Crypto Santa Rally

It's been the most expensive mid-term election in US history, voter turnout is expected to reach record highs, and yet, most analysts are thinking this will not have much impact on the financial markets.

Usually, during the year of a US mid-term election, the stocks rally. However, evidence suggests that this is less about the outcome of the vote than it is about presidential fiscal cycles.

During the 2nd year, the president will usually try to implement some sort of fiscal stimulus to carry them through to the next election. Trump however, introduced his ample stimulus package much earlier in his term, which is one of the reasons that some analysts are saying that prices have topped.

One thing's for sure, whatever the outcome is, markets will very quickly shift focus back to the Federal Reserve who will be meeting this Thursday, they're a much larger market player than Congress.

Today's Highlights

- Tech Divergence

- XRP Rocket

- Crypto Christmas Rally

Traditional Markets

Trading volumes have been thin across the board ahead of the Fed and the mid-term elections. This might continue as we get closer to each event. Thin liquidity often leads to abrupt price movements, so please be cautious.

Yesterday was kind of a weird one as a notable divergence emerged between tech stocks and the rest of the markets. Led by Apple, the tech-heavy Nasdaq index (white) saw declines as the S&P500 (green) ended positively.

(Click on image to enlarge)

As the equity markets figure out what's going on, let's shift over to crypto which is way more interesting at the moment.

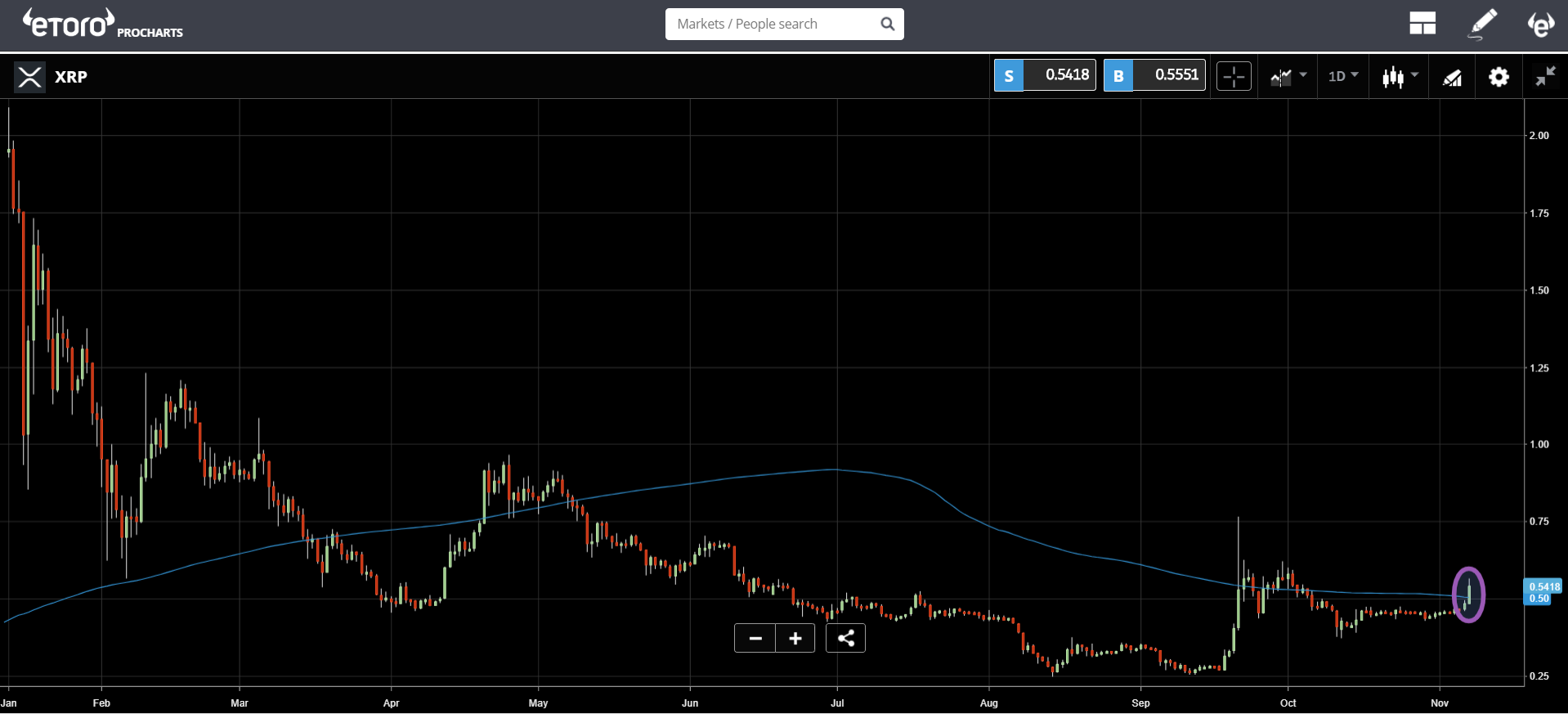

XRP Rocket

There haven't been any big-ticket news items I've noticed that would have pushed the XRP price up 15% in the last 24 hours, so we can only conclude that the move is more technical in nature, or that it's being caused by some large players buying in.

(Click on image to enlarge)

My best guess is that the Bitcoin Cash hard fork has sparked some sort of spillover into other cryptos. The XRP community is known for being closely in touch with short-term price movements, so it makes sense that the rally can be felt most strongly here.

Whatever the reason, XRP is now trading firmly above its 200 day moving average (blue line).

(Click on image to enlarge)

Crypto Christmas

Some stock analysts are saying that the Fed has stolen Christmas this year but it's very possible that the crypto markets are about to take it back.

In traditional markets, it's very common to see a stock rally leading up to the end of the year due to the increased activity in the private sector during the holidays. However, after a volatile October, combined with uncertainty surrounding Trump's trade war and the Fed's monetary policy, price action has been less than positive in the last few weeks.

It may be too early to say this, after all we've only seen very moderate crypto gains this week, but it is very possible that we might see a Santa Claus rally in the crypto markets.

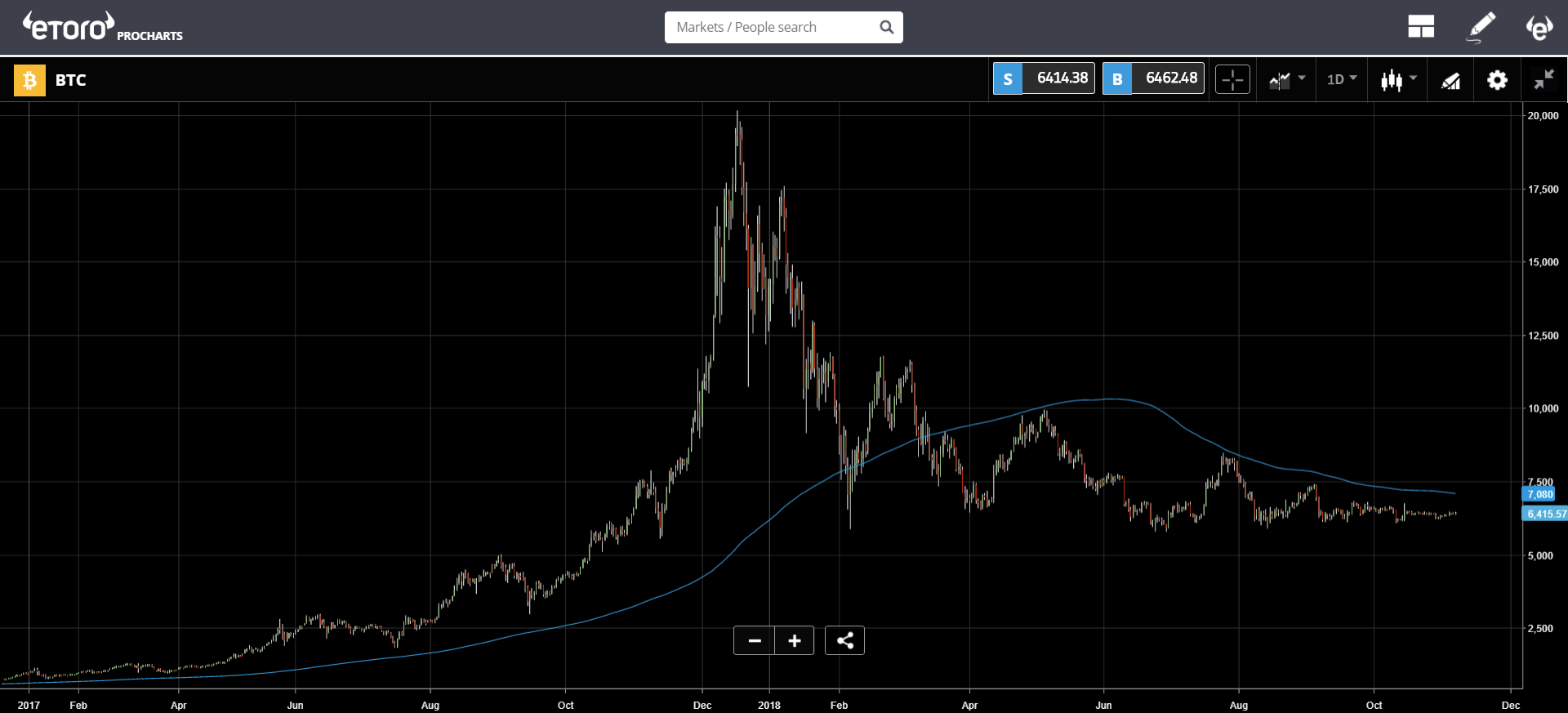

In addition to the XRP moves above, some chartists are now saying that Bitcoin's triangle has been broken to the upside. However, every technical analyst tends to draw their lines a bit differently.

For me, the only clear sign that the bear is gone and the bull is back would be a strong bitcoin breakout above the 200 day moving average, which is currently sitting at $7080.

(Click on image to enlarge)

Now, a movement of $665 from the current price to the blue line normally wouldn't be a big deal for the global currency, but given the inertia of late, it might take a bit more of a catalyst than a BCH hard fork to get the ball rolling.

Disclaimer: This content is for information and educational purposes only and should not be considered investment advice or an investment recommendation. Past performance is not an indication of ...

more