Danger Zone: Why The Tech Sector Is A Bad Investment

Tech sector ETF providers and mutual fund managers are in the Danger Zone this week.

High Cost and Poor Holdings = Bad Deal

Investors need to tread carefully in the Tech sector for two reasons:

- Managers do a poor job of picking stocks.

- Fund costs are misleading.

Plenty of Good Stocks Are Missed

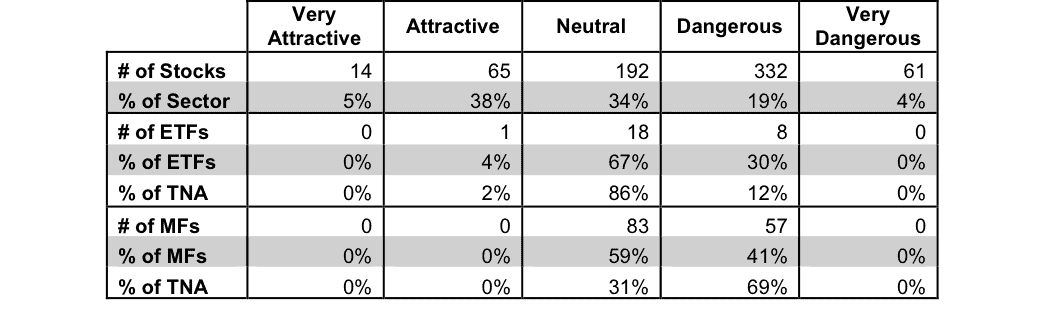

Figure 1 juxtaposes the number of Attractive stocks in the sector with the Portfolio Management Ratings of the ETFs and mutual funds in the sector.

Figure 1: Tech Sector: Comparing Quality of Stock Picking to Quality of Stocks Available

* Best ETFs exclude ETFs with TNAs less than $100 million for inadequate liquidity.

Sources: New Constructs, LLC and company filings

There are 79 Attractive-or-better rated Tech stocks, which comprise 43% of the market cap of the sector. ETF providers and mutual fund managers should have a relatively easy time offering investors baskets of good stocks. But, they do not.

As seen in Figure 1, only one ETF and zero mutual funds earn an Attractive-or-better Portfolio Management Rating.

Over 30% of ETFs and 41% of mutual funds in the sector earn a Dangerous-or-worse Portfolio Management Rating. ETF providers and mutual fund managers are over-allocating to the worst stocks in the sector.

Misleading Expense Ratios

In addition to the poor stock picking of Tech fund managers, these managers tend to charge investors more than managers in other sectors even though they advertise low expense ratios.

Overall, the Tech sector is the most expensive of the 10 sectors according to my Total Annual Costs (TAC) Rating. With a weighted average TAC of 1.27%, its funds are more than twice as expensive as those in the Consumer Discretionary, Consumer Staples, Industrials, and Materials sectors.

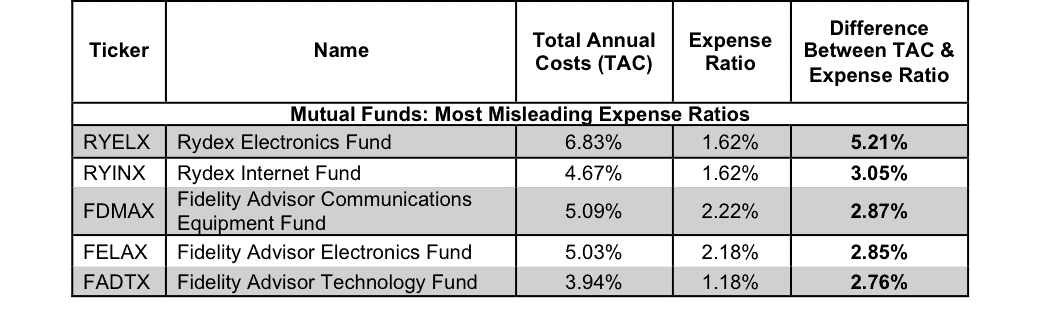

Figure 2 displays the Tech sector mutual funds with the greatest disparities between their Total Annual Costs and expense ratios.

Figure 2: Funds With the Most Misleading Expense Ratios

* Best ETFs exclude ETFs with TNAs less than $100 million for inadequate liquidity.

Sources: New Constructs, LLC and company filings

Rydex Electronics Fund (RYELX) is the Tech mutual fund with the greatest disparity between its expense ratio and its Total Annual Costs, and the second-greatest disparity amongst all sector mutual funds. RYELX’s Total Annual Costs are a startling 5.21 percentage points above its stated expense ratio of just 1.62%. This 5.21% compounds to over 66% in 10 years.

RYELX earns my Very Dangerous overall predictive rating because of its extremely high Total Annual Costs. No matter its holdings, RYELX’s costs will make it difficult for it to earn a better return than a less-expensive fund.

Tech ETFs are also some of the worst offenders when it comes to providing misleading costs. The expense ratios of Tech ETFs understate their true costs by an average of 0.06 percentage points, more than any other sector.

Chasing Short-Term Performance Leads to Disaster in this Sector

Despite the abundance of strong Tech stocks, many ETF providers and mutual fund managers have been chasing short-term returns and have allocated to expensive momentum stocks, for example Netflix (NFLX). The company’s negative free cash flow for each of the past three years is one of many red flags. Netflix’s slowing growth and ballooning content library costs spelled trouble for the company’s stock. I predicted that these factors would lead the stock to drop on an increasingly likely earnings miss. That prediction proved true when the stock tanked 20% on October 16 after disappointing earnings.

So What Have We Learned?

1) Tech sector fund managers are choosing many of the worst stocks in the sector, and 2) They are paid more to do so than managers in any other sector. Simply buying a basket of the many Attractive Tech stocks would allow investors to avoid paying undeserved fees to Tech sector fund managers.

more