Tuesday, March 20, 2018 5:24 AM EDT

Crude oil prices marked time following Friday’s somewhat mysterious upward push. Aggressive risk aversion and JODI data showing Saudi exports rose to 7.17 million barrels per day in January – the highest since March 2017 – failed to make a lasting mark on price action.

Activity may return API inventory flow data crosses the wires. It will be judged against forecasts envisioning a build of 2.34 million barrels to be reported in official EIA statistics due Wednesday. A larger inflow may hurt the WTI benchmark while a smaller one could send it upward.

Gold prices recovered from the previous day’s losses but otherwise failed to make significant headway. The absence of directional conviction may reflect traders’ apprehension ahead of the upcoming FOMC monetary policy announcement, which may mark acceleration of the Fed rate hike cycle.

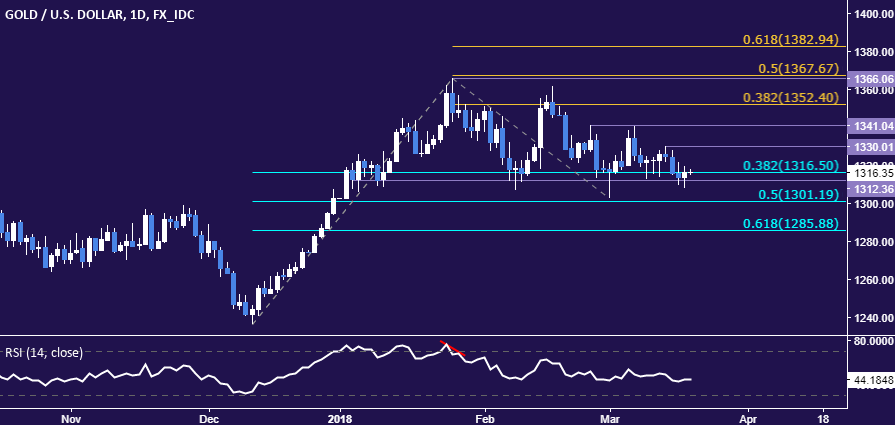

GOLD TECHNICAL ANALYSIS

Gold prices remain stubbornly stuck at support in the 1312.36-16.50 area (range floor, 38.2% Fib retracement). Breaking it on a daily closing basis initially exposes the 50% levelat 1301.19. Alternatively, push upward that breaches the March 14 swing high at 1330.01 opens the door for a test of the recent range top at 1341.04.

(Click on image to enlarge)

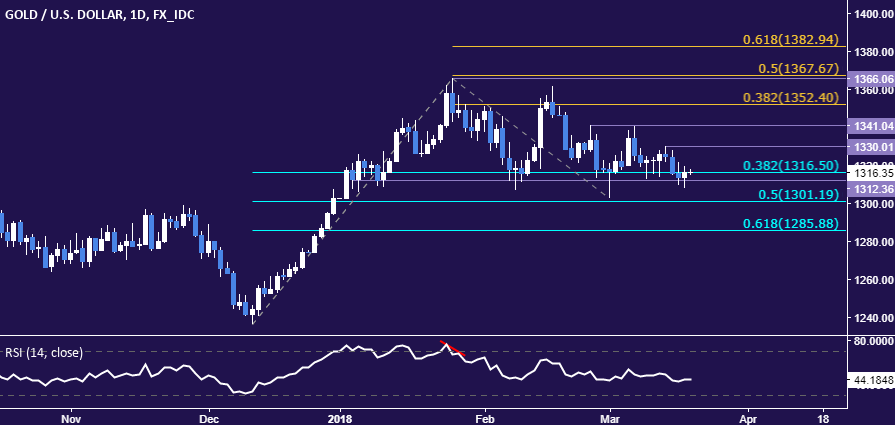

CRUDE OIL TECHNICAL ANALYSIS

Crude oil prices paused to digest after breaking upward from a Falling Wedge chart pattern. From here, a daily close above resistance in the 63.90-64.21 area (23.6% Fibonacci expansion, February 26 high) paves the way to a challenge of the 66.63-67.49 zone (January 25 high, 38.2% level). Alternatively, a drop back through the wedge top targets the $60/bbl figure.

(Click on image to enlarge)

Disclosure: DailyFX, the free news and research website of leading forex and CFD broker FXCM, delivers up-to-date analysis of the ...

more

Disclosure: DailyFX, the free news and research website of leading forex and CFD broker FXCM, delivers up-to-date analysis of the fundamental and technical influences driving the currency and commodity markets. With nine internationally-based analysts publishing over 30 articles and producing 5 video news updates daily, DailyFX offers in-depth coverage of price action, predictions of likely market moves, and exhaustive interpretations of salient economic and political developments. DailyFX is also home to one of the most powerful economic calendars available on the web, complete with advanced sorting capabilities, detailed descriptions of upcoming events on the economic docket, and projections of how economic report data will impact the markets. Combined with the free charts and live rate updates featured on DailyFX, the DailyFX economic calendar is an invaluable resource for traders who heavily rely on the news for their trading strategies. Additionally, DailyFX serves as a portal to one the most vibrant online discussion forums in the forex trading community. Avoiding market noise and the irrelevant personal commentary that plague many forex blogs and forums, the DailyFX Forum has established a reputation as being a place where real traders go to talk about serious trading.

Any opinions, news, research, analyses, prices, or other information contained on dailyfx.com are provided as general market commentary, and does not constitute investment advice. Dailyfx will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

** All times listed in GMT. See the full DailyFX economic calendar here.

less

How did you like this article? Let us know so we can better customize your reading experience.