Daily Market Commentary: S&P Possible 'Bull Trap'

It's perhaps a bit of a reach, but the S&P closed below key 1,987 support in what could turn into a 'bull trap'. What makes the 'bull trap' a tenuous conclusion is the 3 day decline required to get it there. Also, the index hasn't yet tested its 50-day MA, this should be an area of demand. Technicals are developing bearish, but are not net bearish. Bulls will have another opportunity at the 50-day MA which could see a test tomorrow.

The Nasdaq closed at the low of the day, but not before it attempted an intraday rally. The rally came before a test of support, a support level which will fast see the 50-day MA coming to help.

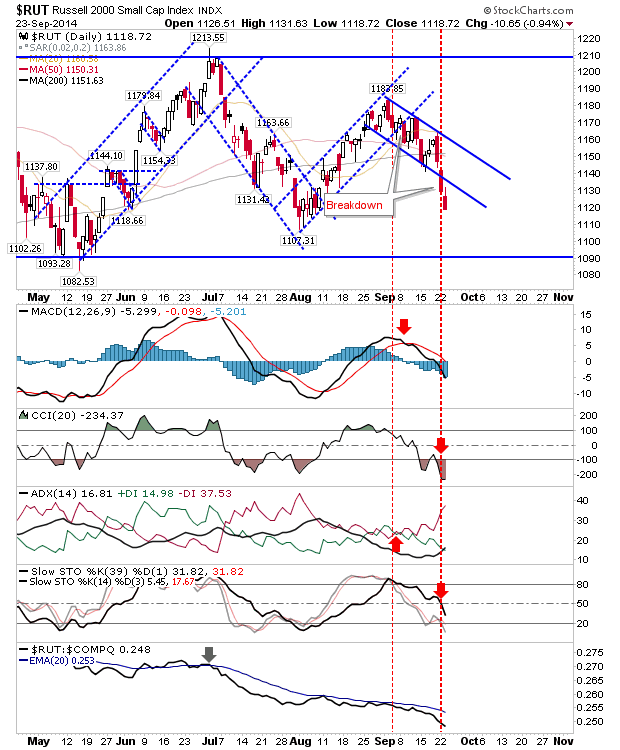

The Russell 2000, which suffered the most yesterday, took another hard hit today. As a canary-in-the-mine it's not an omen of good fortune, but until it breaks below 1,090 support there is little more to add.

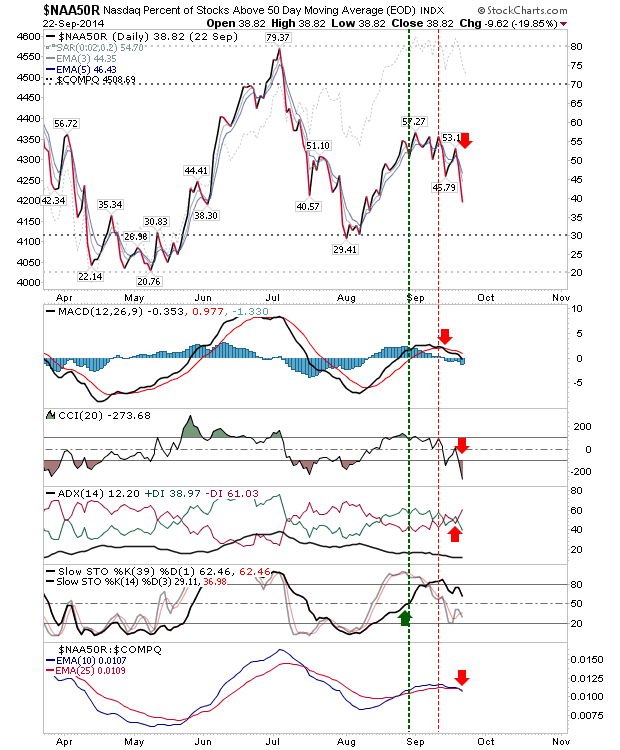

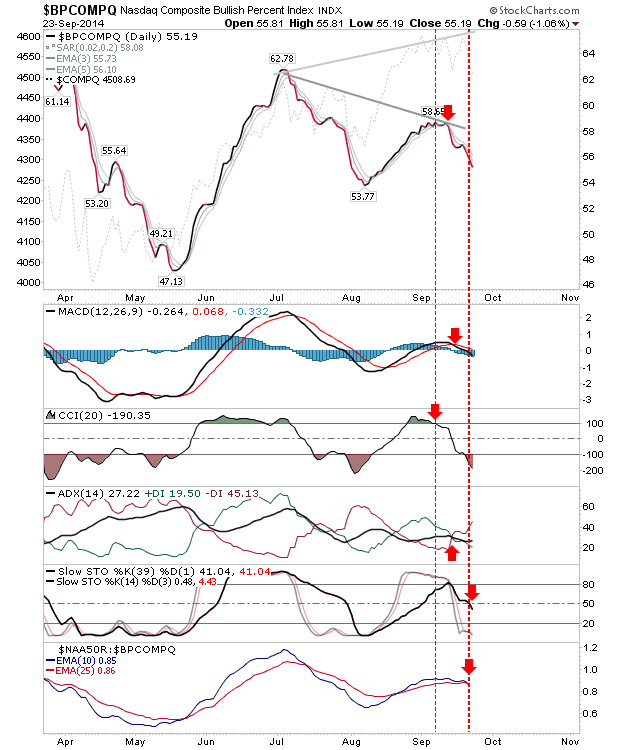

Nasdaq breadth is showing a strong bearish divergence, but is not oversold.

For tomorrow, bulls will get another shot, although cagey longs would be best to wait for 'bull traps' to reverse or successful moving average tests to happen before committing.

Disclosure: None.

The real thing to look at is interest rates. I advised a person today to wait putting more money into term bonds because rates keep rising regardless of the fact there is little to support a improving economy and signals that are pointing to quite the opposite.

Be cautious from here on out. The smart money is increasingly turning toward cash while exiting real estate bonds, the stock market, and commodities.