Dividend Aristocrats In Focus Part 20 Of 54: Cardinal Health

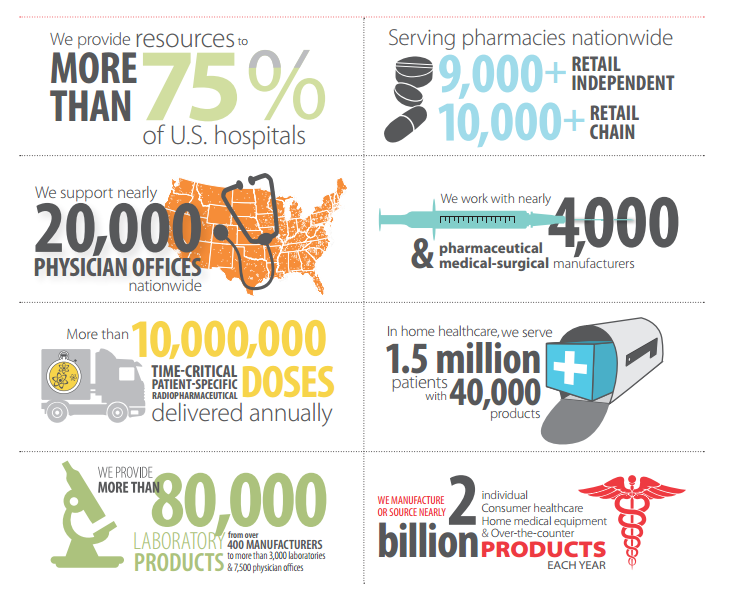

In part 20 of my 54 part Dividend Aristocrats In Focus series, I take a closer look at Cardinal Health (CAH). Cardinal Health is a leading pharmaceutical consolidator and distributor. It also manufactures and distributes basic medical supplies like gloves, gowns, and drapes. The company was started in Columbus Ohio in 1971. Since that time Cardinal Health has grown into a $25 billion medical distribution powerhouse. The company’s success is shown in its 30 year streak of consecutive dividend increases. The infographic below sums up the impact Cardinal Health has on health care.

Source: Cardinal Health 2014 Annual Report

Business Overview

Cardinal Health operates in two segments; pharmaceutical and medical. The pharmaceutical segment consolidates and distributes generic pharmaceuticals from manufacturers and distributes them to hospitals, pharmacies, and other health care providers. The pharmaceutical segment was responsible for 80% of the company’s profits in fiscal 2014.

The medical segment manufactures and distributes gloves, gowns, drapes, and other low technology medical supplies for use in various health care facilities. The division also builds ready-to-use surgical kits for quicker surgery access. The medical segment was responsible for 20% of the company’s profits for fiscal 2014.

Competitive Advantage

Cardinal Health’s primary competitive advantage comes from the sheer volume of its supply chain. The company serves over 100,000 health care locations daily. The size of their operations is truly impressive. The company generated over $90 billion in revenue over the last 12 months, primarily from the consolidation and distribution of generic pharmaceuticals and medical products.

Unlike most of the dividend aristocrats I have analyzed thus far, Cardinal Health is in a low margin business. The company has a net profit margin of about 1.3%. Cardinal Health may operate in the health care industry, but it does not generate its profits from high-tech innovations or medical breakthroughs. Rather, the company will continue to grow as long as the consumption of pharmaceuticals and the overall health care industry grows. I am not sure of much, but I find it highly unlikely that the consumption of pharmaceuticals specifically and health care use in general will decrease over the next several years, or even decades. The low-tech scale and price advantage that Cardinal Health has over competitors creates an extremely durable competitive advantage that is unlikely to be diminished for a very long period.

Growth Prospects

Cardinal Health’s management has done an excellent job of growing shareholder wealth. The company recently entered into a 50%-50% joint-venture with CVS Caremark (CVS). The joint venture creates a new company called Red Oak Sourcing. Red Oak Sourcing combines the purchasing power of both businesses to realize lower costs than either cold individually. The joint-venture is for sourcing only and does not combine the two businesses in any way other than for sourcing.

Aside from the Red Oak Sourcing venture, Cardinal Health has seen rapid gains in China. For fiscal 2014, the company managed to grow revenue 30% in China. In total, the company did $2.6 billion in sales in China for fiscal 2014. Cardinal Health is actively looking for medical wholesalers to acquire in China. The company is specifically looking for smaller, tuck-in acquisitions, not a large single acquisition of a well known business. With 30% growth over the most recent fiscal year, the company’s Chinese growth strategy is working well. I expect Cardinal Health to continue growing rapidly in China as long as the Chinese economy continues to grow.

Cardinal Health is forecasting EPS growth of between 7% and 12% next year, with lower revenue growth. About 2 percentage points of growth will come from share repurchases net of share issuances. The bulk of the growth is expected to come from organic growth and margin improvements as the company realizes gains from its Red Oak Sourcing venture. Over the past decade, Cardinal Health has grown revenue per share at a modest 5% per year. I expect the company’s long-term growth to fall around 5% a year, with 2% coming from share repurchases and 3% coming organically.

Dividend Analysis

Cardinal Health currently has a dividend yield of about 1.8% and a payout ratio of 36.5%. The company’s fairly low payout ratio gives it room to raise its dividend quicker than long-term company growth. Over the past 5 years, Cardinal Health has grown its dividend payments at over 15% a year, while earnings per share have grown at about 9%. The company has been slowly increasing its payout ratio over the last several years. I look for Cardinal Health to continue to increase its dividend faster than overall company growth for the next several years. The company has not announced a target payout ratio, but it has plenty of room to grow dividends at a double digit rate like it has done over the past several years.

Valuation

Cardinal Health currently trades for a PE ratio of 21.6, well above the S&P500’s PE ratio of 18.2. The company has historically traded at only 0.96x the S&P500’s PE ratio. I believe Cardinal Health to be a high quality business deserving a premium multiple of 1.1x the S&P500’s PE ratio. The problem is, the S&P500 is currently overvalued relative to its long-term average PE ratio of 15. If you use the long term average PE ratio of the S&P500 as your guide and apply the 1.1x quality multiple, Cardinal Health should trade for a PE ratio of between 15 to 18 at fair value. I believe Cardinal Health is currently somewhat overvalued at today’s prices.

Final Thoughts

Cardinal Health is a high quality business with a low-cost scale competitive advantage; one of the most durable competitive advantages. Its business model is more similar to businesses like Wal-Mart and Amazon than many other health care dividend aristocrats I have analyzed. Cardinal Health’s underlying business is phenomenal, but the stock is pricey at this time. The company’s mediocre revenue per share growth rate over the last decade coupled with an average dividend yield makes it not rank particularly highly using The 8 Rules of Dividend Investing. While the underlying business is excellent, I believe there are better high quality divided growth stocks to invest in than Cardinal Health at this time.

Disclosure: I am not long any of the stocks mentioned in this article