Crypto For Your Television

Please join me in welcoming the newest player in the crypto industry, the Wall Street Journal...

In this outstanding video, a WSJ reporter documents the process of creating a crypto-asset and faces some of the harsh realities of the industry.

Even though Steven struggled to find a use case for WSJ coin or even get it past the level-headed compliance officer at the paper and eventually had to shut it down, this type of documentation goes a long way to introducing this exciting new world to institutional investors.

Still, the WSJ is only dabbling here. Others in the blockchain space have already taken crypto journalism to a whole new level. Now, for real this time...

Today's Highlights

- Bond Signals

- Look in the Mirror

- Bitcoin Dollar Relationship

Traditional Markets

Everything started out alright, but by the afternoon of New York's trading session, there was a clear signal from the bond markets that everything is not alright.

Bond yields trade inversely to the price of the bond so a rising yield means that traders are selling.

The yield on the US 10 year shot up to the highest level since 2011!!

This makes it a bit more difficult to manage your risk score. Many traders on eToro and elsewhere like to keep a large amount of bonds in their portfolio in order to maintain a reasonable amount of risk but when the bonds are falling, even though they fall softly compared to other assets, it makes them more difficult to hold . Especially when the perception is that they could fall further.

Stock markets were also affected but to a much smaller degree. The main indexes managed to close relatively close to their all time highest levels. Watch them closely today though.

(Click on image to enlarge)

Bonds across Asia and Europe are having a terrible day...

Global bond yields just exploded

The US Dollar is also extending gains and is currently pushing the upper limits of its range, which is also destroying the EM currencies this morning.

(Click on image to enlarge)

Look in the mirror

Not to get too far down a rabbit hole here, just wanted to highlight the debate around crude oil, because it does seem to be impacting other markets.

So, here's the headline, notice that it's filed under the category "politics."

Putin Tells Trump to Blame Guy in the Mirror for High Oil Prices

Of course, I'd rather stay out of the politics but as long as this argument is waging, the price is surging. Crude oil is now trading above where it was when this happened...

The above headline from 2014 is circled on the chart below and incidentally marks the middle of the massive super range on crude oil from $30 to $120 that has been playing out over the last two decades.

(Click on image to enlarge)

Bitcoin Dollar Relationship

No ranting and raving from me today here. Just wanted to point out that a trend we've been tracking for the last few months may be changing.

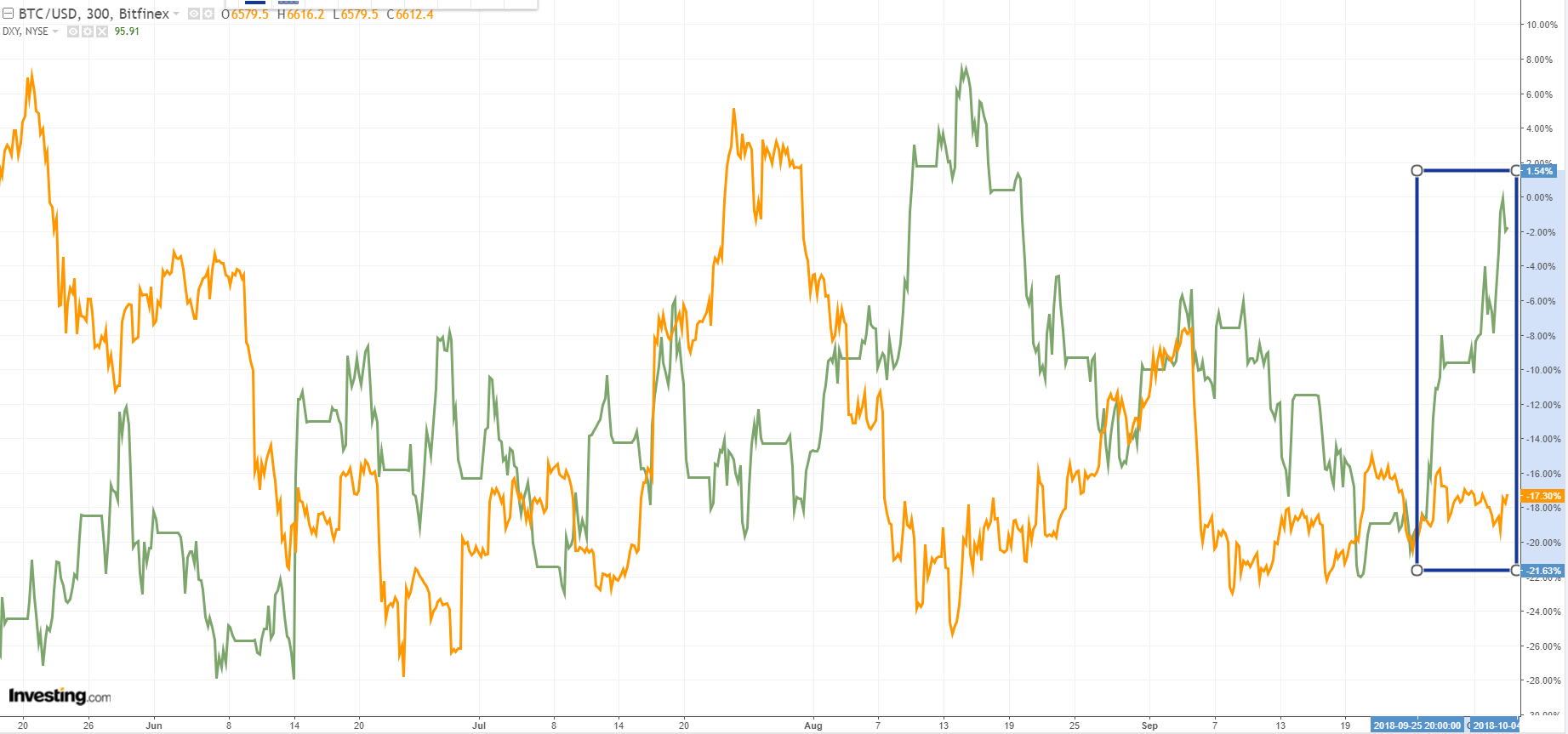

In this chart, we can see the reverse relationship between bitcoin and the US dollar that has been holding since mid-May...

(Click on image to enlarge)

...as we can clearly see, the USD has been on a rocket ride ever since September 25th. However, rather than selling off during this time bitcoin has remained relatively stable.

Notice how at the very end (last 48 hours or so), the Dollar has been giving another push to new highs (as indicated in the mid-section of this analysis above). During this time, bitcoin has made a strong push from the lows and is now travelling in the same direction as the USD.

Disclaimer: This content is for information and educational purposes only and should not be considered investment advice or an investment recommendation. Past performance is not an indication of ...

more