Despite Concerns Over The Possibility Of A Trade War, The Global Expansion Continues To Strengthen

“The global economy has continued to move forward with what has been, so far, a synchronized global economic expansion with few notable exceptions, i.e., Venezuela. While reflecting the improvement in global economic growth, more and more central banks in the developed world are starting to follow the U.S. Federal Reserve in raising interest rates.” (Wells Fargo Global Outlook, April 11, 2018)

At Least Temporarily, Try To Put Aside The Possibility Of A Trade War

It is virtually impossible to ignore the heightened tensions related to the possibility of a trade war and the myriad of risks associated with a volatile Trump Presidency.

Indeed, if the trade outcomes are dire, the impacts will be felt around the world and of course on virtually every kind of investment. No wonder that the public and many governments are anxious.

After all, the two largest economies in the world, the U.S., and China, are battling over trade issues. If one expects that the trade fight will be prolonged, it would potentially affect the rest of the global economy. However, it is still expected (or hoped) that a global trade war is unlikely.

Fortunately, there is a glimmer of hope that from Canada’s perspective the NAFTA negotiations may be settled. It may be possible for the Trump Administration to settle for a perceived win on NAFTA that the Canadian government could accept. From the power dynamic in negotiations, however, China will be less a pushover on its trade interests than Canada and Mexico.

The Goldilocks Global Economic Outlook Should Continue

If one could comfortably set aside the trade war risk, the outlook for the global economic economy continues to be very strong.

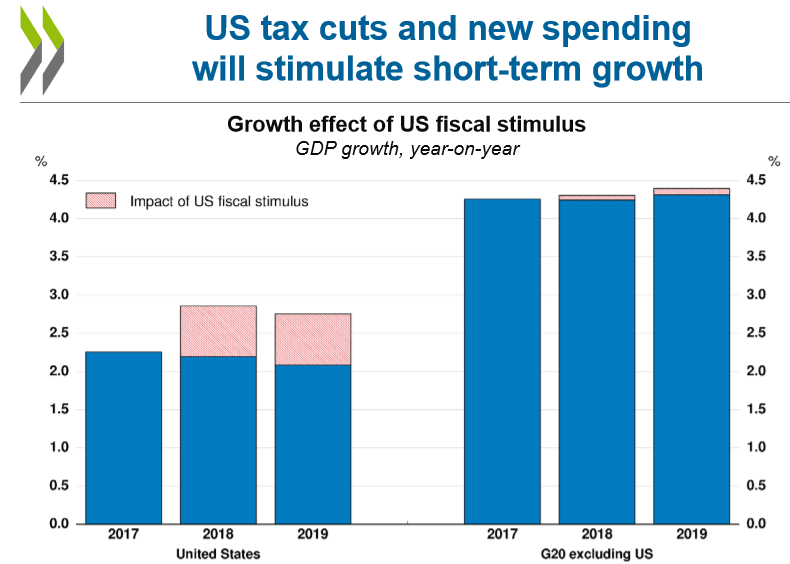

In broad macroeconomic terms, fiscal policy among the advanced economies has been providing considerable support to economic growth. This is particularly the case in the U.S, where there was a huge tax cut as well as substantial increases government spending. (The Committee for a Responsible Federal Budget estimated that the tax cut alone would cost roughly $2.2 trillion over 10 years.) Of course, this unbelievably strong fiscal boost is being imposed on an economy which is almost fully employed, and which is growing quite well.

Another important policy development is the plan by the major central banks to dial back on their monetary stimulus. Quantitative monetary tightening began in the U.S. last year and will spread to the Bank of England and the European Central Bank. Nonetheless, the shift to reduced monetary accommodation will be gradual, and on balance, central bank interest rates will still be quite low this year and in 2019.

Because of the continued global expansion and the new potential monetary policy “convergence”, the U.S. dollar has been weakening. The extent of further U.S. dollar weakening really will depend upon interest rates and the degree of monetary policy adjustments in Europe.

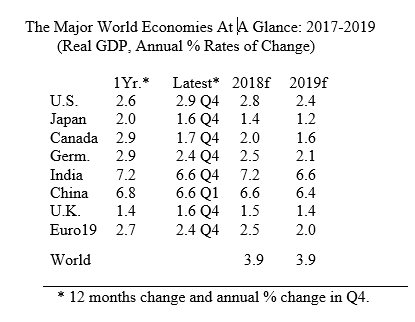

Returning to the recently improved global outlook, world GDP is expected to increase 3.9% in both 2018 and in 2019 from an estimated 3.7% growth in 2017.

The recent speed up in the world economy has increased international trade and has lifted commodity prices, particularly in the energy sector.

According to a recent Scotia Bank report (April 11th), improved global growth should support an average WTI oil price this year of about US$65 per barrel, nearly US$15 per barrel higher than last year’s prices.

As for the outlook for the major economies, Canada’s economy is on a relatively slow, but stable growth trajectory of 2% in 2018 and 1.6% in 2019.

In the U.S. the two main economic policy instruments are operating somewhat in opposition, but the size of the fiscal stimulus is so large that GDP growth is expected to increase to 2.8% in 2018 and 2.4% in 2019.

The Euro Zone economies are expected to record 2.5% growth this year and 2% in 2019. Once again, India and China are expected to be the fastest growing large economies, with India once again growing slightly faster than China’s economy this year (7.2% versus 6.6%).

The following chart simply highlights the importance of the Republican/Trump fiscal boost to the U.S. and other economies.

Despite the massive size of the fiscal boost, it still only provides about one half of a percentage point of extra GDP growth the U.S. economy is 2018 and 2019. Of course, there is also a slight positive spillover effect into the growth rates of the other advanced economies.

Source: OECD World Economic Forecast (March 2018)

What Could Go Wrong With The Goldilocks Global Growth Scenario?

Economic history suggests that economic expansions do not die of old age; they tend to by cut off by policy blunders or exogenous shocks.

In other words, recessions are typically preceded by an accumulation of excesses within the economy, which then entices consumers, businesses, and policymakers to suddenly become more risk-averse. However, the unusually slow pace of the current U.S. economic recovery has left the economy in pretty good shape.

On the exogenous shock front, this writer does not feel that trade issues and irritants will turn out to be a serious exogenous shock.

In other words, the absence of any major distortions in the U.S. economy suggests that the expansion is healthy and that a near-term recession is rather unlikely.

Inflation and interest rates continue to be low, consumers are not overleveraged, corporate balance sheets are in decent shape, commodity prices have rebounded, and global growth has been improving.

All of this suggests that the slow but steady U.S. economic growth projections of 2.8% for 2018 and 2.4% in 2019 seem appropriate.

Disclosure: None.

Agreed that a recession isn't in the cards this year. Inflation is also showing up which is opposite of a recession unless it gets out of hand.