CPI In October 2017 And Gold

On Wednesday, a report on U.S. consumer inflation was released. What does it imply for the gold market?

As we predicted last month, the monthly rate of inflation slowed down in October after soaring in September due to disruptions caused by hurricanes. Consumer prices increased 0.1 percent. The move was driven mainly by higher housing costs (which jumped 0.3 percent). The core index, which excludes food and energy, rose 0.2 percent. These changes were generally in line with expectations.

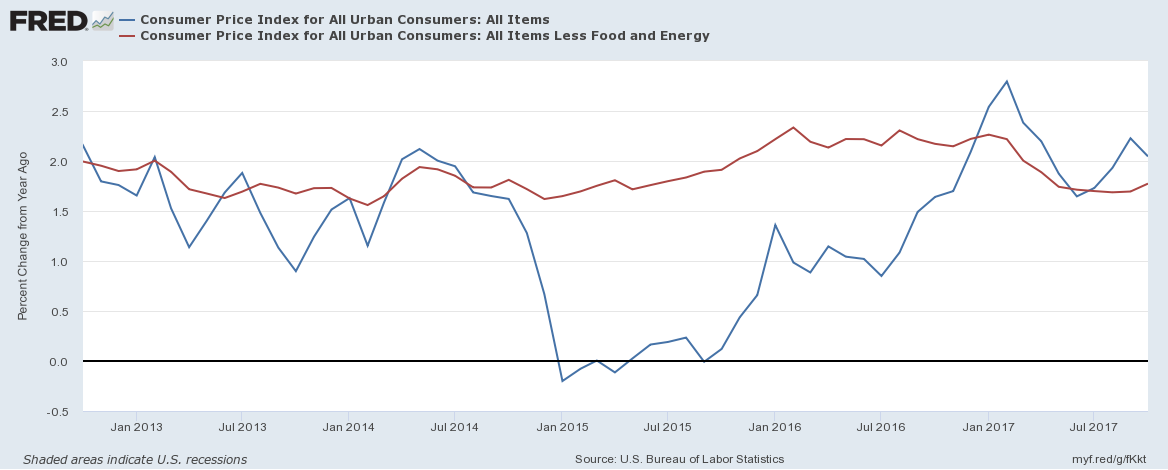

On an annual basis, the overall CPI rose 2 percent, while the core CPI increased 1.8 percent, slightly better than in September and slightly better than expected. Therefore, the core index moved slowly in the direction toward the Fed’s 2-percent goal, as one can see in the chart below.

Chart 1: CPI (blue line) and core CPI (red line) year-over-year from October 2012 to October 2017.

(Click on image to enlarge)

However, the recent report should not significantly change the Fed’s stance and the gold market, at least in the short run. The U.S. central bank is likely to remain on track to raise interest rates in December and to continue its gradual tightening. And the report on retail sales also came out on Wednesday: although they slowed in October (not surprisingly, given a sharp gain in September), they still managed to rise 0.2 percent, better than expected. Hence, the recent U.S. economic data may slightly support hawks at the Fed.

And if we see a steady (though slow) acceleration in inflation, the hawk camp at the FOMC will strengthen further. As we wrote yesterday, investors should not forget that, due to personal changes, the U.S. central bank is likely to be more hawkish next year (it is not good news for the price of gold). Hence, the Fed may hike interest rates more quickly in 2018 than investors currently expect, especially if the inflationary pressure picks up. It would be bearish for the gold market.

If you enjoyed the above analysis, we invite you to check out our other services. We focus on fundamental analysis in our monthly more