trillion, far more than China’s $1.25 trillion. State and municipal governments, along with investment funds and individuals, command another $5.1 trillion. Even the Federal Reserve holds more U.S. debt than China; the central bank has amassed $2.5 trillion in Treasuries due in large part to its quantitative easing programs since the Financial Crisis and ensuing recession.

Characteristics of U.S. Treasury Market

The market for U.S. Treasuries is one of the most liquid in the world as U.S. government debt is coveted for its security and yield, especially in today’s global debt market for government bonds where rates have turned negative in some countries. Hundreds of billions of dollars of U.S. debt exchange hands every trading day.

There are various types of Treasuries investors can buy with the major defining characteristic being the length of maturity – when an investor gets his or her principal back. Treasury bills (T-bills) have the shortest maturities, up to a year, and can have maturities as short as a month. They are sold at a discount to their face value with investors getting their money lent plus their interest in a lump sum payment at maturity. For example, if you buy a 4 week T-bill with a face value of $100 for $99, then you will receive $100 from the government in 4 weeks. The interest is the difference, $1 in this case, equating to a yield just over 1% on your original $99.

Treasuries with longer maturities are referred to as Treasury notes (T-notes) and Treasury bonds (T-bonds). T-notes have maturities ranging from two to ten years. Unlike T-bills, T-notes pay interest every six months. Likewise, T-bonds pay interest every six months, but their maturities go out past a decade to 30 years. T-bonds, T-notes, and T-bills can all be sold before they mature to other investors in secondary markets, so even if you buy a 30-year T-bond, you can sell it the next day no problem.

U.S. Debt is the Foundation

Countries own Treasuries with various maturities according to their needs. What’s important is that U.S. debt is the foundation of not only the U.S. financial system but the global one as well. U.S. debt is considered to be risk-free, meaning that the U.S. debt is impervious to default. Countries like China use the dollars they get in foreign trade to purchase Treasuries, giving them a safe place to store their money and earn a fair return. This symbiotic relationship also lowers interest rates and helps U.S. consumers get lower interest rates for their homes, cars, and other goods. It’s likely that China, Japan, and countries around the world will be holding big chunks of U.S. debt for years to come.

Disclaimer: None.

Thanks for sharing

Thanks for sharing