DJIA About To Start “Cooking With Gas”

Past price action no guide to future

Looking solely at the price of the DJIA over the past decade it can be seen where it has been. However, it tells nothing about its value, neither does it tell why the price has changed nor about where it is going.

There have been a number of changes in the fundamentals that are commonly thought to impact the price of the DJIA. The U.S. GDP, the DJIA earnings, the PE ratio.

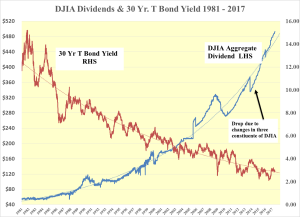

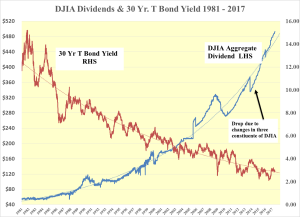

There have also been changes in the two main factors that determine the value of the DJIA, the dividends and the 30 year T bond yield. The latter, of course, has a direct impact on the changes of the value and price of the bond market.

P/E Ratio Not Be All and End All, Particularly in Isolation.

Perceived wisdom holds that the DJIA is forward looking. If this is the case why are so many pundits crying that the P/E multiple is too high?

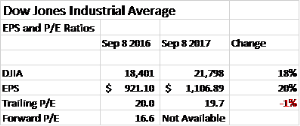

The same cry has been heard for over a year. But if this year’s actual earnings had been correctly forecast last year and used to calculate the forward P/E multiple of 16.6 then the clamor to sell might have been more muted.

In the event, DJIA earnings are up 20% while the price of the DJIA is up 18%. If there was no need to panic and sell last year why should there be a rush for the exits now?

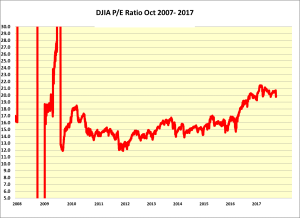

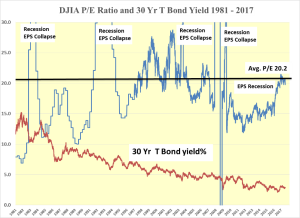

Using the P/E ratio on its own is not helpful. It has been extremely volatile, moving towards infinity as earnings fall in recessions and towards negative infinity as losses were incurred during the Lehman fiasco. The average P/E ratio over the past 36 years has been 20.2 on historical earnings. Slightly more than the current ratio of 19.7. On its own, this suggests that the DJIA is fairly priced.

P/E Multiple Has to be Viewed in Context of 30 Year T Bond Yield

However, this is without any reference to the prevailing 30 Year T bond yield, which has fallen from 15.2% on September 29, 1981, to 2.67%. The bond market has been in a phenomenal bull market for 36 years with its price rising 5.69 times. Falling long term rates should have had, and did have, a positive impact on the P/E multiple of the DJIA until the Lehman catastrophe.

From 1981, when the DJIA P/E stood at 6.9, up until Lehman the P/E expanded gradually higher, as it should have, with a falling discount rate. The P/E multiple has risen again but mainly because of the 2016 earnings recession, brought on by falling energy prices and the relative strength of the U.S. dollar. This is rather than a return to the pre-Lehman expansion, it has been brought about by falling long bond yields.

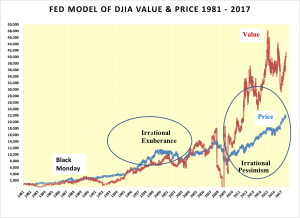

The Fed Model

This model of valuing the stock market holds that the yield of the 30 year T bond should match the earnings yield of the DJIA. The earnings yield is the reciprocal of the P/E.

Using the price of the DJIA on September 29, 1981, as a starting point the Fed model puts a fair value of the DJIA at 41,457. This supports Alan Greenspan’s recent comment that there is plenty of room for the price of the DJIA to move higher without being overpriced.-

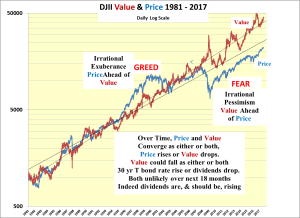

As earnings disappeared during the financial crisis the Fed value of the DJIA also disappeared and it is little wonder that the price of the DJIA fell by 55%. Since Lehman, the Fed value of the DJIA has rebounded as earnings recovered and has been well in excess of its price as fear continues to stalk equities in a period of “irrational pessimism”. The opposite of the latter part of the 1990s, which Alan Greenspan termed a period of “irrational exuberance”!

It should be noted that irrational fear has not held back the bond market which continued to rise after Lehman to new highs. Perhaps pervasive fear of risk in the equity market helped propel funds into the so-called, “risk-free” bond market!

If, as and when long-term interest rates rise, it will be enlightening to see how “risk-free” those bonds will be. Certainly, investors should receive their capital back at maturity but in the meantime, the monthly brokerage statements will not look good when the bonds are marked to market over the next couple decades.

Moving From the Fed Model to the Dividend Discount Model

While very much the case during and after Lehman, dividends have historically been much less volatile than earnings. As such dividends are considered a much more preferable vector in determining value.

Substituting the dividend yield for the earnings yield in the Fed model results in the Dividend Discount Model. The correlation between the resulting DJIA dividend discount value and its price stood at 0.93 prior to Lehman.From 1981 to date the correlation has been 0.89.

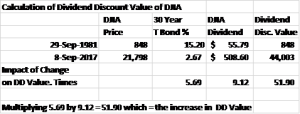

The dividend-discount value of the DJIA is a function of two vectors, the aggregate dividend of its constituents and the yield of the U.S. 30 year T Bond. Since September 1981, when the U.S. 30 year T Bond peaked at 15.20% following Mr. Volker’s fight against inflation, the dividend of the DJIA has risen 9.12 times from $55,79 to $508.60 while the yield of the T Bond yield has fallen to 2.67% resultingin a 5.69 fold increase in the price of the 30 year T bond.

Multiplying the 5.69 times increase in the bond market with the 9.12 fold rise in the dividend, the dividend-discount value of the DJIA has risen 51.9 times. Using the DJIA price from the same day as the 30 year T bond peaked at 15.2% the DJIA value has moved from 848 in 1981 to 44,003. The price of the DJIA, however, stands at a 50% discount from its dividend discount value.

This is the same model that I have been using since the summer of 1987. The price and value had a correlation coefficient up until Lehman of 0.93 and for the entire period since 1981 of 0.89. As such the model has been extremely useful in pointing to where the value of the DJIA is and where the price should be. Today the value, at 44,003, points to continuing upward pressure on the price of the DJIA, as it has been since Lehman and hence there is every reason to continue to BUY the DJIA.

It makes sense that the Fed model value of 41,457 is back up to a level similar to the dividend discount value of 44,003 now that earnings have recovered and the payout ratio has fallen back to 46% at which level the DJIA dividend is considered secure.

What if long term rates rise when the Fed starts to shrink its balance sheet?

The last thing the Fed wants is for interest rates to move rapidly higher and tip the United States into a recession. Hence, the watchword is gradual. In the meantime, the DJIA is really about to start "Cooking with gas"!

The rallying cry since Leman of “Buy and take no prisoners” remains unchanged!DJIA about to start “cooking with gas”

Disclosure: None.