Dividend Income Update – June 2015

With half the year officially under our collective belts a clearer picture of our full year of dividend income comes into view. June, of course, is a favorite month among dividend investors as end of quarter months usually signify higher than average passive income. I’m curious to see how the next quarter of dividends totals up as June was a busy month for me as I completed eight separate buyswhich was much higher than my usual one or two buys I make in a month. No doubt, my increase in June activity will reap bigger dividends in the coming months. I have yet to make my July buys but with all this market volatility many names from my July stock considerations list are looking significantly more attractive with Dover Corporation (DOV), The Toronto-Dominion Bank (TD), The Bank of Nova Scotia (BNS) and even Royal Bank of Canada (RY) enticing me. Time will tell where I ultimately deploy my July cash. With that being said, let’s take a look back at my June dividend income.

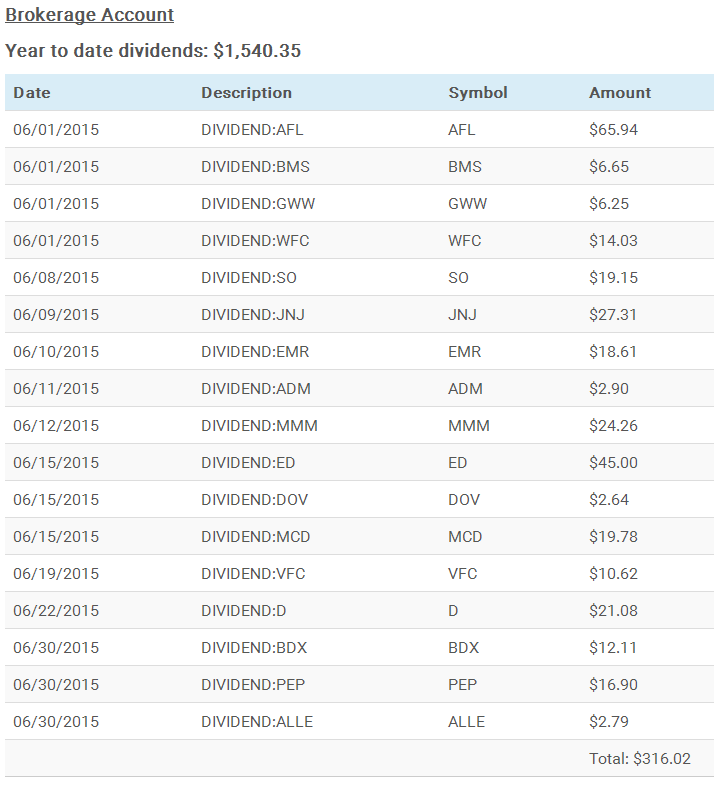

Dividend income from my taxable account totalled $316.02 up from $261.26 an increase of 20.96%from June of last year.

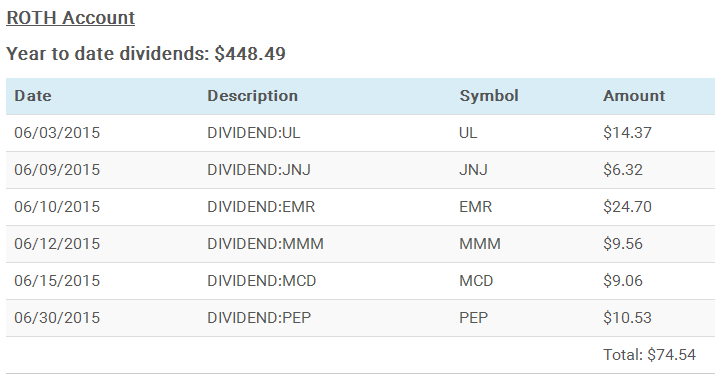

Dividend income from my ROTH account totalled $74.54 up from $53.37 an increase of 39.67% from this time last year.

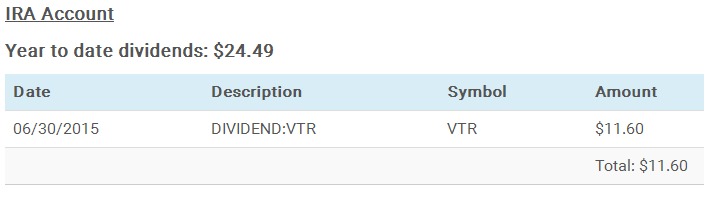

Dividend income from my IRA account totalled $11.60 up from $0 from this time last year.

Grand total for the month of June: $402.16.

Who says dividend growth investing doesn’t work? Just look at the figures above and see what fresh capital, dividend raises and compounding can do to year over year income.

Are any of these dividend stocks in your portfolio too? How was your June dividend income? Please let me know below.

Disclosure: Long all above.