Daily Market Commentary: Sixth Day Of Gains For S&P

The S&P banked another gain while the Dow touched resistance. Percentage gains in the Russell 2000 and Nasdaq were greater than the Dow and S&P, but the outlook for the latter indices looks better.

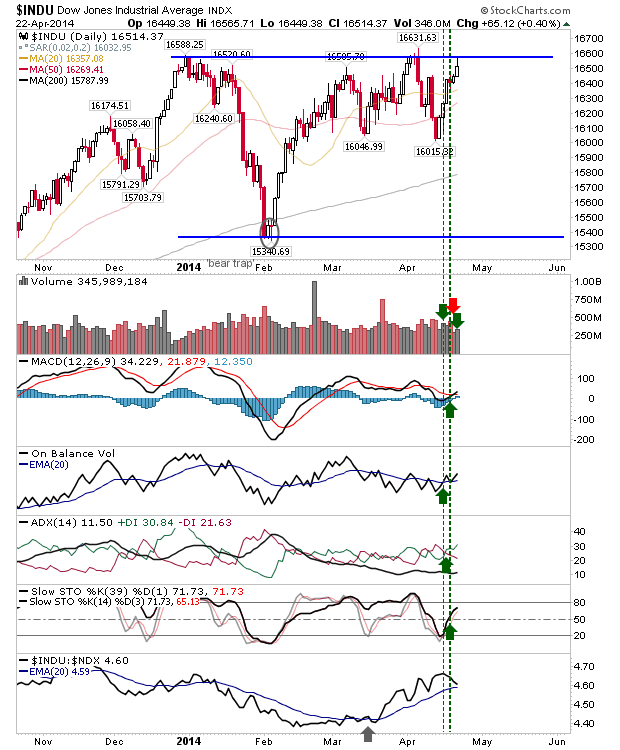

The Dow is nicely positioned to break upside, perhaps by the end of the week. Tuesday registered as an accumulation day, marking good demand from buyers. Bears may try to push their luck tomorrow, but the close proximity of 20-day and 50-day MAs makes any selloff unlikely to hold.

The S&P didn't push resistance, but did register an accumulation day. The S&P also has converging 20-day and 50-day MAs to lend support. It's not as strong as the Dow, but bulls won't care.

The Nasdaq maintained its run of good form, closing above its 20-day MA, but is well away from its 50-day MA.

Nasdaq Breadth is indicating a swing low, but not a major swing low. Technicals haven't confirmed, but given the relative position of supporting indicators it may yet be a few days before they do.

Also helping the Nasdaq is the semiconductor index. Its rally has take it above both 20-day and 50-day MAs, but hasn't yet approached the last swing high. One to watch.

Tomorrow may see some downside as a lengthy sequence of gains finally comes unstuck, but it looks like the S&P and Dow will see new all-time highs sooner rather than later.

None.