Cycling Blindly In Chartland

Wall Street's beer-goggle induced complacency is not simply a matter of eager-beaver optimism or an excessively short-term focus on the meme of the day. It is exhibit #1, in fact, of the profound intellectual mendacity, sloth and downright corruption that has accompanied the Fed's destructive regime of monetary central planning.

Needless to say, the latter has thoroughly falsified financial asset prices and obliterated the processes of honest price discovery. Accordingly, the daily financial narrative has become a dumbed-down derivative---meaning that it merely attaches fleeting headlines and transient talking points to whatever the day traders and robo-machines are doing at the moment.

Between the March 2009 bottom and the January 2018 peak, of course, they were essentially buying the dips----about 50 of them with material dimension. The short-run narrative constantly changed--- low-interest rates, escape velocity ahead, synchronous global reflation, Goldilocks once more----but the mechanic was always the same.

But all bubbles come to an end and this one, too, is now laboring heavily to stay afloat. So right now, the machines and day-traders are whip-sawing furiously between the 50-DMA (resistance) and 200-DMA (support) trend lines on the trading charts.

As is evident, ever since the failed levitation that peaked on January 26 at 2873 on the S&P 500, its been practically an odd and even day cycling motion between the DMAs.

Today the machines had all the purposefulness of a moth heading toward a light bulb. That is to say, they were heading straight for the 50-DMA at 2689 on the chart below, but, alas, faltered in the last hour--the better for the night-shift machines to make another run at it in the wee hours.

Under the circumstances, of course, that particular chart point is ludicrous. It represents 23.4X earnings for the March 2018 LTM period at a point when the current aging business cycle is fixing to roll-over; earnings are being boosted by a one-time change in corporate tax rates; and the coming bond market "yield shock" has just begun to show its ugly head as the 10-year UST pokes above the 3.00% red line.

As we have repeatedly pointed out, a good part of how earnings got to an estimated $116 per share during the current LTM period is that companies borrowed hand-over-fist to buy back stock and to buy out each other. That had the effect of shrinking share count today and thereby artificially fattening earnings per share.

But it also exposed corporate balance sheets to unprecedented debt loads, which nearly doubled since the 2007 pre-crisis peak, and to soaring interest expense as rates normalize and Washington's own debt-a-thon rages.

Accordingly, we estimate that even if the 10-year benchmark manages to stay below 3.75%----and we think it's going far above that----the S&P 500 companies will face $35 per share of higher after-tax interest expense.

On a pro forma basis, therefore, current LTM earnings would be more like $82 per share in an interest-normalized world. That means the 50-DMA represents 33X normalized earnings.

And that's, well, about as abnormal as it gets.

(Click on image to enlarge)

To be sure, the above is all just the noise of robo-traders cycling in a steadily narrowing channel. It's also why our opening proposition is so on point.

To wit, the dumbed-down narrative rationalizing the above irrationality is now devoid of any content except that momentum is its own virtue: Buy the market because Q1 earnings are going up by double digits---even if that blip is artificial, the outcome of a four year-round trip that amounts to only $10 per share and is completely unsustainable unless the business cycle is outlawed soon.

Beyond that, all contact with the real fundamentals has been lost. Indeed, today's derivative narrative is so thin that even Bob Pisani struggles to keep a straight face on bubblevision.

We were reminded of the uselessness of the Wall Street narrative again this AM when GM reported absolutely lousy Q1 numbers, but was still credited with a headline "beat" by the servo-bots of the financial press. As CNBC's robo-writer put it: "General Motors tops estimates on strong sales of crossovers."

The truth was more nearly the opposite as Dave Kranzler of Investment Research Dynamics was quick to point out:

Revenues dropped 3.2% year over year in Q1. Revenues would have been worse but GM joined the rest of the country and extended financing to future deadbeats who took out loans greater than their annual pre-tax income in order to buy a pick-up truck. In other words, GM’s financing unit generated 25% growth in revenues, which cushioned drop in GM’s automotive revenues. Operating income fell off a cliff, plunging nearly 80% vs, last year....

...... Only in America can a company’s operating numbers go down the drain and yet still be credited with a headline GAAP-manipulated net income “beat.” I find much humor in this absurdity. Others might find it, upon close examination, to be pathetic or even tragic.

We'd go with pathetic---especially when the premier auto forecasting firm, J.D. Power, is projecting April sales to be down by 9% and that the SAAR will drop to just 16.6 million light vehicles (compared to a so-called "healthy" market of 18 million+).

And that's no one-month aberration. The debt-bloated auto retail sector was going down for the count last summer when it got rescued by massive replacement demand in the hurricane-devastated areas of Texas and Florida.

But the fundamentals of rising loan delinquencies, falling used car prices, increasing interest rates and record consumer rebate incentives could not be denied---just deferred. The apparent rein of Bastiat's "broken window fallacy" simple had a spectacular by short-lived interlude last fall.

So given the huge headwinds facing the auto industry as yet another debt-driven sales binge reaches its sell-by date, you'd think a transparently manipulated "beat" would be laughed out of court.

After all, it doesn't take much investigation to see that underneath this mountainous eruption of auto debt there is a nasty cycle of defaults brewing, and that if any company happily moved the metal to any borrower who could fog a rearview mirror, it was General Motors. Again.

The chart below is thus worth 100 "beats" because it begs an obvious question. To wit, since Q3 2010, US hourly wages have risen about 15%, but auto loans have soared by more than 60%----from $700 billion to $1.1 trillion.

So what happens when the carry cost of that debt rises sharply and soaring defaults cause auto credit to drastically tighten, as it always does?

The answer is worse than you think because on the margin much of this surge in auto debt was not financed by banks. Instead, it was advanced by a passel of newly minted auto finance companies who were unrestrained by bank regulators, but the recipients of a tsunami of yield-seeking investors.

As shown in the graph below, the subprime portion (26%) of the above debt mountain is overwhelmingly the product of finance companies (red line). And the latter overwhelmingly raised their capital from LBO shops (a thin equity layer), the junk bond market (mezzanine capital) and the auto loan securitization sector (senior debt).

Needless to say, there are two common denominators behind all three layers: (1) they were driven by the hunt for yield; and (2) they all operate on a mark-to-market basis and are supported by underlying investors which have nearly instant ability to sell the mutual fund shares and securitized paper on which the whole auto finance company edifice rests.

In other words, the auto financing market is vulnerable to exactly the kind of panic meltdown that afflicted the sub-prime mortgage sector last time around. It's a ticking time bomb that Wall Street is again blithely ignoring.

As Wolf Richter recently noticed, the edifice is already wobbling badly:

There are scores of these smaller specialized subprime auto lenders, some of them backed by private equity firms. And three of them - Summit Financial Corp, Spring Tree Lending, and Pelican Auto Finance - have now collapsed into bankruptcy or were shut down. Allegations of fraud and misrepresentations swirling through the bankruptcy filings.

There are scores of these smaller specialized subprime auto lenders, some of them backed by private equity firms. And three of them - Summit Financial Corp, Spring Tree Lending, and Pelican Auto Finance - have now collapsed into bankruptcy or were shut down. Allegations of fraud and misrepresentations swirling through the bankruptcy filings.

Needless to say, as the "yield shock" rolls into the total bond market, the junk sector is going to take a double-whammy. Benchmark rates will rise sharply, and the interest rate add-ons to cover loss provisions will soar even more.

In a word, the bottom 25% of the auto market is about to take a pounding. And it will spiral outward from there because even among more credit-worthy borrowers, falling used car prices (less loan collateral value) and reduced advance rates (which are at a 120% of higher in many instances) will sharply curtail credit availability.

At the same time that credit is about to succumb, the auto OEMs have again prolonged the cycle artificially by piling on customer incentives. J.D. Power is recently reported that the amount of rebate cash-on-the-hood has now reached an all-time record of $3,700 per vehicle.

Once again, therefore, the auto industry has goosed it sales via cheap loans and leases to any one ambulatory enough to visit a showroom; and, once again, it is also generating record delinquency rates for sub-prime auto credits.

Moreover, the auto sector is only a poster boy. The search for yield driven by ZIRP and QE infected every sector of the economy and the size and purpose of almost all financial transactions.

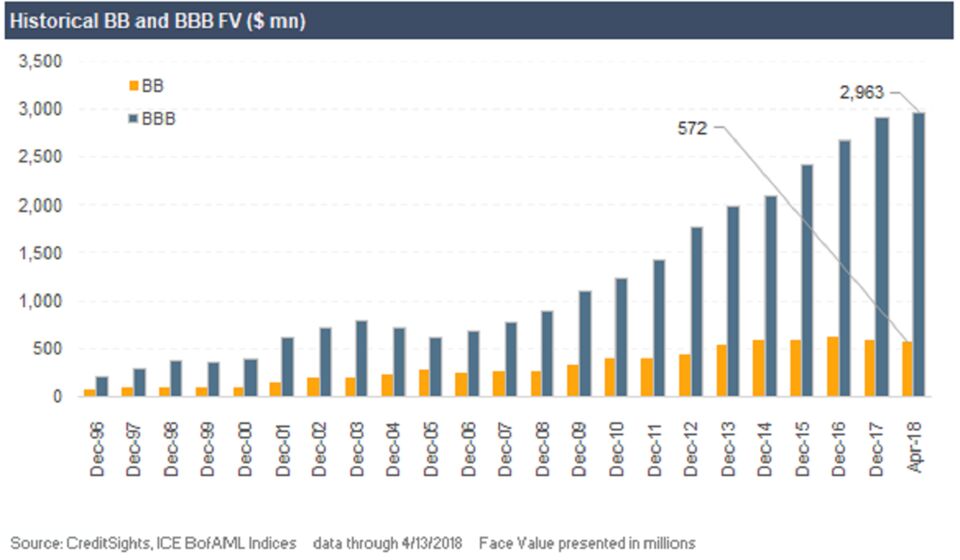

For instance, the record M&A binge of the last six years is a direct product of the 4X expansion of the BBB sector (lowest investment grade rating). In fact, these were the leveraged takeover bonds of choice that fueled the mega M&A deals, which in turn further shrunk the share count.

There were $800 billion of BBB bonds outstanding in December 2007---but today the number is a whopping $3 trillion. As Bloomberg noted,

The big push into the bottom end of high-grade bonds was driven by the search for yield amid record-low rates following the 2008 financial crisis and unprecedented stimulus from central banks. Investors who were comfortable in A-rated bonds moved to BBBs, and those who were comfortable in BBBs dipped into high yield, according to Lyons of CreditSights.

“What happens when that all retraces?” she said.

Good question!

(Click on image to enlarge)

The potential for turmoil ahead. for example, can be seen in the case of Teva Pharmaceutical Industries Ltd. The company's bonds were recently cut to junk from investment grade by Moody’s after its $41 billion buyout of Allergan's generics business in 2016 left the company with an unmanageable debt load.

Still, the next shoes are only beginning to fall. Tomorrow we will consider the case of the recently completed $700 billion junk bond placement by WeWorks.

With a $1 billion annual loss and an $18 billion portfolio of long-term building leases, it is the living epitome of Bubble Finance gone wild: It's 250,000 "desks" are 80% occupied by month-to-month renters who claim to be in the business of providing tech, financial and other services, but are mainly in the business of burning venture capital cash.

So this one's going to be some kind of bonfire.