Do Nu Skin Inventory Red Flags Spell Trouble Ahead?

Last Friday morning, a comment posted on Twitter by Marc Cohodes about Nu Skin Enterprises (NYSE: NUS), a Utah based multi-level marketing company, caught my curiosity. Cohodes is a legendary short-seller with an excellent track record and looks for "fads, frauds, and failures" involving public companies. He wrote, "The Clown who runs NUS tried to squeeze shorts. Screw him! He will get what's coming to him in spades one day. Too much Inventory is an issue." Afterwards, I decided to take a close look at Nu Skin's financial reports. So far, my first issue is that management's explanation for its massive increase in inventory levels does not square against its own historical numbers, guidance it gave to investors, and analysts' consensus estimates. In addition, Nu Skin may be have to take significant margin reductions to unload its excess inventory and possibly have to recognize a material impairment charge against inventory in a future period.

Background

Generally, if a company is efficient at managing its inventory levels, its inventory and cost of goods sold should grow in tandem over time. If a company becomes more efficient at managing its inventory levels, its cost of goods sold will grow faster than inventory reflecting shorter periods of time to turnover its inventory into revenues. However, over the last seven quarters, Nu Skin's reported inventory levels grew significantly faster than its growth in cost of goods sold resulting in longer periods of time to turn its inventory into sales.

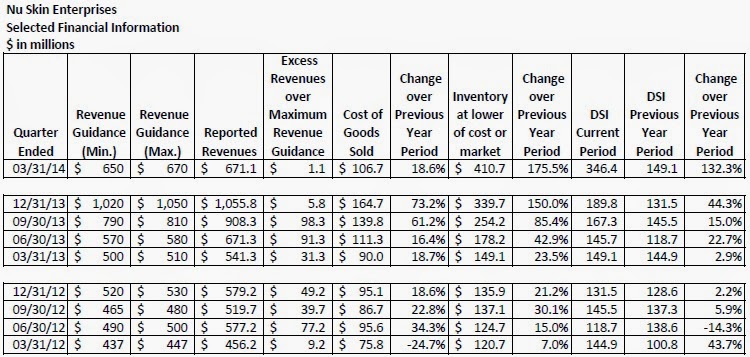

A more troubling issue is that Nu Skin's reported revenues exceeded its own maximum revenue projections while its inventory turnover decreased for each of the last seven quarters. In two of those seven quarters, Nu Skin beat its maximum revenue guidance by over $90 million. Generally, it provided revenue guidance for the current quarter approximately 4 to 5 weeks into same quarter. Therefore, Nu Skin already possessed several weeks of sales data before it provided revenue guidance for the entire 13 week quarterly period. Since Nu Skin's reported revenues exceeded its most optimistic forecasts within a relatively short period of time, its inventory turnover should have increased because it should have ended the period with fewer inventories on hand than it had anticipated. However, an analysis of Nu Skin's numbers indicates that it is taking progressively longer periods of time to turn its inventory into sales.

Calculations

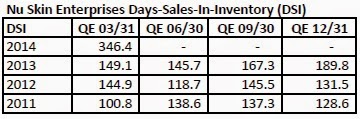

Days-Sales-in-Inventory (DSI) measures the number of days it takes for a company to turn its inventory into sales. DSI is computed as follows: (Ending inventory/Cost of goods sold during the period) X number of days in period. If the DSI number grows over time it indicates that a company's inventory turnover is decreasing because it is taking longer periods of time for a company to turn its inventory into sales. In general, a growing DSI could indicate one or more of the following potential red flags:

- A company is mismanaging its inventory,

- A company may be required to reduce gross margins in future periods to sell slow moving products to normalize inventory levels,

- A company may be required to take a one-time material impairment charge against earnings in a future period to write-down to the cost of slow moving or obsolete inventory to its lower market value, or

- A company is possibly inflating inventory numbers to overstate income by either fabricating inventory numbers or by its failure to write-down inventory to market value.

Click on the image below to enlarge it.

Note: In Q4 2013, Nu Skin reduced its revenues and selling expense going back at least three years to correct an accounting error in classifying certain rebates. According to the company, the reclassification had no effect on gross profit, operating income, net income or comprehensive income, the consolidated balance sheet or cash flow (2013 10-K report page 50). However, the error caused relatively small changes in previously reported revenues. For 2012 and 2013, I used the revised quarterly revenue numbers tucked inside page 68 of its 2013 10-K report. However, Nu Skin did not disclose the effect of the revenue correction on 2011's quarterly numbers. Therefore, I used 2011's quarterly revenue numbers as they were originally reported in filings with the S.E.C. to make comparisons against management's 2011 quarterly revenue guidance. The error had no effect on DSI calculations.

Huge surge in inventories during latest quarter

In the latest quarter ended March 31, 2014 (Q1 2014), Nu Skin's reported revenues exceeded its maximum revenue projection by $1.1 million. Its cost of goods sold increased by 18.6% over the previous year's first quarter (Q1 2013). However, its inventories mushroomed 175.5% to $410.7 million compared to $149.1 million in the same period of the previous year. It took Nu Skin 346.4 days to turn its inventory into sales in Q1 2014 compared to only 149.1 days in Q1 2013, an increase of 132.3% extra days to sell its products. In Q1 2014, DSI was over three times the level it was in Q1 2011.

Rising inventory levels don't square with management's explanation

In its Q1 2014 10-Q report, Nu Skin claimed that, "we built a large amount of inventory during the first quarter for planned product launches in 2014...." However, its disproportionate buildup in inventories does not square against its own historical numbers, guidance it gave to investors, and analysts' consensus projections. DSI has been progressively growing from 2011 levels. (Click on the image below to enlarge it.)

In Q1 2013, Nu Skin turned its inventory into sales 0.6 times (cost of goods sold $90 million/inventory $149.1 million). In Q1 2014, its inventory mushroomed to $410.7 million. To maintain the same rate of inventory turnover in Q1 2014 as it did in Q1 2013, Nu Skin would have needed to sell inventory costing it $247.9 million during Q1 2014 (Q1 2013 inventory turnover 0.6 X Q1 2014 inventory $410.7 million). In Q1 2014, Nu Skin realized revenues on its inventory at a multiple of 6.29 times its cost ($671.1 million revenues/$106.7 million cost of goods sold). Therefore, the approximate amount of revenues required for Nu Skin to maintain its historical level of inventory turnover without eroding gross profit margins was $1.559 billion for that quarter.

However, Nu Skin reported only $671.1 million revenues for Q1 2014. In May 2014, Nu Skin projected only $700 million of revenues for Q2 2014. The current analyst consensus estimate for Q2 2012 is $712.2 million in revenues, Q3 2014 is $858.5 million in revenues, and Q4 2014 is $948.2 million in revenues. The analyst consensus estimate for revenues in full year 2014 is $3.19 billion, slightly higher than revenues of $3.17 billion reported for 2013.

There are plenty of other issues of concern involving Nu Skin's multi-level marketing business model, domestic and foreign regulatory issues, its apparent dislike of whistleblowers and financial disclosures, but it will have to wait for another day. If Nu Skin's management does not act like mature grownups, I might make investigating and reporting about the company my new hobby. Right now, I have my doubts on management's story about its disproportionately huge rise in inventory levels.

Written by:

Sam E. Antar

I am a convicted felon and a former CPA. As the criminal CFO of Crazy Eddie, I helped my cousin Eddie Antar and other members of ...

more

.jpg)