Dereliction: They All Had One Job

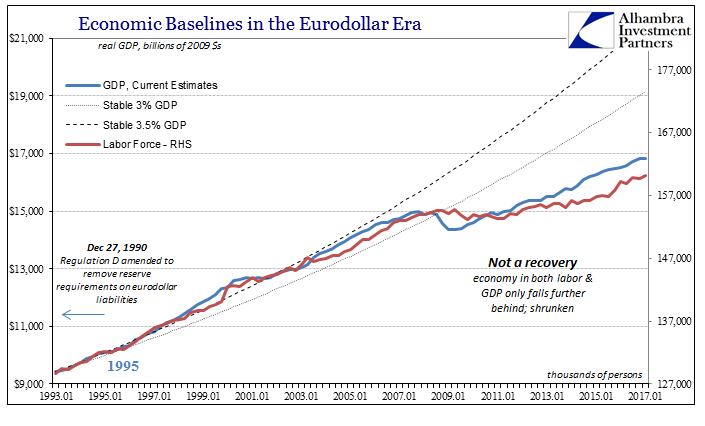

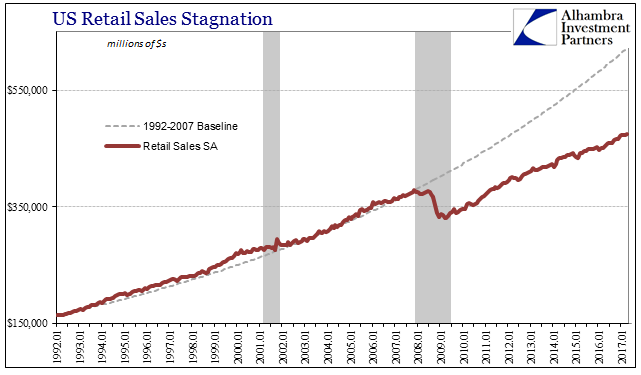

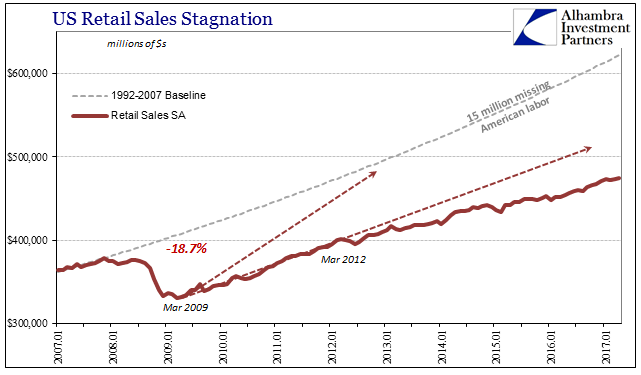

What is truly frustrating is that only now is the world trying to come to terms with the last ten years, and only because it ignored the major, seismic developments over the preceding forty. It’s not a question of too little, too late, it’s more so that after being bludgeoned with failure there are no leaps of intuition, merely baby steps that would have been mildly helpful in 2008 are now more haranguing than anything. You see it often in academia, where some sheltered scholar makes what he or she thinks is an earth-shattering discovery only to be graded with a dismissive “you didn’t know that before?”

The Bank for International Settlements (BIS) has gone in the direction of the actual “dollar” system for some time, but never manages to quite get there. I can’t figure if it is legacy ideology or the sometime shaky politics of the place, but for whatever reason when you start to think that they are on the cusp of figuring out something they fall back to the safe, orthodox, uninsightful baseline.

Practically no one remembers the monkey business in gold back in July 2010, of the few who might have been aware it had even happened. Summer 2010 wasn’t just some calm meadow in the woods, it was maelstrom all its own merely dwarfed by what came immediately before and what followed immediately after. Had the events of the middle of that year occurred in isolation they would have been burned into our collective memory, studied at great lengths throughout history.

The flash crash of May 2010 was the actually the least impressive part of it. The global “dollar” system was supposed to have been healed, or at least most of the way by then, after all QE1 had at the end of March 2010 expired. Greece had other ideas, which is to say the “dollar” system hadn’t been restored so that what should have been a little nothing became almost everything.

By July, the ECB was rescuing European banks who were thus beset by “dollar” difficulties all over again. In stepped the BIS with a gold swap of 346 tons; TONS. Their counterparty? Ten European banks that included some of the big ones: HSBC, BNP Paribas, and Société Générale; just the sort of names that would be repeated throughout the next few years for all the wrong reasons.

Nobody could quite figure out what the BIS was doing, for gold swaps were rare and never between it and commercial banks in any jurisdiction. The whole swap arrangement was meant for central banks, historically as nothing more than a more efficient arrangement to move gold without having to physically move it from place to place (good delivery standards were different in different places, therefore rather than moving bars from London to Paris, for example, and have to re-essay them upon arrival Banque de France could swap some of its Paris delivery gold so that London delivery gold needn’t be transported and changed). But just as you can figure out an unknown word by the context of the passage it is contained within, you can likewise surmise the general intent here by the monetary context of the summer of 2010.

I wrote about this more than four years ago as an instructive example to better understand the then ongoing gold slam and what it meant about “dollar” conditions in 2013, 2010, or 2017:

In the case of the large gold swap in 2010, the commercial banks accessed dollar liquidity “off-market” since the BIS simply held the bullion in its custody. Being accustomed to holding physical gold, it did have $23 billion, about 1,200 tons already on account, meant no additional hassle. The BIS surely incurred storage and administrative costs, but they would easily be absorbed by the interest rate the banks would pay on this collateralized loan (essentially the gold swap in this case amounted to a dollar denominated loan with gold bullion held as collateral by the BIS).

In fact, the use of gold would become something of a “thing” throughout that year right on into the next, as the Financial Times reported in December 2011:

Gold dealers said that banks – primarily based in France and Italy – had been actively lending gold in the market in exchange for dollars in the past week.

You wouldn’t have needed a flash crash in stocks, just these outliers in gold to know that “something” was wrong with “dollars” even after one QE (as in July 2010) or two (as in December 2011). But orthodox economics does not recognize anything but individual systems separated by more than just geography. It didn’t matter the dollar swaps the Fed put on to nearly $600 billion in late 2008, the dollar was to them domestic and little more.

Thus, in August 2011, Fed policymakers were aghast at having to face the prospects of another liquidity crisis just two years after the largest one since the Great Depression; and being totally unable to make any sense of it. The reality was then and is now quite simple, meaning that it all occurred in these cracks beyond the scope of recognized monetary economics, these offshore places way off in the shadows where nobody bothers to look because they have no idea all this is going on out there.

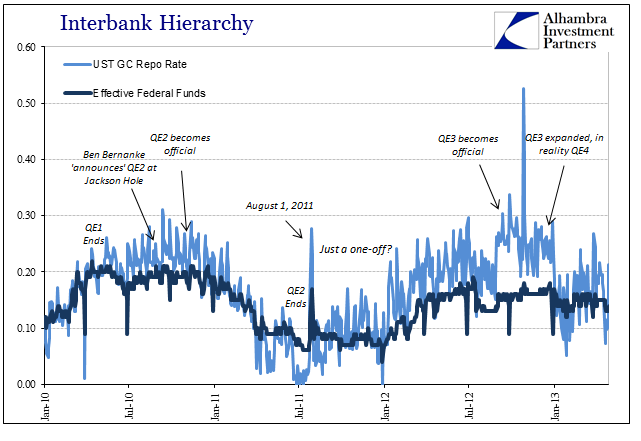

It wasn’t as if domestic monetary conditions were the height of bliss; after creating $1.6 trillion in bank reserves through two QE’s, the Fed, as I have discussed before, was actually debating a repo market bailout by August 2011. Stunned as they were over the possibility, they deliberated it because it was real in a way those $1.6 trillion in bank reserves clearly were not.

MR. ENGLISH. With the funds rate up only a few basis points over the same period, a natural question is whether the repo rate has idiosyncratically diverged from the overall constellation of money market rates or whether it is a symptom of broad dislocations in money markets that could interfere with the transmission of the Committee’s intended monetary policy stance.

You can see the mistake in just this one quotation; “that could interfere with the transmission of the Committee’s intended monetary policy stance.” How about instead a “symptom of broad dislocations in money markets that could” screw up the whole global economy for good? Repo and gold; 2010 and 2011; onshore and offshore.

Where was the BIS in all this? Were they not in communication with Fed officials, giving them at least a heads up that they were attempting off-the-books (or at least undisclosed) dollar programs with European banks despite QE1? I can imagine two scenarios, neither of which reflect well on anyone. First, the BIS could have called up Ben Bernanke to warn him about what they were doing with gold, which had to have been something like a last resort kind of thing for them, and him laughing back at them, mumbling something about a trillion in bank reserves and dollar swaps. The second is merely that the BIS didn’t really know what it had on its hands in 2010, and simply ignored it like the rest of them.

We do know that it never made it to the official policy level in the US, however it may have potentially been discussed unofficially in the course of either Fed or BIS business. The FOMC transcripts record nothing of the BIS or gold, just the usual sustained mass confusion.

So it is quite frustrating that the BIS last month publishes a couple of papers (thanks to T. Tateo), the first that might have done some good in April 2007 rather than April 2017 if only to prevent Bernanke from playing the subprime-is-contained fool a second time (he said it originally in March 2007).

Behind the financial channel of exchange rates is a dense matrix of financial claims in dollars. The global economy is a matrix, not a collection of islands, and the matrix does not respect geography. A European bank lending dollars to an Asian borrower by drawing dollars from a US money market fund has its liabilities in New York and assets in Asia, but headquarters in London or Paris.

Forgive my language, but no shit. The only way that passage would have been even close to acceptable was if it was prefaced by something like, “There is absolutely no excuse for that we should have known this thirty years ago, but we now realize…”

The other, though, is even worse.

Underneath the relative stability in headline measures of activity and pricing, there are signs of banks being less willing to undertake repo market intermediation, compared to the period before the crisis. The volatility in prices and volumes around balance sheet reporting dates can be associated with banks in some jurisdictions contracting their repo exposure in order to “window dress” their regulatory ratios.

I could launch a different profanity here, as the reasons the BIS authors give for this (way too late) assessment of the repo market is the same garbage as you will find anywhere else.

The report identifies several drivers behind these changes including exceptionally accommodative monetary policy, which provided ample central bank liquidity to the market and reduced the need for banks to trade reserves through the repo market, and changes in regulation, which have made intermediation more costly in terms of regulatory capital.

Is it really so difficult to connect these dots? The BIS practically lived them more than anyone else, and yet this is what they come up with? Do they really believe this? Repo and gold; 2010 and 2011; onshore and offshore. Nah, it’s just regulations and “ample central bank liquidity.”

What’s missing in these academic reviews is that context. They assess repo without connecting it to the conditions under which their review took place. It’s as if the gold swap in July 2010 was treated as a gold swap taking place in July 1990; or repo problems in 2011 were the same as repo problems in 2001 (which were considerable but for vastly different reasons). Maybe it is the orthodox devotion to randomness that prevents all the dot connecting, because if you treat today as totally unrelated to yesterday when that is just not reality I suppose you will go through life thinking you are making great discoveries that turn out to be far less impressive outside of the bubble.

The central banks of the world had one job to do, even though they gave themselves other tasks along the way. For its part, the BIS had also one job which involved helping central banks get their job correct. What did happen was criminal, as they all fell in love instead with those other tasks, running these separate economies, or so they thought, at the direct expense of their one job. When it came time to do that job, they were so unprepared that the last decade, which twenty years ago would have sounded insane, actually happened. Maybe there is an excuse about 2008, coming at them too fast, but there is no excuse whatsoever for all that afterward. April 2017 is far, far too late to be finally realizing the obvious and then trivializing it as still nothing.

Disclosure: This material has been distributed fo or informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any ...

more