CPI Hits Two

For the first time since 2014, the CPI was above 2% in December. Unlike the PCE Deflator, the CPI has been above 2% on other occasions after the 2012 slowdown, notably in mid-2014 when policymakers were making the same extrapolations as to its meaning. The inflation index had been as high as 2.13% in May 2014, before the economy of the “rising dollar” intruded including the most direct effects in oil prices on inflation.

It is oil that drives the CPI more than any other factor, and the subcomponent for energy prices rose 5.4% in December. That was the highest gain since February 2012, as the base level for the current measure is now at the lowest points of the past few years.

The problem for extrapolating CPI inflation pressure as a matter of economic analysis and monetary policy is obvious, as that would mean an overemphasis on oil (which is one reason the Fed prefers the PCE Deflator to the CPI). In terms of oil prices alone, the effect on the CPI is still looking to be fleeting more than durable. The WTI futures curve not only remains in a noticeably narrow range, the outer years have coalesced very tightly around $55.

The overall curve has moved around a bit more than what is pictured above, but not all that much more. We still find “dollar” influence at the front and only slight backwardation toward the middle. Thus, the curve suggests a lid on oil prices still moving forward while at the same time downside risks (“dollar”) to prices overall.

As far as monetary policy in general, inflation that is due entirely or even in most part to commodity price changes has not been treated the same as inflation backed up by especially wage growth. The FOMC continues to talk about wages, of course, including today’s Beige Book which once again “sees signs” of wage acceleration. After more than two years at or near so-called full employment, the economy should no longer be so arguable as to not display inarguably robust wage and income growth. It is instead a sign more so that the economy continues to be wrong that the Beige Book can only refer anecdotally to “seeing signs”, and instead it is only that the oil sector may have moved past the financial and physical imbalances of the last two and a half years in terms of inflation.

Fed officials have already expressed satisfaction with “rising inflation” when in fact because of these combined conditions it is the opposite of what we should want. Nowhere is that more apparent than in the disparity between rising rents and lackluster wages and incomes that are not. The CPI for Rent of Primary Residence rose 4.3% in December 2016 above December 2015, the fastest price increase since January 2008.

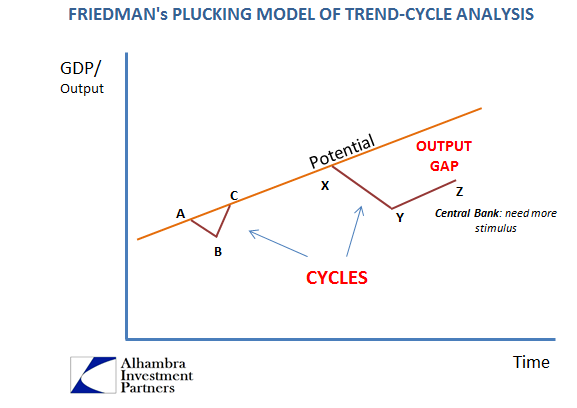

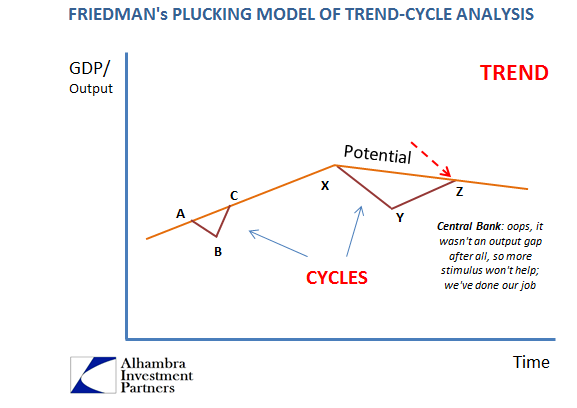

With wages being stuck still in nominal terms (and therefore obviously lower in real terms of a higher CPI), the disparity continues to be historically large. It is one of the ways in which the current economy “feels” like recession to far too many people, and thus in part continues to act like one, too. As in 2011, the economy doesn’t shift from softness to recovery, but from softness (or outright contraction, as in 2015) to stagflation (setting up the condition for the next part of the “cycle”, softness all over again).

For monetary policymakers to claim fulfillment of their mandate, they must be credibly assured that inflation will not just hit 2% once every few years but remain there for the long run. It doesn’t matter at all that the economy has been devastated since 2008, and that even in the past few years that devastation actually became worse, so long as inflation is around 2% and unemployment 5% the orthodox textbook says there is nothing left for the central bank to do.

I suspect that Fed officials know that there is this “hollowness” to both statistics, and thus that is why for the past three years they have been “seeing signs” of wage growth in the same way so-called ghost hunters on TV see ghosts. It is also why central banks quietly hold conferences about “secular stagnation” but more so what is for them to do within it than to address how to get out of it. In short, they are searching for all the ways in which they can get out of the economy business because it has been for them only failure. If it is oil prices that do it, for however little time that might ultimately be, I think they will take it.

Disclosure:

This material has been distributed fo or informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation ...

more