Dividend Aristocrats In Focus Part 17: ADP

In part 17 of my 54 part Dividend Aristocrats In Focus series, I take a look into the operations of Automatic Data Processing (ADP). ADP provides businesses of all sizes with payroll, tax, and human resource services and software. The company was founded in 1949 in Patterson, New Jersey. Now ADP has 620,000 customers in 125 countries. The company has seen strong growth through its 65 year operating history and has now paid increasing dividends for 39 consecutive years.

Business Overview

ADP operates in two primary business units after the recent spinoff of its auto dealership focused Dealer Services divisions was completed in September of this year. The company’s two remaining divisions are employer services, and PEO services.

The employer services division accounted for 79% of revenues and 91% of operating profits for ADP in fiscal 2014, adjusting for the spinoff of the dealer services division. The PEO services division was responsible for 21% of revenues and 9% of operating profits for the company in fiscal 2014, adjusting for the spinoff of the dealer services division.

Competitive Advantage

When a business is selecting a company to handle its human resources, government compliance, and taxes it absolutely must find a company that will ‘get it right’. ADP operates in a field where being ‘cheap’ can cost companies significantly more in governmental penalties and fees. As a result, the bulk of the market goes to the largest most trusted company in the human resources field. ADP is that company.

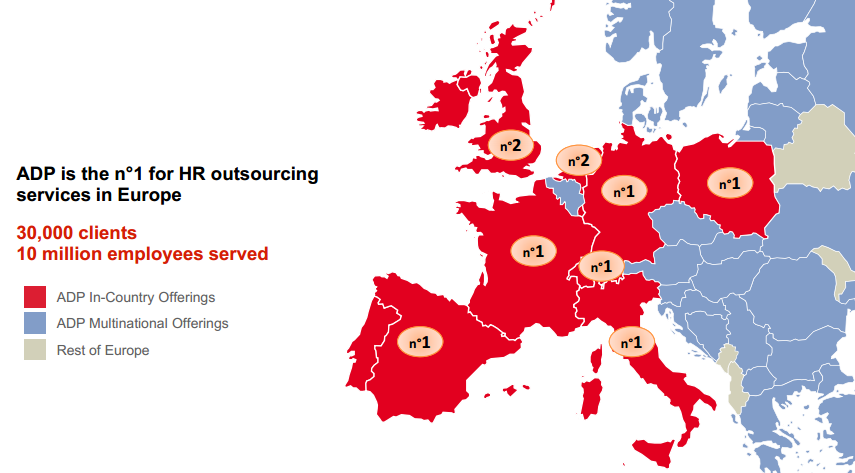

ADP is the Human Resources provider for over 80% of Fortune 500 companies. Further, the company pays 1 in 6 workers in the U.S. through its payroll processing services. ADP’s market dominance is not confined to the U.S. The company is also the number one outsourced human resource provider in Europe.

Source: ADP NASDAQ OMX Conference Presentation

Another competitive advantage for ADP is its global scale. The company can manage the payroll for virtually all employees of multi-national corporations, a strong selling point that smaller rivals cannot claim. ADP’s size gives it the ability to better serve the largest multi-national companies in a way that reduces the complexity of their operations by having only one payroll provider globally.

ADP operates in an industry that is both rapidly changing due to advancing technology, yet somewhat stable due to the unchanging need for human resources, government compliance, and tax help for both small and large businesses. The human resources, payroll, and tax help industry is similar to the insurance industry in that it provides a service that will always be in demand as long as governments are around (which will probably be a long, long time) while benefitting from technological progress which has made gathering, sharing, and analyzing information easier than ever. This change enhances the services of the human resources industry without causing the industry to go obsolete.

Growth Prospects

Despite the slow economic recovery in the developed world, ADP is growing quickly. Thee company experienced 8% revenue growth for fiscal 2014, nearly all of which was organic. Guidance in 2015 is 7% to 8% revenue growth. The company is seeing even faster growth from its PEO services division, which is expected to grow 13% to 15% for the company’s fiscal 2015. Overall, ADP is expecting to grow earnings per share 11% to 13% for its fiscal 2015 not counting share buybacks or one-time expenses associated with its recently completed spin-off. Including share repurchases, I expect earnings per share growth 1% higher than the company’s forecast for full fiscal 2015, which is 12% to 14% earnings per share growth per share.

ADP’s growth is being driven by its new improved service offerings. The company’s new cloud services platform has been well received by its customers. The company has successfully migrated 430,000 customers over to its cloud based services. In addition, ADP doubled the amount of people using its Mobile Solutions App to 2.5 million. The company has also expanded its help and customer services hours, and offers 24x7 service for many of its product offerings. The result of the company’s focus on serving customers more efficiently and when they need help has boosted ADP’s retention rates, which are critical for long-term growth of recurring revenue businesses. ADP’s retention rate for fiscal 2014 was 91.4%, an all time high for the company.

The company’s future growth prospects look very favorable going forward. In 2015, ADP is rolling out new solutions to help customers handle integration of the Affordable Care Act in the US. ADP is in a unique position in that it benefits from increased government regulation, and especially complex government regulation. When small and large businesses feel they cannot keep up with the regulatory burden of payroll taxes and government compliance in general, they will turn to an outsourced payroll provider like ADP. The long-term trend throughout the world is for governments to grow in both size and complexity, which will in turn drive future growth for ADP around the world.

Dividend Analysis

ADP currently has a payout ratio of 62% and a dividend yield of 2.64%. ADP targets a payout ratio of 55% to 60%. As a result, dividends are expected to grow slower than earnings over the next 2 years as the company’s payout ratio falls to be in line with its target. I expect 12% to 14% earnings per share growth for fiscal 2015 (as discussed in the growth section above), and earnings per share growth of at least 7% in fiscal 2016. The 7% growth number for 2016 is conservative and in line with the company’s revenue per share growth over the last decade. If the company grows as expected and reduces its payout ratio to 60% by the end of fiscal 2015, and then to 58% (near the mid range of its target payout ratio), it will have the following earnings and dividends:

- Fiscal 2015: EPS of $3.51, dividends per share of $2.11, payout ratio of 60%

- Fiscal 2016: EPS of $3.76, dividends per share of $2.18, payout ratio of 58%

Under this scenario, the company will grow dividends per share at about 6.6% a year while hitting its target payout ratio. After this, I would expect dividends to grow at overall company growth which will likely be around 7% based on historical growth.

Valuation

ADP currently has a PE ratio of 23.3, well above the S&P500’s PE ratio of 18.5. The company is a high quality business with a long history of rewarding share holders and strong growth prospects going forward. As a result, it should trade at a premium to the S&P500. Over the last decade, ADP has traded at an average of 1.23x the S&P500’s PE ratio. This works out to the following ratios for ADP:

- PE of 22.8 at current market levels

- PE of 18.5 if market falls to historical average PE ratio of about 15

ADP is trading about in line with its historical premium over the market at current prices. Like most stocks, it is trading at a premium over its long-term historical fair value due to the overvalued status of the market in general.

Recession Performance

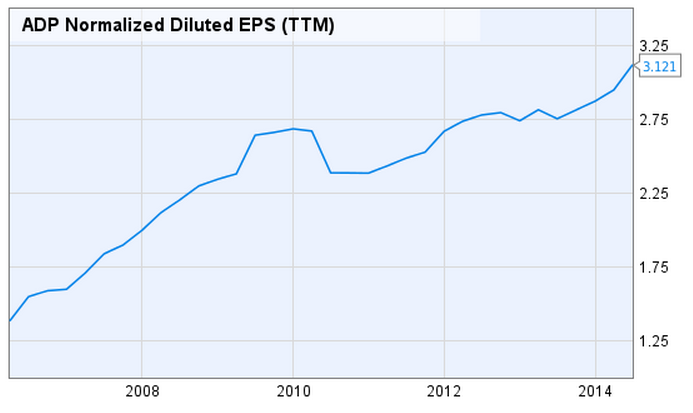

ADP performed very well during the recession of 2007 to 2009. Despite economic downturns, businesses still must pay employees and keep up with government regulation. As a result, ADP is fairly well insulated from the effects of recessions. The company also has an extremely solid balance sheet with virtually no long-term debt and a very safe amount of cash and market securities on hand. ADP’s revenue per share and earnings per share increased each year from 2007 to 2009, throughout the recession. The copmany’s long-term earnings per share are shown in the image below:

Source: Ycharts

Final Thoughts

ADP is a high quality dividend aristocrat that has solid historical growth and good future growth prospects. The company is the dominant player in the payroll and human resources industry and offers shareholders safety due to its competitive advantages and conservative balance sheet. The downside to the company is that it appears to be somewhat overvalued at this time. As a result, it is ranked 43rd out of 132 businesses with 25+ years of dividend payments without a reduction using the 8 Rules of Dividend Investing.

Disclosure: I am not long any of the stocks mentioned in this article